- Carlisle Companies announced a 10% increase in its regular quarterly dividend to US$1.10 per share, with the higher payout scheduled for September 2025, and also outlined its latest financial results and share repurchase activity.

- Despite stable sales year-over-year, net income and earnings per share decreased compared to the prior year, while the company highlighted ongoing capital returns through both dividends and share buybacks.

- With the dividend increase and continued share repurchases, we'll assess how Carlisle's capital return focus affects its long-term investment thesis.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Carlisle Companies Investment Narrative Recap

To be a shareholder in Carlisle Companies, you have to believe in the durability of the commercial reroofing market and the company’s ability to deliver steady capital returns, especially when new construction is pressured. While the recent dividend increase and ongoing share buybacks reinforce that commitment, they do not materially change the biggest near-term catalyst, resilient reroofing demand, or address the main risk: continued margin pressure from flat pricing and elevated costs.

The most relevant recent announcement is the 10% dividend hike to US$1.10 per share, reflecting Carlisle’s confidence in its cash generation even as earnings have softened. This stronger cash return policy lands at a time when input cost pressures are stretching profitability and underscores the company’s focus on shareholder value during periods of top-line stability and margin uncertainty.

But for all the near-term positives, investors should not overlook the lingering risk that price competition and stubborn costs could further compress operating margins...

Read the full narrative on Carlisle Companies (it's free!)

Carlisle Companies' narrative projects $5.8 billion revenue and $997.0 million earnings by 2028. This requires 4.9% yearly revenue growth and a $193.1 million earnings increase from $803.9 million today.

Uncover how Carlisle Companies' forecasts yield a $425.57 fair value, a 16% upside to its current price.

Exploring Other Perspectives

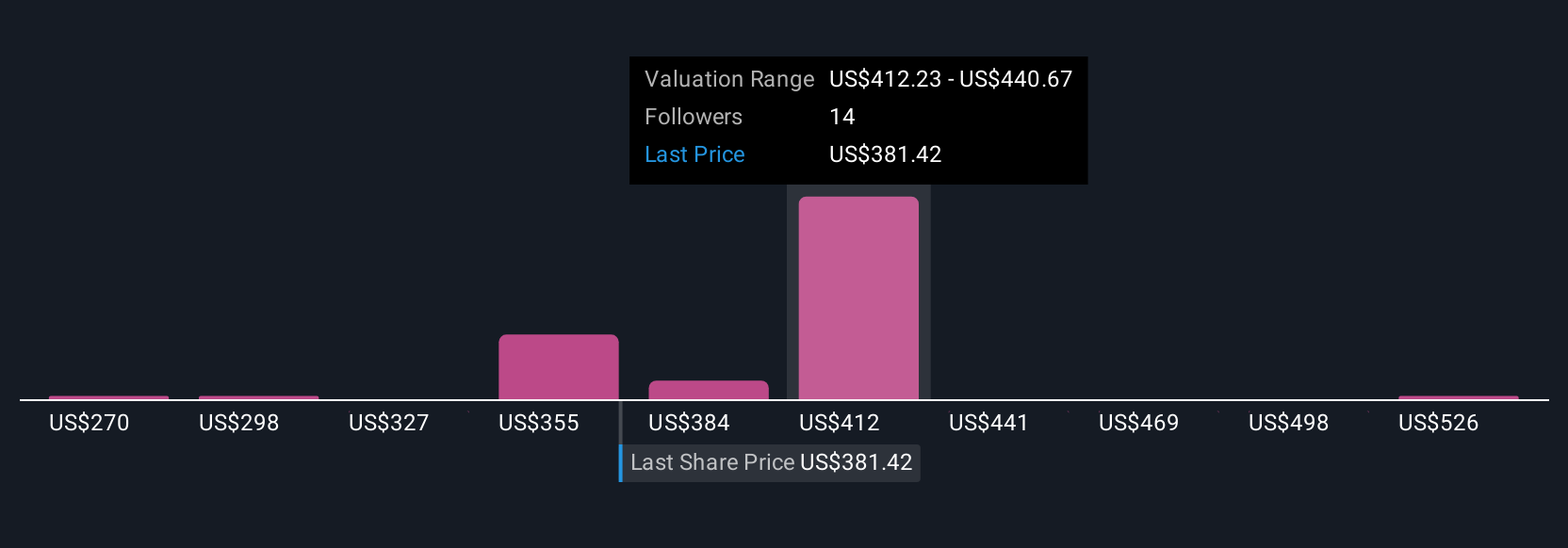

Seven members of the Simply Wall St Community have valued Carlisle Companies between US$270 and US$554.45 per share, with the highest estimate almost double the lowest. Persistent margin risk from flat pricing and input costs continues to be a focal concern that could impact how the company is perceived by both analysts and private investors. Explore several alternative viewpoints to understand where your outlook fits.

Explore 7 other fair value estimates on Carlisle Companies - why the stock might be worth as much as 51% more than the current price!

Build Your Own Carlisle Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carlisle Companies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carlisle Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carlisle Companies' overall financial health at a glance.

No Opportunity In Carlisle Companies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com