- Belden Inc. recently reported its second quarter 2025 results, posting year-over-year gains in sales and net income, and released earnings guidance for the third quarter with forecast revenue between US$670 million and US$685 million and GAAP EPS expected in the US$1.33 to US$1.43 range.

- A key insight is that Belden's ability to deliver consistent financial growth and offer future performance targets may reflect increased confidence in the company's operational outlook and its capacity to respond to customer demand.

- We'll now explore how Belden's financial results and updated quarterly guidance may influence analyst expectations for its future earnings growth.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Belden Investment Narrative Recap

To be a Belden shareholder today, you need to believe in the company's ability to harness digital infrastructure growth, win major industry contracts, and defend its margin profile even as input cost and market volatility persist. The latest quarterly results reinforce Belden's progress on sales and earnings, but they don't fundamentally change the near-term catalyst, sustained demand for smart infrastructure, and the chief risk, which remains exposure to swings in customer investment cycles. The impact of this quarter’s guidance on these factors appears incremental rather than material.

The most relevant recent announcement is Belden's Q3 earnings guidance, which closely follows the strong Q2 performance. By projecting revenue and EPS in line with current trends, Belden is signaling ongoing customer momentum and operational stability during a period where winning and delivering on high-value digital transformation projects could support future order visibility. This backdrop will likely frame analyst discussions on the company's resilience amid shifting macro conditions.

Yet, in contrast to the optimism around customer demand, persistent macro and policy uncertainty is something investors should be aware of, especially if...

Read the full narrative on Belden (it's free!)

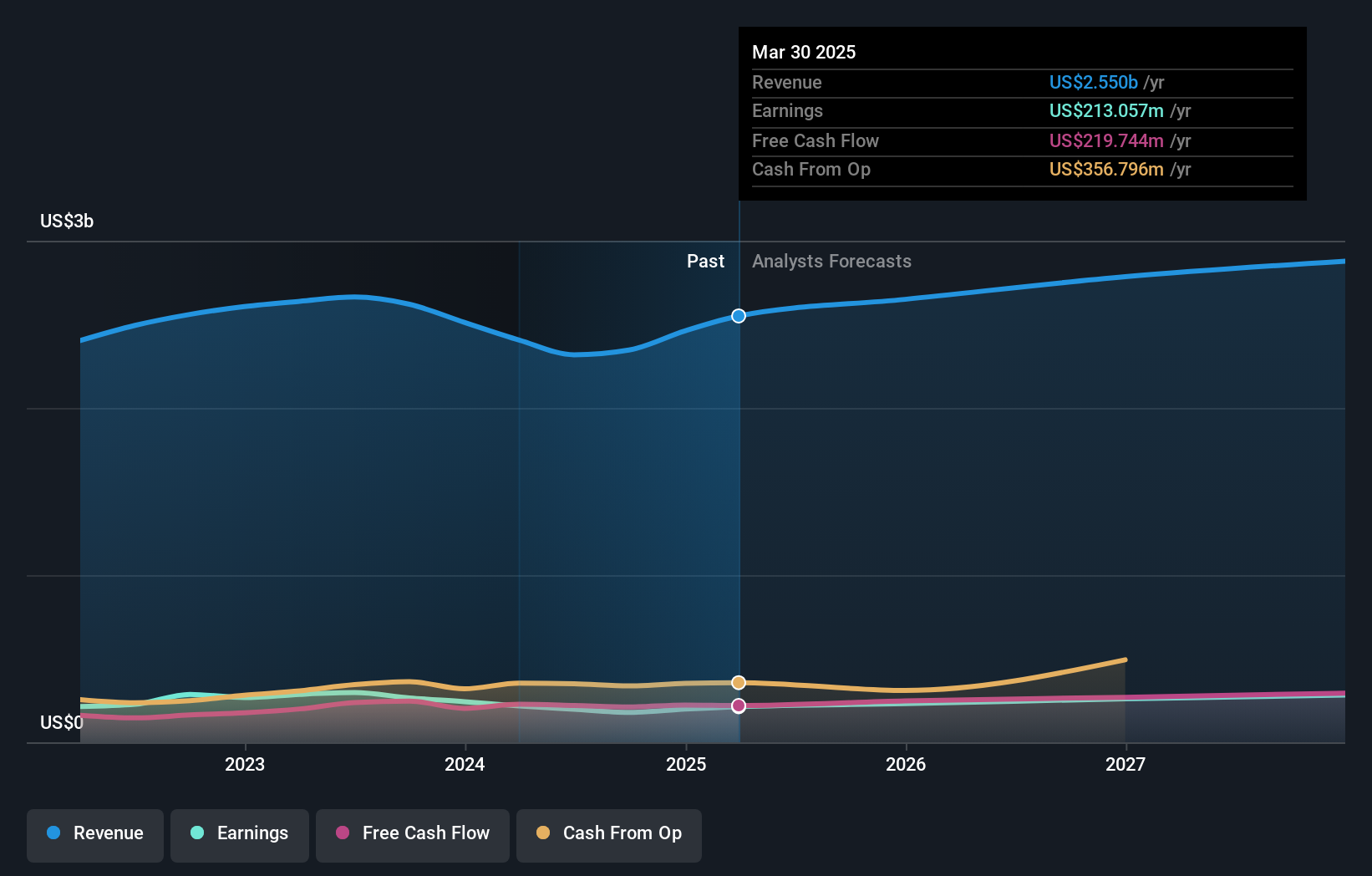

Belden's narrative projects $3.0 billion revenue and $293.6 million earnings by 2028. This requires 4.3% yearly revenue growth and a $68.6 million earnings increase from $225.0 million today.

Uncover how Belden's forecasts yield a $139.67 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have fair value estimates for Belden ranging from US$80.69 to US$139.67, reflecting a wide spread of individual opinions across just 3 analyses. At the same time, ongoing investment in smart infrastructure is seen as a growth driver, but opinions vary, consider reviewing several viewpoints to understand the full range of outlooks.

Explore 3 other fair value estimates on Belden - why the stock might be worth as much as 17% more than the current price!

Build Your Own Belden Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Belden research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Belden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Belden's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com