- Arcosa, Inc. recently announced its second quarter 2025 earnings, reporting sales of US$736.9 million and net income of US$59.7 million, both up from the prior year, alongside an updated full-year guidance with consolidated revenues expected between US$2.85 billion and US$2.95 billion.

- This update highlights rising sales and improved profitability in the latest quarter, while also underscoring the company's expectation that tariff impacts for 2025 will be minimal.

- We'll explore how Arcosa's robust second quarter results and refined guidance influence its investment narrative, especially as management signals confidence in forward momentum.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Arcosa Investment Narrative Recap

To be a shareholder in Arcosa, you need to believe in the company’s ability to drive steady growth in U.S. infrastructure through its core construction, engineered structures, and transportation businesses. The recent strong second quarter results and tightened full-year revenue guidance support the near-term catalyst of rising demand across key segments, while the biggest risk, ongoing pressures from increased working capital and interest costs, remains only moderately addressed by this update.

Among recent announcements, Arcosa’s debt refinancing on improved terms in June stands out as most relevant, as it addresses financial flexibility just as enhanced Q2 sales and profitability reinforce management’s outlook. This step could offer some buffer against pressures from acquisition-related financial requirements, which are a key risk highlighted by recent analyst commentary.

In contrast, investors should be aware that even with strong quarterly growth, elevated net working capital needs and debt from past acquisitions could...

Read the full narrative on Arcosa (it's free!)

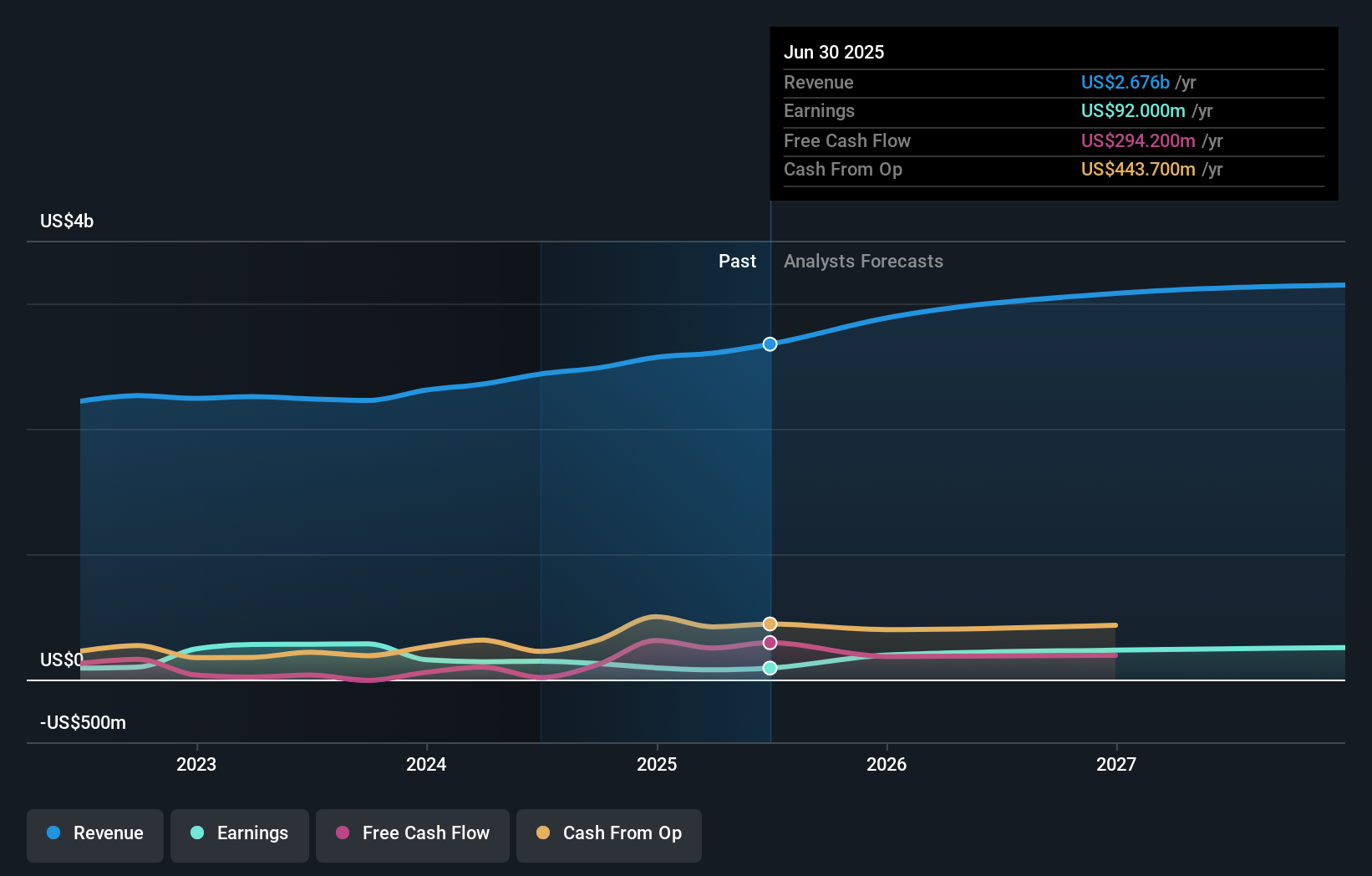

Arcosa's narrative projects $3.5 billion revenue and $453.3 million earnings by 2028. This requires 10.0% yearly revenue growth and a $375.5 million earnings increase from the current $77.8 million.

Uncover how Arcosa's forecasts yield a $111.83 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Arcosa range from US$43.16 to US$111.83, based on 2 private investor perspectives. Despite stronger Q2 results, concerns about ongoing acquisition-related financial pressures may matter more for future outlooks, see how other investors approach these scenarios.

Explore 2 other fair value estimates on Arcosa - why the stock might be worth less than half the current price!

Build Your Own Arcosa Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arcosa research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Arcosa research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arcosa's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com