- Mueller Industries announced that its Board of Directors declared a regular quarterly cash dividend of 25 cents per share, payable on September 19, 2025, to shareholders of record as of September 5, 2025.

- Despite reporting strong profits, attention has turned to the fact that a significant portion came from a one-time US$60 million gain, raising questions about the sustainability of the company’s core earnings.

- We’ll explore how investor concerns around non-recurring earnings items could shape Mueller Industries’ longer-term investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Mueller Industries' Investment Narrative?

To be a shareholder in Mueller Industries, you need to believe in the company’s ability to generate solid earnings from its underlying metal products and manufacturing operations. The latest dividend affirmation reaffirms a focus on rewarding investors, while the core investment case has hinged on steady growth, a disciplined buyback approach, and an experienced management team. However, recent attention around a sizable one-time US$60 million profit gain puts a spotlight on the sustainability of earnings moving forward. This news introduces some uncertainty about the strength of recurring profits, though the muted stock response suggests that most immediate risks and catalysts remain unchanged for now. The positive trend in profits and return measures over the past year is encouraging, but future earnings clarity will be key. Investors should keep an eye on developments that could impact the consistency of core operating results.

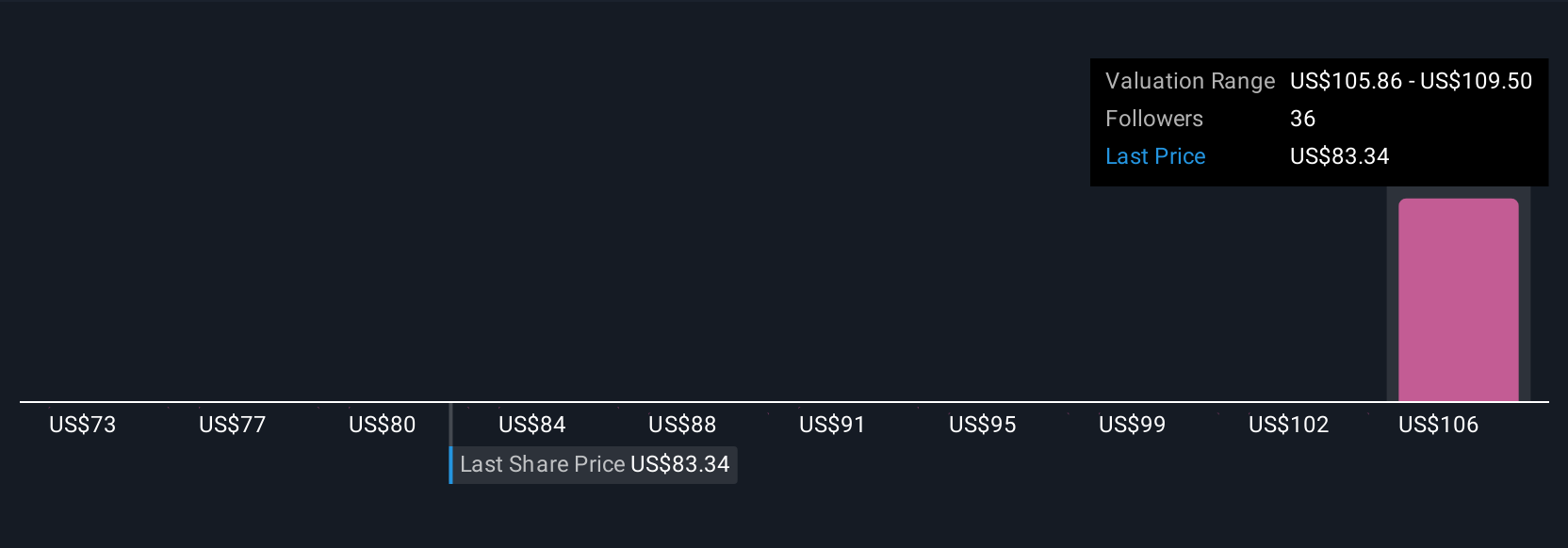

But with so much of last quarter’s profit tied to a single event, investors should pay close attention. Mueller Industries' shares have been on the rise but are still potentially undervalued by 11%. Find out what it's worth.Exploring Other Perspectives

Explore 7 other fair value estimates on Mueller Industries - why the stock might be worth as much as 29% more than the current price!

Build Your Own Mueller Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mueller Industries research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Mueller Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mueller Industries' overall financial health at a glance.

No Opportunity In Mueller Industries?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com