- Arm Holdings reported first quarter results with revenue of US$1.05 billion, up from US$939 million a year earlier, but saw net income decrease to US$130 million from US$223 million; the company also issued new Q2 2026 revenue guidance in the range of US$1.01 billion to US$1.11 billion.

- Despite the rise in sales, a significant year-on-year drop in net income highlights shifting cost and margin dynamics for the business.

- To better understand how a revenue increase alongside a sharp drop in net income affects Arm’s investment case, we’ll examine its broader outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Arm Holdings Investment Narrative Recap

To be an Arm Holdings shareholder, you really have to believe in the company’s ability to drive royalty growth as it expands from phones into data centers, automotive, and AI. The recent dip in net income, despite climbing revenue, brings focus squarely onto margin pressure: the biggest short-term catalyst remains Arm’s AI-driven data center market share, while the most important risk is higher costs from ramped-up R&D. This quarter’s news does not appear to alter these core issues in a material way.

One announcement standing out amid these results is Arm’s new Q2 2026 revenue guidance, with the company expecting US$1.01 billion to US$1.11 billion in sales. Against a backdrop of ambitious targets in AI and edge computing, this guidance provides a tangible check on whether its investments, particularly in R&D, are translating into profitable top-line growth, putting near-term management execution under the spotlight for investors.

Yet, on the flip side, there’s the risk every investor should keep front of mind: reliance on premium smartphones exposes Arm to headwinds if demand weakens or rivals start to eat into its...

Read the full narrative on Arm Holdings (it's free!)

Arm Holdings' narrative projects $7.4 billion revenue and $2.3 billion earnings by 2028. This requires 21.7% yearly revenue growth and a $1.6 billion increase in earnings from $699.0 million today.

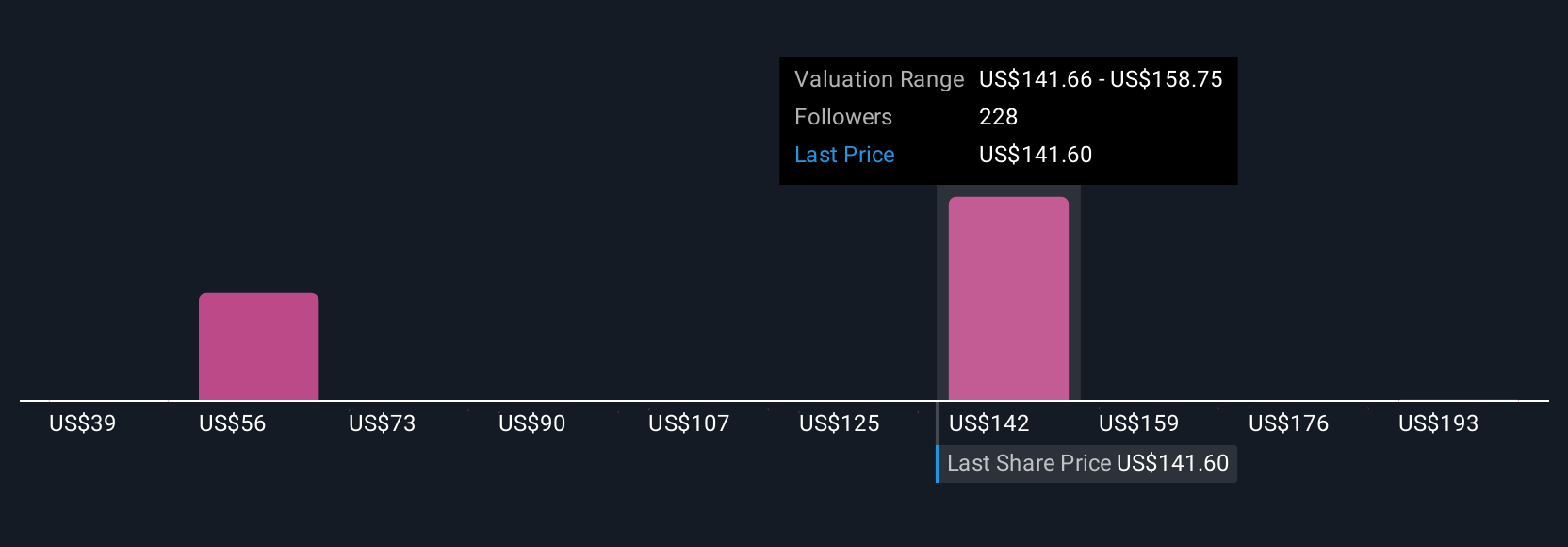

Uncover how Arm Holdings' forecasts yield a $150.89 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts previously forecast Arm’s revenue climbing as high as US$8.5 billion by 2028, ascribing far greater upside from its data center share and edge AI expansion. These forecasts are much higher than consensus and highlight that your view on Arm could change dramatically depending on whether you focus on growth opportunities or caution around risks. Both narratives were set before these earnings, so it’s important to check if this new data shifts expectations in either direction.

Explore 20 other fair value estimates on Arm Holdings - why the stock might be worth less than half the current price!

Build Your Own Arm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arm Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Arm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arm Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com