- Morgan Stanley recently completed and announced multiple fixed-income offerings, including both floating and fixed-rate notes with maturities ranging from 2028 to 2045, as well as significant senior unsecured issues totaling over US$12 million in principal amount.

- An interesting aspect is Morgan Stanley's focus on a mixture of floating and fixed-rate instruments, catering to a range of investor preferences amid evolving market conditions.

- We'll examine how this series of fixed-income issuances aligns with Morgan Stanley's expansion in wealth and asset management services.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Morgan Stanley Investment Narrative Recap

To own Morgan Stanley, investors need confidence in its ability to deliver sustained fee-based growth in wealth and asset management, despite shifting client demands and disruptive competition. The recent wave of fixed-income issuances, while reinforcing capital flexibility, is unlikely to alter the most important near-term catalyst: expanding recurring revenue from wealth management. Key immediate risks remain in digital disruption and potential regulatory shifts, neither of which are meaningfully affected by this latest financing activity.

Among recent announcements, the July 16 dividend increase to US$1.00 per share stands out as most relevant. This move emphasizes Morgan Stanley’s commitment to returning capital to shareholders, a priority that directly supports investor focus on steady earnings growth and consistent capital management, both central to the company’s appeal as a wealth management leader.

Yet, while the business is pursuing new growth, investors should consider the possibility that heightened regulation could suddenly reshape the operating environment...

Read the full narrative on Morgan Stanley (it's free!)

Morgan Stanley's outlook anticipates $76.0 billion in revenue and $17.2 billion in earnings by 2028. This is based on 5.0% annual revenue growth and a $3.1 billion increase in earnings from the current $14.1 billion.

Uncover how Morgan Stanley's forecasts yield a $143.40 fair value, in line with its current price.

Exploring Other Perspectives

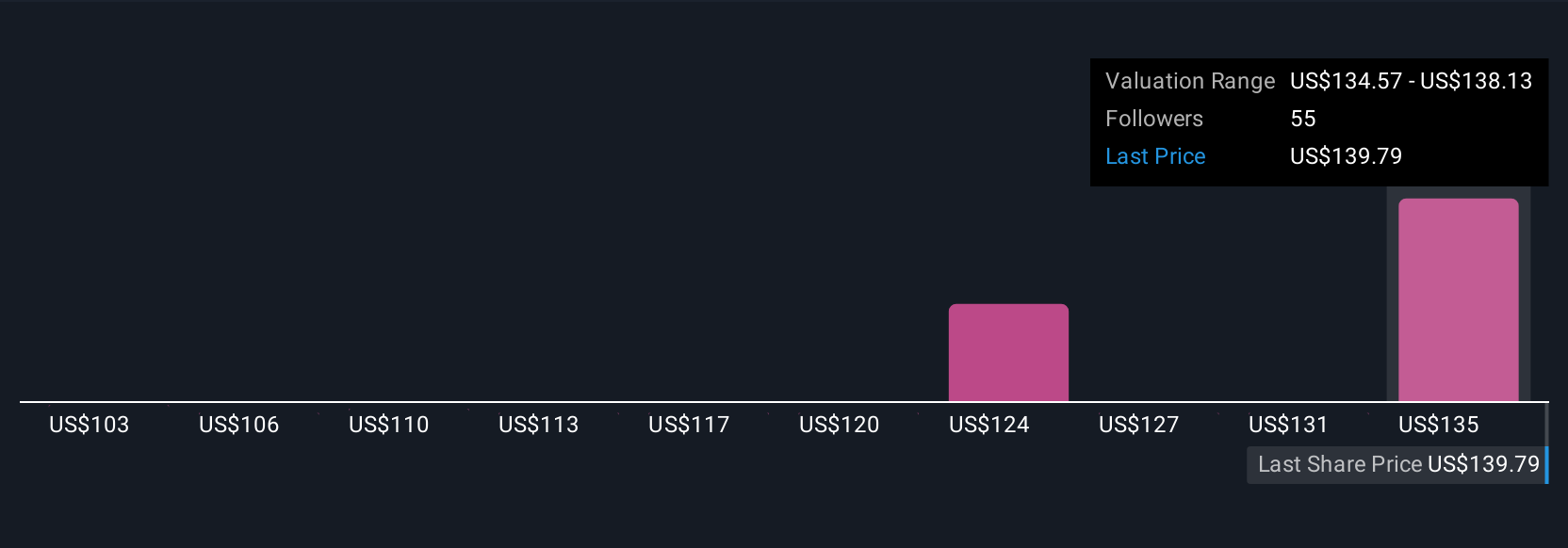

Five private investors from the Simply Wall St Community see Morgan Stanley’s fair value anywhere from US$102.53 up to US$143.40. Despite this wide range, the continued shift toward passive investing remains a force that could influence the company’s fee-based revenue growth. Explore how these varying viewpoints can challenge or reinforce your own expectations.

Explore 5 other fair value estimates on Morgan Stanley - why the stock might be worth as much as $143.40!

Build Your Own Morgan Stanley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Morgan Stanley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morgan Stanley's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com