- United States Lime & Minerals, Inc. announced that its Board of Directors declared a regular quarterly cash dividend of US$0.06 per share, payable September 12, 2025 to shareholders of record on August 22, 2025, following the release of improved second quarter and first half financial results compared to the previous year.

- Strong growth in both sales and net income highlights the company’s ongoing operational momentum amid its continued capital returns to shareholders.

- We’ll examine how this performance-driven earnings report, supported by dividend consistency, shapes United States Lime & Minerals’ investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is United States Lime & Minerals' Investment Narrative?

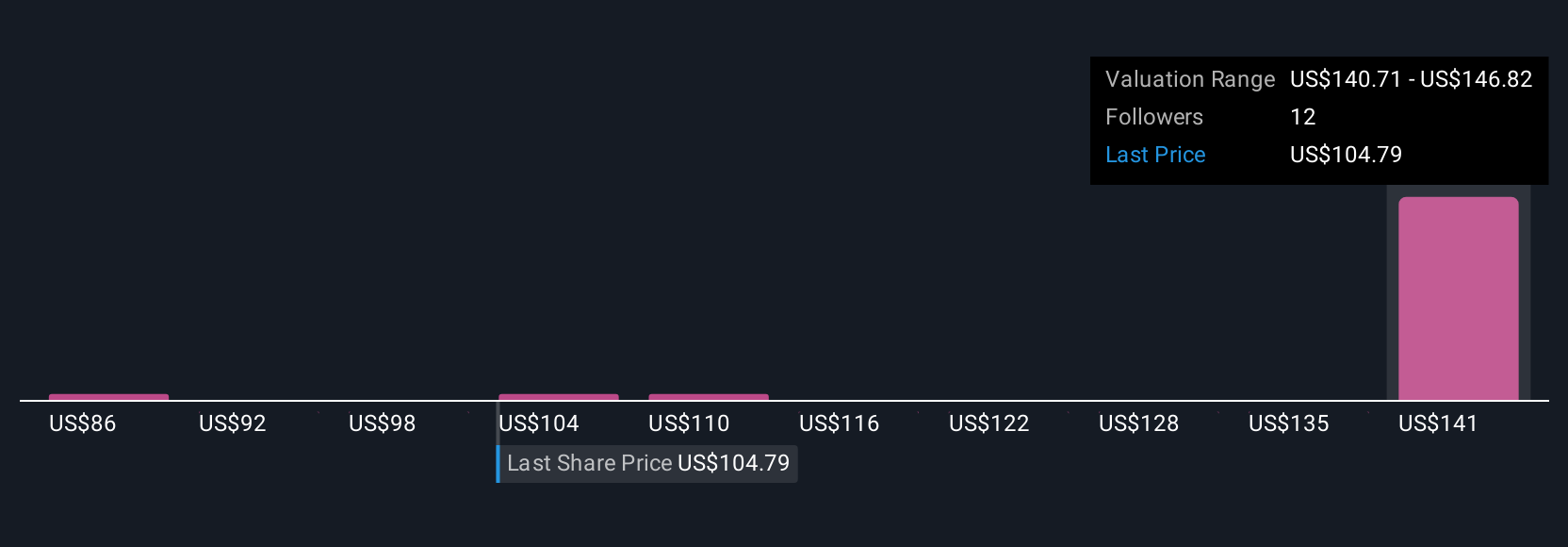

To see United States Lime & Minerals as an attractive holding, you’d need to align with the belief in its ability to sustain operational momentum and execute consistently in a specialty niche, where proven profit growth and recurring dividends make up much of the shareholder story. The latest results, which delivered substantial growth in both sales and net income, highlight robust demand and pricing power; that momentum is further reinforced by another quarterly dividend. While the earnings jump accompanied a sharp share price move higher, the most critical near-term catalyst, stable or expanding margins, is arguably strengthened by this data. As risks go, the business remains somewhat expensive by common valuation measures, leaving sensitivity to profit margin compression or any unexpected slowdown in demand. Unless industry conditions shift suddenly, the recent news mainly fortifies existing strengths in the short run. On the other hand, today’s robust metrics don’t erase the company’s premium price risk, so pay attention.

United States Lime & Minerals' shares have been on the rise but are still potentially undervalued by 17%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on United States Lime & Minerals - why the stock might be worth 24% less than the current price!

Build Your Own United States Lime & Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United States Lime & Minerals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free United States Lime & Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United States Lime & Minerals' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com