- Sterling Infrastructure announced in early August 2025 that it had surpassed analyst expectations for the second quarter, reporting quarterly sales of US$614.47 million and raising its full-year 2025 guidance for both earnings and revenue.

- The company credited its robust performance to growth in its E-Infrastructure and Transportation segments, along with an expanded backlog and plans to acquire CEC Facilities Group, highlighting management's optimism about future demand and margin improvements.

- We'll explore how Sterling's raised outlook and strong segment results may shift its investment narrative, particularly given the increased confidence in sustained revenue growth.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Sterling Infrastructure Investment Narrative Recap

To be a Sterling Infrastructure shareholder, you need to believe in the company’s ability to sustain demand and margin expansion in its E-Infrastructure and Transportation segments, fueled by secular growth in data centers and large project backlogs. The recent raised 2025 guidance helps reinforce confidence in continued revenue and earnings momentum, but the short-term catalyst remains the durability of this strong order pipeline, while a slowdown in mega-project awards is still the biggest risk and hasn’t been neutralized by the current quarter’s results.

Among recent announcements, the reaffirmed plan to acquire CEC Facilities Group stands out as most relevant to the current growth narrative. This transaction is positioned to enhance Sterling’s capabilities in electrical and mechanical services, which could support further margin and backlog growth at a time when investors are increasingly focused on the company’s ability to secure and execute complex projects.

By contrast, investors should be aware that even with a record backlog and raised guidance, the risk of overexposure to cyclical mega-project work remains...

Read the full narrative on Sterling Infrastructure (it's free!)

Sterling Infrastructure's outlook forecasts $2.6 billion in revenue and $276.4 million in earnings by 2028. This scenario assumes 6.9% annual revenue growth and a $8.6 million earnings decrease from current earnings of $285.0 million.

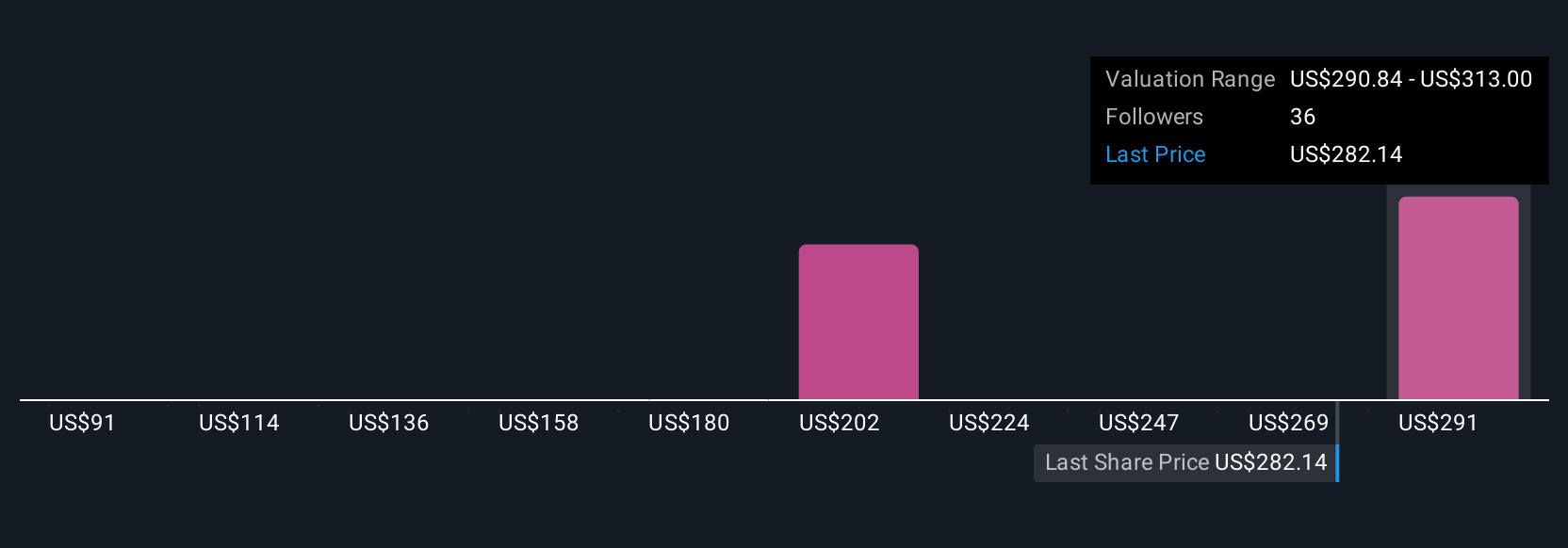

Uncover how Sterling Infrastructure's forecasts yield a $313.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Community members on Simply Wall St rated Sterling Infrastructure’s fair value between US$91.36 and US$313, across six independent analyses. While the company’s raised outlook highlights strong near-term growth, differences in how investors weigh future mega-project risks could affect sentiment on performance.

Explore 6 other fair value estimates on Sterling Infrastructure - why the stock might be worth less than half the current price!

Build Your Own Sterling Infrastructure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sterling Infrastructure research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sterling Infrastructure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sterling Infrastructure's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com