- M&T Bank Corporation recently completed a US$750 million fixed-to-floating rate subordinated note offering, issuing callable, variable-rate corporate bonds due July 30, 2035 at a price of 100% with a 0.13% discount.

- This sizeable fixed-income issuance is significant, as it directly impacts the bank's capital structure and indicates an ongoing focus on balance sheet flexibility.

- We’ll now examine how this substantial capital raise fits into M&T Bank’s ongoing emphasis on capital strength and balanced growth.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

M&T Bank Investment Narrative Recap

To be a shareholder in M&T Bank, you need confidence in the bank’s disciplined capital management and commitment to balanced growth, especially through prudent moves that support earnings resilience. While the recent US$750 million subordinated note offering enhances balance sheet flexibility and capital strength, it does not materially alter the short-term catalysts underpinning M&T’s focus or the main risk of elevated funding costs if deposit balances decline.

Among recent announcements, the July 2025 earnings report stands out, marking higher net income and improved profit margins year-on-year, reinforcing the company’s ongoing emphasis on capital efficiency and operational execution. This ties closely to the themes behind the bank’s latest capital raise, as both reflect efforts to maintain financial strength and position for future growth through shifting market cycles.

In contrast, investors should be aware of what could happen if pressure on funding costs unexpectedly intensifies…

Read the full narrative on M&T Bank (it's free!)

M&T Bank's narrative projects $10.2 billion revenue and $2.6 billion earnings by 2028. This requires 4.5% yearly revenue growth and a $0.1 billion earnings increase from $2.5 billion today.

Uncover how M&T Bank's forecasts yield a $215.68 fair value, a 15% upside to its current price.

Exploring Other Perspectives

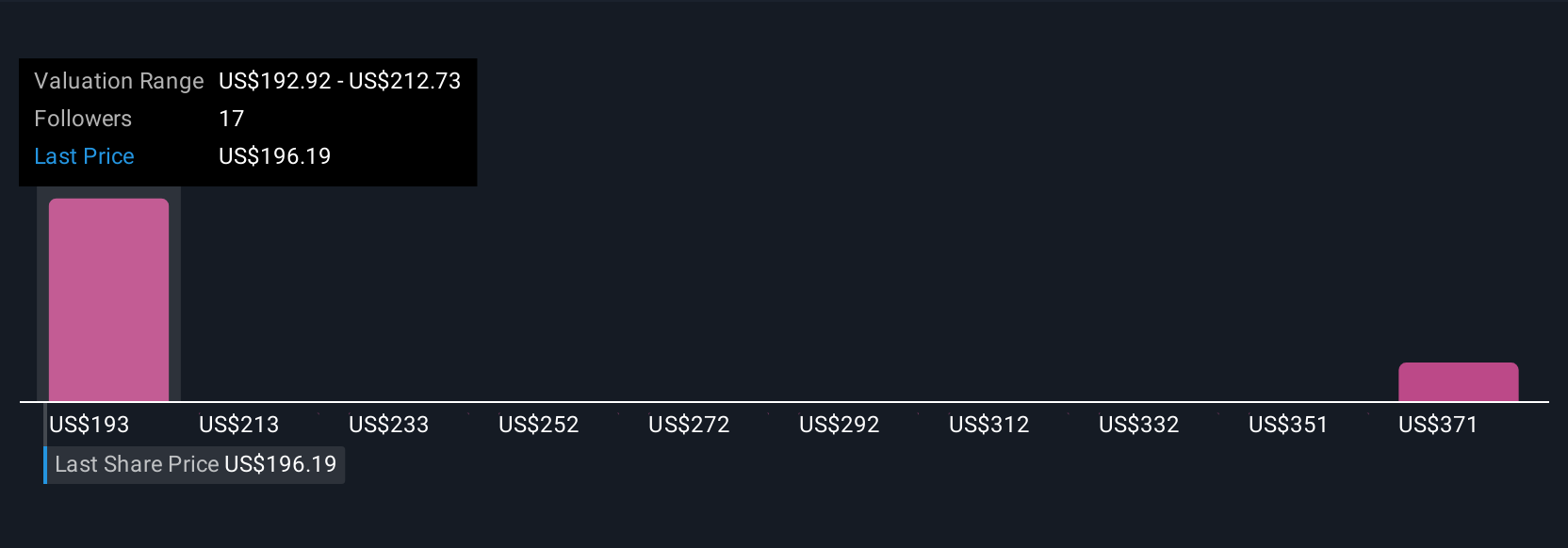

The Simply Wall St Community’s fair value estimates for M&T Bank range widely from US$192.92 to US$350.70, across 4 different individual perspectives. While the community outlook varies, heightened funding cost risk remains a watchpoint that could influence the company’s ability to sustain margin improvements and capital growth over time.

Explore 4 other fair value estimates on M&T Bank - why the stock might be worth as much as 87% more than the current price!

Build Your Own M&T Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your M&T Bank research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free M&T Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate M&T Bank's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com