- Cintas Corporation recently announced that its Board of Directors approved a 15.4% increase to the quarterly cash dividend, raising it to US$0.45 per share payable September 15, 2025, to shareholders of record as of August 15, 2025.

- This dividend hike marks the forty-second consecutive year that Cintas has increased its dividend since its initial public offering in 1983, highlighting an ongoing commitment to returning capital to shareholders.

- We'll examine how this long-standing pattern of dividend growth could impact Cintas' investment narrative and appeal among income-focused investors.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Cintas Investment Narrative Recap

To be a Cintas shareholder, you need to believe in the endurance of outsourced workplace services and the company’s ability to offset risks from structural industry changes. The recent 15.4% dividend increase reinforces the capital returns story, but doesn't materially shift the near-term catalyst, which remains tied to durable revenue growth from new offerings; however, inflation and costs remain a watchpoint.

A relevant recent announcement is Cintas’ fiscal year 2026 revenue guidance of US$11.00 billion to US$11.15 billion. This outlook, following another year of earnings and margin expansion, supports the narrative that cross-selling and extended product lines are currently more important drivers of business momentum than headline dividend news.

Yet, despite these positives, investors should also keep a close eye on the structural risks from remote work and...

Read the full narrative on Cintas (it's free!)

Cintas' narrative projects $12.8 billion in revenue and $2.4 billion in earnings by 2028. This requires 7.2% yearly revenue growth and a $0.6 billion increase in earnings from the current $1.8 billion.

Uncover how Cintas' forecasts yield a $220.06 fair value, a 3% downside to its current price.

Exploring Other Perspectives

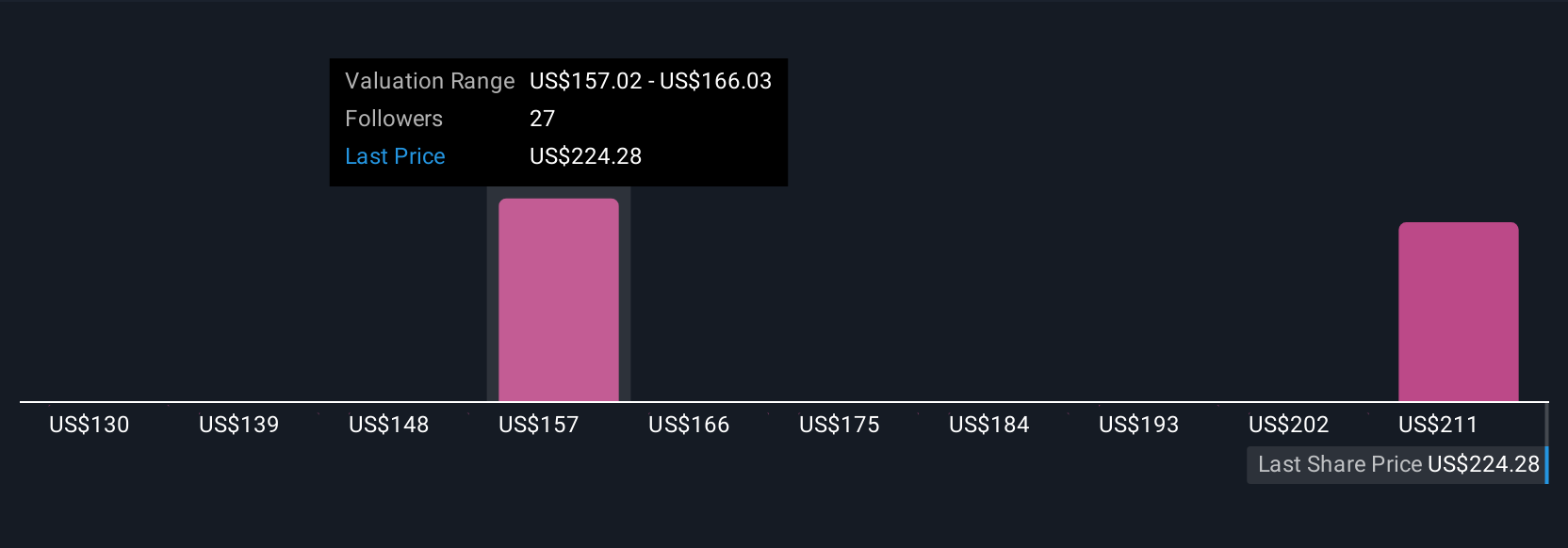

Five fair value estimates from the Simply Wall St Community span from US$130 to US$220.06 per share. These varied perspectives highlight that continued dividend growth is just one piece of how Cintas’ future performance is being evaluated, take a look at the range of opinions for more insight.

Explore 5 other fair value estimates on Cintas - why the stock might be worth as much as $220.06!

Build Your Own Cintas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cintas research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cintas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cintas' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com