- In recent weeks, Ally Financial Inc. completed and announced several fixed-income offerings, including callable senior unsecured notes with fixed and variable coupon structures, featuring maturities ranging from 2028 to 2035 and principal amounts up to US$600 million.

- These actions highlight an active approach to managing liquidity and capital structure, as the company seeks to balance funding needs with long-term debt service considerations.

- We'll explore how Ally Financial's multiple debt issuances may affect its investment outlook, particularly regarding funding costs and capital flexibility.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ally Financial Investment Narrative Recap

To be a shareholder in Ally Financial, you need to believe in the company's ongoing transition to a digital-first financial platform, and its ability to sustain loan growth and profitability despite shifting trends in auto lending and increasing competition. The flurry of recent fixed-income offerings is unlikely to materially affect the most important short-term catalyst, growth in digital banking and customer deposits, or offset the biggest risk, which remains elevated credit loss uncertainty tied to consumer lending.

Among the latest debt issuances, the US$600 million callable fixed-to-floating rate senior notes due 2033 stand out for their role in boosting liquidity and supporting capital structure flexibility at a time when market funding and proactive balance sheet management are increasingly relevant to sustaining growth. This aligns with ongoing efforts to support higher net interest margins and create optionality as Ally invests in technology and product expansions.

But, in contrast to these positive moves, investors should also be aware of the rising competition in auto lending, as this could affect...

Read the full narrative on Ally Financial (it's free!)

Ally Financial's outlook projects $9.6 billion in revenue and $1.8 billion in earnings by 2028. This is based on a 12.0% annual revenue growth rate and a $1.5 billion increase in earnings from the current $324 million.

Uncover how Ally Financial's forecasts yield a $46.00 fair value, a 23% upside to its current price.

Exploring Other Perspectives

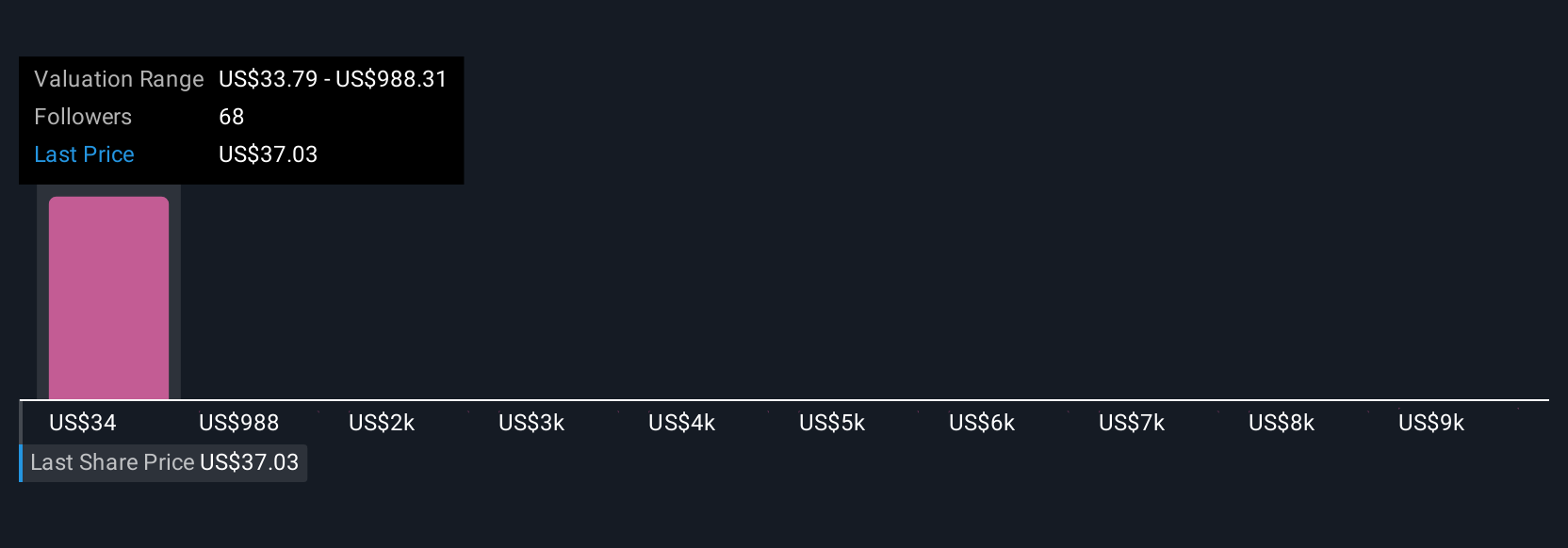

Simply Wall St Community members produced ten fair value estimates for Ally ranging from US$33.79 to US$9,578.94 per share. As the company faces intensifying pressure from both traditional banks and fintechs, you may want to discover how other investors interpret these risks and opportunities.

Explore 10 other fair value estimates on Ally Financial - why the stock might be a potential multi-bagger!

Build Your Own Ally Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ally Financial research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ally Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ally Financial's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com