- MetLife reported second quarter 2025 earnings with quarterly revenue and net income declining year-over-year, while six-month revenue increased, and also announced recently completed share repurchase tranches totaling over US$650 million.

- In addition to its financial results, MetLife announced Adrienne O’Neill will become Executive Vice President and Chief Accounting Officer, further strengthening its finance leadership team.

- We will explore how MetLife’s continued share buybacks and mixed earnings performance may affect its long-term investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

MetLife Investment Narrative Recap

To be a MetLife shareholder, you likely believe in the company’s ability to deliver consistent returns through prudent capital allocation, disciplined risk management, and diversification, even amid earnings volatility and economic headwinds. The recent quarterly earnings decline may temper near-term expectations, but unless these softer results persist or worsen, the largest immediate catalyst, continued buybacks and capital returns, remains mostly intact, as does the key risk of global macroeconomic and currency pressures.

Of the recent announcements, the completion of over US$650 million in share repurchases stands out in the context of maintaining shareholder value. These sizable buybacks reflect ongoing efforts to return capital following a period of mixed earnings results, directly supporting the company’s stated goal of enhancing earnings per share and overall capital flexibility.

However, investors should also be aware that ongoing foreign currency impacts could continue to weigh on future earnings, especially since...

Read the full narrative on MetLife (it's free!)

MetLife's outlook points to $82.6 billion in revenue and $6.2 billion in earnings by 2028. This is based on a 4.0% annual revenue growth rate and a $1.9 billion increase in earnings from the current $4.3 billion.

Uncover how MetLife's forecasts yield a $94.14 fair value, a 23% upside to its current price.

Exploring Other Perspectives

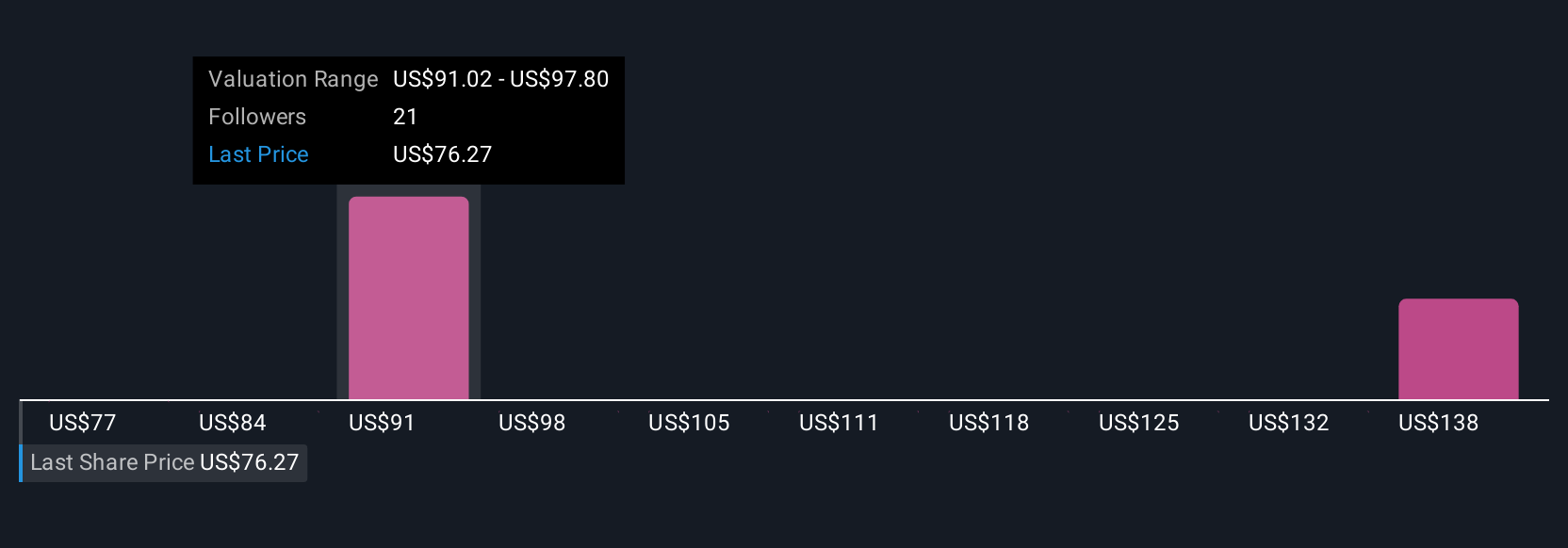

Simply Wall St Community members offered three distinct fair value estimates for MetLife, from US$77.46 to US$145.26 per share. As many weigh these divergent views, the recurring risk of foreign currency fluctuations remains in sharp focus for the company’s forward results.

Explore 3 other fair value estimates on MetLife - why the stock might be worth just $77.46!

Build Your Own MetLife Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MetLife research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MetLife research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MetLife's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com