- Between April 1 and June 30, 2025, Texas Instruments repurchased 1,847,766 shares for US$289.59 million, completing the latest tranche of its buyback program announced in 2018, with a total of 49,938,873 shares and US$7.70 billion spent overall.

- This milestone highlights the company’s consistent use of share repurchases to return capital to shareholders and potentially boost future earnings per share.

- We’ll examine how this recently completed share buyback activity could influence Texas Instruments’ investment narrative and future capital return outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Texas Instruments Investment Narrative Recap

Being a Texas Instruments shareholder typically means believing in the company's stable cash generation from analog and embedded chips, its role in industrial automation and automotive growth, and its robust capital return policy. The recent completion of a large buyback program, totaling nearly US$7.70 billion since 2018, reflects management's continued commitment to shareholder returns, but does not fundamentally shift the near-term catalyst of a broad-based recovery in industrial and automotive demand or the largest risk of potential underutilization from heavy manufacturing investments.

One recent announcement directly linked to this news is Texas Instruments’ plan to invest over US$60 billion in new U.S. semiconductor fabs. While the completed buyback underscores that the company maintains capacity for meaningful capital returns, these sizable investments mean future cash flow and asset utilization remain closely watched, especially as they relate to the risk of oversupply or a downturn in demand.

By contrast, investors should be aware that if market demand falls short of these expanded factory plans...

Read the full narrative on Texas Instruments (it's free!)

Texas Instruments' outlook forecasts $22.3 billion in revenue and $7.9 billion in earnings by 2028. This trajectory calls for 10.1% annual revenue growth and a $2.9 billion increase in earnings from the current $5.0 billion level.

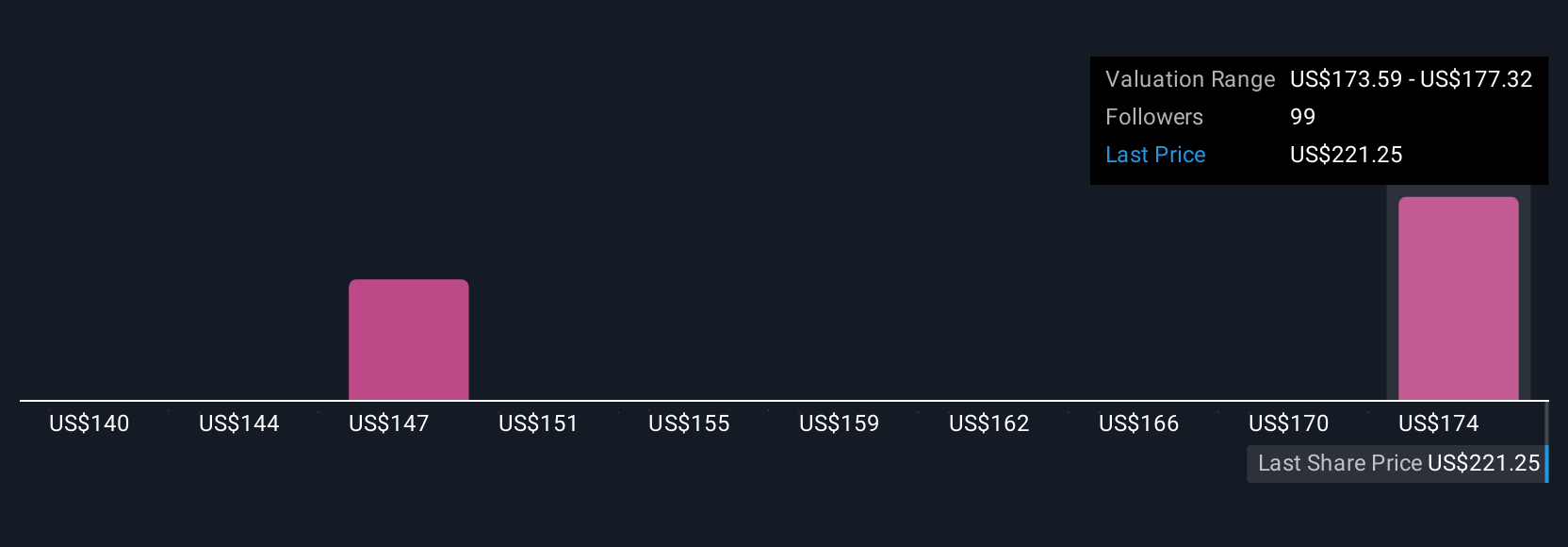

Uncover how Texas Instruments' forecasts yield a $205.73 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Some analysts suggested Texas Instruments’ revenue might only reach US$20.0 billion by 2028, highlighting bearish worries about margin pressures and oversupply risks. If you are seeking different views on how these new developments could alter consensus or bearish outlooks, you may wish to read on.

Explore 7 other fair value estimates on Texas Instruments - why the stock might be worth 26% less than the current price!

Build Your Own Texas Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Instruments research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Texas Instruments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Instruments' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com