- Loews Corporation announced in early August 2025 that it reported second-quarter net income of US$391 million, increased earnings per share, and continued active share repurchases while also expanding its Board of Directors with the appointment of Jennifer VanBelle to the Audit Committee.

- The appointment brings deep financial and leadership experience to the board, while ongoing share buybacks reflect an emphasis on returning capital to shareholders.

- We'll explore how the renewal of Loews' buyback initiative and leadership expansion influences the company’s overall investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Loews' Investment Narrative?

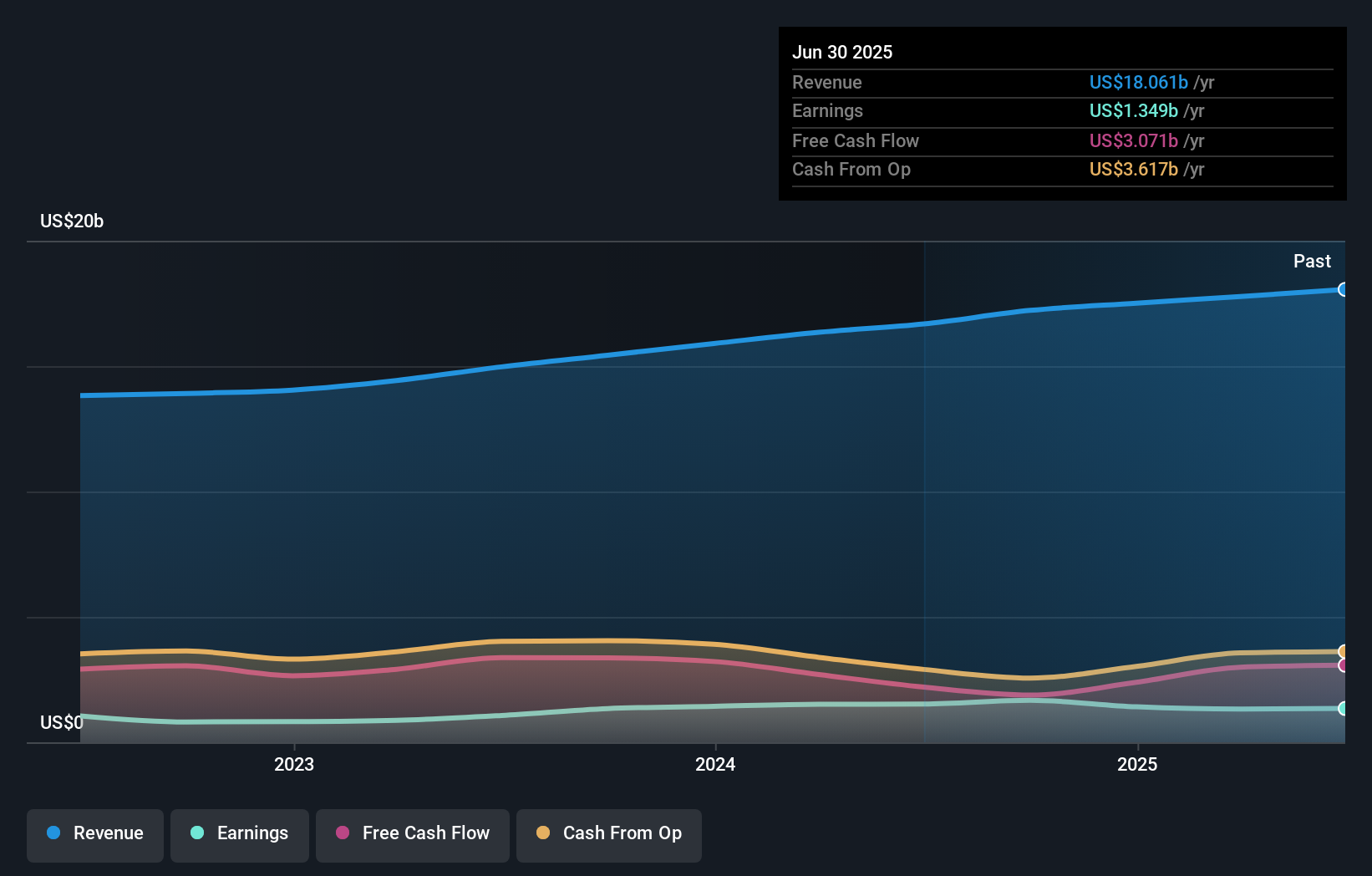

Long-term shareholders in Loews tend to focus on the company’s resilience as a diversified conglomerate, its ongoing capital returns, leadership depth, and steady operational performance. The new appointment of Jennifer VanBelle to the board, with her deep financial expertise from GE, further bolsters confidence in strong oversight, especially at a time when leadership transitions and board changes have increased in frequency. Recent earnings and the renewal of the buyback program align with Loews’ historical emphasis on shareholder returns, and the consistent dividend announcement underscores ongoing financial stability. Despite the constructive signals from these updates, the most important short-term catalysts, earnings improvements and share repurchases, remain generally unchanged, as the moves are in line with prior capital management strategies. The business still faces key risks tied to insurance underwriting cycles and broader macroeconomic pressures, which this news only partially addresses.

But while recent results support confidence, underwriting volatility remains an important consideration for investors. Loews' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Loews - why the stock might be worth 26% less than the current price!

Build Your Own Loews Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Loews research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Loews research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Loews' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com