- Integral Ad Science Holding Corp. recently reported significant growth in both revenue and net income for the second quarter of 2025, raising its full-year guidance and projecting third-quarter revenues between US$148 million and US$150 million.

- The company also became the first to achieve Ethical Artificial Intelligence Certification from the Alliance for Audited Media, highlighting IAS’s focus on responsible AI practices in digital ad measurement.

- We’ll examine how the company’s raised earnings guidance and AI certification may impact its investment narrative and future prospects.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Integral Ad Science Holding Investment Narrative Recap

To be a shareholder in Integral Ad Science Holding Corp. (IAS), one needs to believe in the company’s ability to sustain its revenue and earnings expansion as the digital advertising ecosystem demands ever more transparent and AI-driven analytics. The recent Q2 results and raised guidance reinforce the near-term catalyst of continued margin improvement, though the main risk, reliance on evolving media formats and shifts in user engagement, remains material and could affect future growth if industry trends change abruptly.

The company’s achievement of the first Ethical Artificial Intelligence Certification from the Alliance for Audited Media stands out, underscoring its commitment to responsible AI and data standards as a differentiator in premium ad measurement, a theme closely tied to IAS’s outlook for new product adoption and ongoing partnership success in social and CTV markets. Yet, while this elevates IAS’s positioning with advertisers and platforms, it does not fully address exposure to disruptions stemming from changes in digital media consumption patterns.

However, what many investors might overlook is the potential consequence if user engagement on key platforms suddenly pivots away from formats where IAS excels...

Read the full narrative on Integral Ad Science Holding (it's free!)

Integral Ad Science Holding's outlook anticipates $755.7 million in revenue and $94.5 million in earnings by 2028. This implies an 11.2% annual revenue growth rate and a $47.5 million increase in earnings from the current $47.0 million.

Uncover how Integral Ad Science Holding's forecasts yield a $13.47 fair value, a 50% upside to its current price.

Exploring Other Perspectives

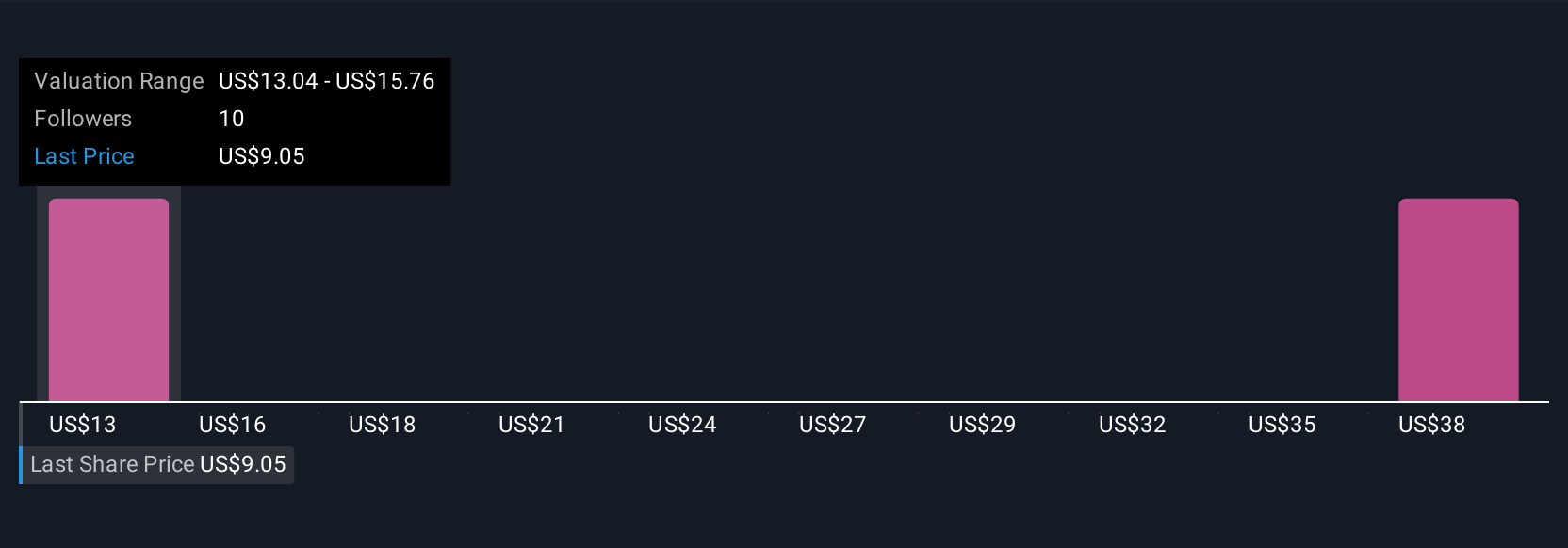

Simply Wall St Community members offered two fair value estimates for IAS ranging from US$13.47 to US$40.31 per share. Given the company’s increased earnings guidance and focus on responsible AI, continued product adoption will remain pivotal to future outcomes.

Explore 2 other fair value estimates on Integral Ad Science Holding - why the stock might be worth just $13.47!

Build Your Own Integral Ad Science Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integral Ad Science Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Integral Ad Science Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integral Ad Science Holding's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com