- Adtalem Global Education Inc. recently reported higher fourth-quarter and full-year earnings, issued positive 2026 revenue guidance, expanded its revolving credit facility to US$500 million, and disclosed a new collaboration with Sallie Mae to develop alternative student financing options.

- This planned initiative with Sallie Mae comes as federal Grad PLUS loans are being phased out, potentially affecting funding for students across Adtalem's five healthcare institutions.

- We'll look at how Adtalem's continued revenue growth outlook and student financing initiatives shape its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Adtalem Global Education's Investment Narrative?

For investors considering Adtalem Global Education, the story hinges on believing in the ongoing demand for healthcare education and the company's ability to adapt as student financing shifts. The new collaboration with Sallie Mae is a meaningful development, arriving just as federal Grad PLUS loans are being phased out, which could have posed a significant funding risk for Adtalem’s student base. This partnership could offset some of that risk and support the company's 2026 revenue growth guidance, serving as a short-term catalyst if executed smoothly. At the same time, the company’s credit facility expansion gives it extra financial flexibility. While recent earnings and revenue figures are strong, with guidance for further growth, the reliance on successful rollout of alternative loan products adds a new variable to watch that may change the risk profile for shareholders in the near term. On the flip side, share price momentum following the news suggests optimism about managing these shifts, but the real test will be in delivering student funding solutions without disruption to enrollment or margins. Yet, there’s another side to the story, with any alternative financing, transition risks for students and Adtalem remain a key issue to monitor.

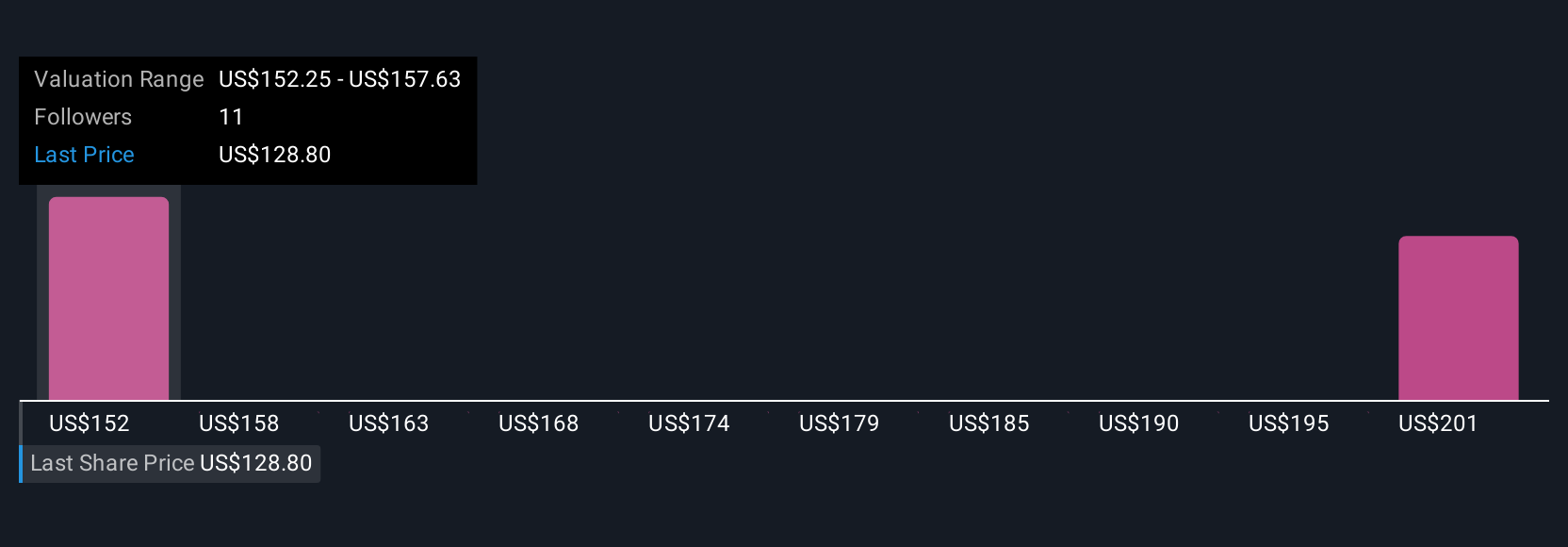

Adtalem Global Education's shares have been on the rise but are still potentially undervalued by 37%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Adtalem Global Education - why the stock might be worth as much as 58% more than the current price!

Build Your Own Adtalem Global Education Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adtalem Global Education research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Adtalem Global Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adtalem Global Education's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com