- Royalty Pharma plc recently reported its second quarter and half-year earnings, revealing revenues of US$578.67 million and US$1.15 billion, respectively, with quarterly net income of US$30.18 million compared to US$102 million a year earlier.

- The results reflect a divergence between higher revenues and lower quarterly profits, raising questions about cost pressures or operational changes affecting margins despite earnings growth over the six-month period.

- With quarterly net income dropping markedly while revenues grew, we'll examine how these cost or operational factors might influence Royalty Pharma's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Royalty Pharma Investment Narrative Recap

To believe in Royalty Pharma as a shareholder, you need confidence in the long-term growth of royalty revenues driven by biopharma innovation and portfolio diversification. The recent earnings, with higher revenue but sharply lower quarterly net income, do not materially alter the most important short-term catalyst: the success of major new royalty deals like the Revolution Medicines transaction. However, they do lend greater immediacy to the risk around margin pressure due to cost or operational changes.

Among recent announcements, the US$2 billion funding agreement with Revolution Medicines stands out. Supporting global development of daraxonrasib, this deal is a primary driver for future cash flow and serves as an important near-term catalyst, reinforcing the company's strategy of securing proprietary stakes in next-generation therapies.

In contrast, ongoing cost pressures and unresolved royalty disputes may impact future profitability in ways investors should be aware of...

Read the full narrative on Royalty Pharma (it's free!)

Royalty Pharma's outlook projects $3.7 billion in revenue and $1.4 billion in earnings by 2028. This reflects an 18.3% annual revenue growth rate and a $300 million increase in earnings from the current $1.1 billion.

Uncover how Royalty Pharma's forecasts yield a $42.15 fair value, a 12% upside to its current price.

Exploring Other Perspectives

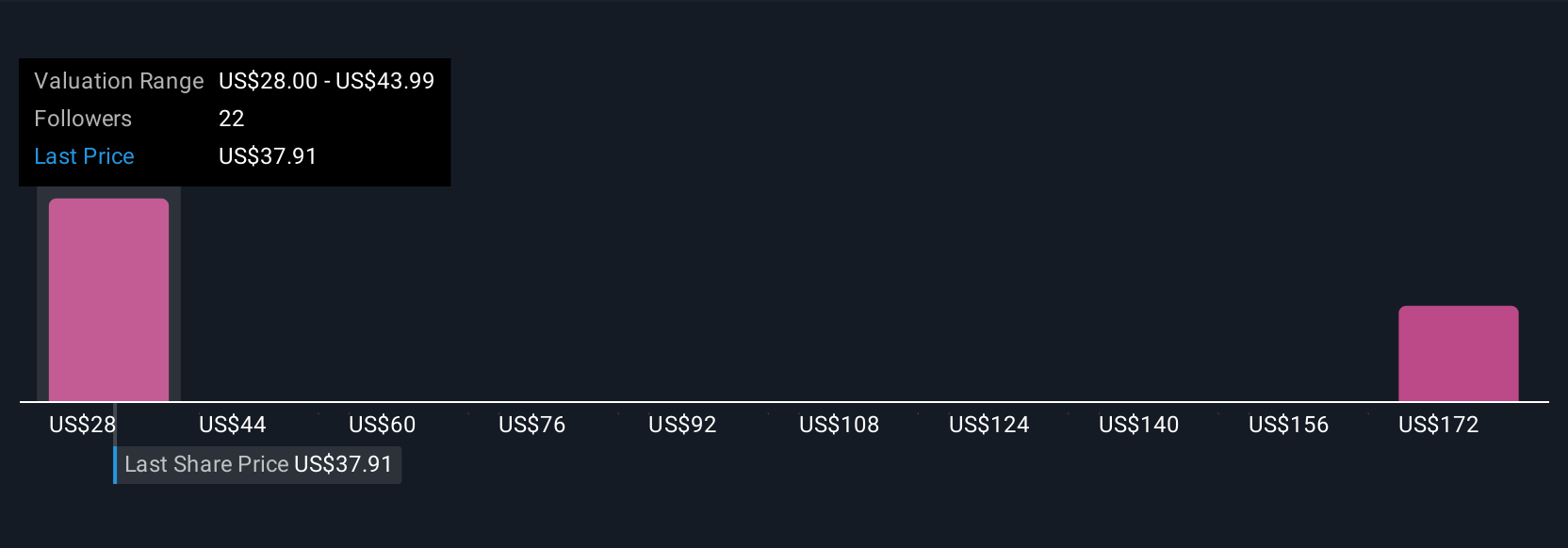

Simply Wall St Community retail fair value estimates for Royalty Pharma range widely from US$28 to US$187.82, with four views represented. While opinions differ sharply, the current margin compression underscores why it pays to review a range of investor perspectives on the business outlook.

Explore 4 other fair value estimates on Royalty Pharma - why the stock might be worth over 4x more than the current price!

Build Your Own Royalty Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royalty Pharma research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Royalty Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royalty Pharma's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com