- PPG Industries recently announced the integration of its PPG ADJUSTRITE® commercial estimating platform with PPG PAINTMANAGER® XI color management software to boost workflow efficiency and productivity for commercial vehicle repair customers.

- This product integration highlights PPG's continued focus on leveraging technology to streamline operations and improve accuracy for clients in a competitive sector.

- We'll explore how automating workflow through new software integration could influence PPG's broader investment narrative and future growth outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

PPG Industries Investment Narrative Recap

Owning shares of PPG Industries means believing in the long-term value of its innovation-led strategy, especially advancing digital tools, as a key to winning market share and driving organic growth. The recent integration of ADJUSTRITE® with PAINTMANAGER® XI streamlines commercial workflows, but is unlikely to move the needle on near-term revenue, where risks like softer automotive demand and inflation in key regions remain the most important challenges to monitor.

Among recent company developments, the extension of PPG's long-standing joint venture with Asian Paints in India stands out. While not directly related to the new product integration, this alliance reiterates PPG's intent to expand its reach, which could prove essential if short-term catalysts in core segments stall or regional headwinds intensify.

But in contrast, investors should also be mindful of how ongoing regional inflation and currency impacts could...

Read the full narrative on PPG Industries (it's free!)

PPG Industries' narrative projects $16.9 billion in revenue and $2.0 billion in earnings by 2028. This requires 2.7% yearly revenue growth and a $0.7 billion increase in earnings from $1.3 billion today.

Uncover how PPG Industries' forecasts yield a $127.30 fair value, a 19% upside to its current price.

Exploring Other Perspectives

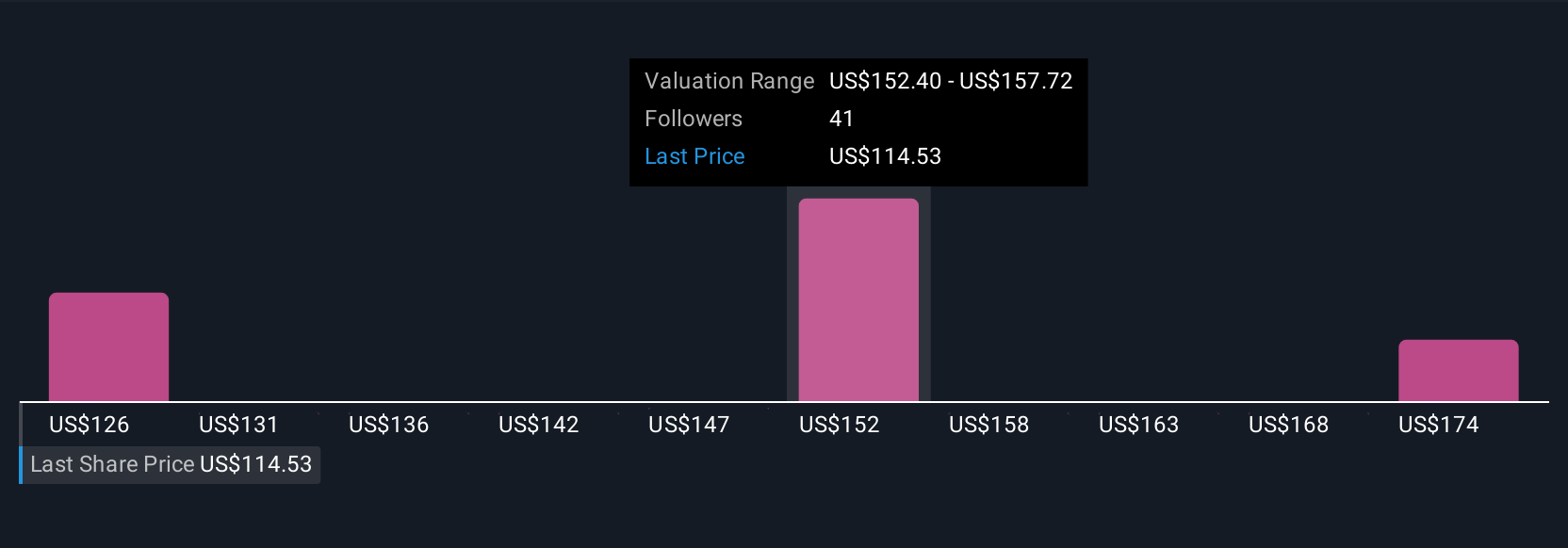

With three fair value estimates from the Simply Wall St Community ranging from US$127.30 to US$170.81, your fellow investors are split by more than US$43,000 in their outlooks. Share your perspective around PPG’s digital-driven growth as cost inflation and slower volumes remain in focus for profitability.

Explore 3 other fair value estimates on PPG Industries - why the stock might be worth just $127.30!

Build Your Own PPG Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PPG Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PPG Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PPG Industries' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com