- In recent months, Abbott Laboratories advanced its Diabetes Care business with FDA approvals for two new over-the-counter continuous glucose monitoring systems and announced further product development in the US market.

- While the company is gaining momentum in diabetes technology, investors have expressed concern after recent earnings revealed a significant, potentially non-recurring tax benefit that could distort the company’s underlying profitability.

- We'll now assess how the Diabetes Care product launches and investor concerns about profit sustainability factor into Abbott's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Abbott Laboratories Investment Narrative Recap

To be a shareholder in Abbott Laboratories, you need to have confidence in its ability to defend and build on its leadership in key areas such as diabetes care and medical devices, even as headwinds in diagnostics and foreign exchange pose risks. The latest buyback announcement, showing no recent share repurchases, is unlikely to shift the near-term focus away from product launches in the Diabetes Care segment, the most important current growth driver. Risks remain around margin sustainability as core earnings are scrutinized after recent non-recurring tax benefits.

Of the recent company updates, the FDA approval for Abbott’s dual-analyte glucose-ketone sensor stands out, as it reinforces the company’s competitive positioning and product innovation in the diabetes market, a crucial catalyst supporting its growth ambitions despite competitive and pricing pressures elsewhere in the business.

However, investors should be aware that, in contrast to product momentum, concerns around recurring profitability, especially after factoring out one-off tax gains, could ...

Read the full narrative on Abbott Laboratories (it's free!)

Abbott Laboratories' outlook anticipates $53.3 billion in revenue and $9.4 billion in earnings by 2028. This scenario assumes a 7.3% annual revenue growth rate and a $4.5 billion decline in earnings from the current $13.9 billion.

Uncover how Abbott Laboratories' forecasts yield a $142.48 fair value, a 6% upside to its current price.

Exploring Other Perspectives

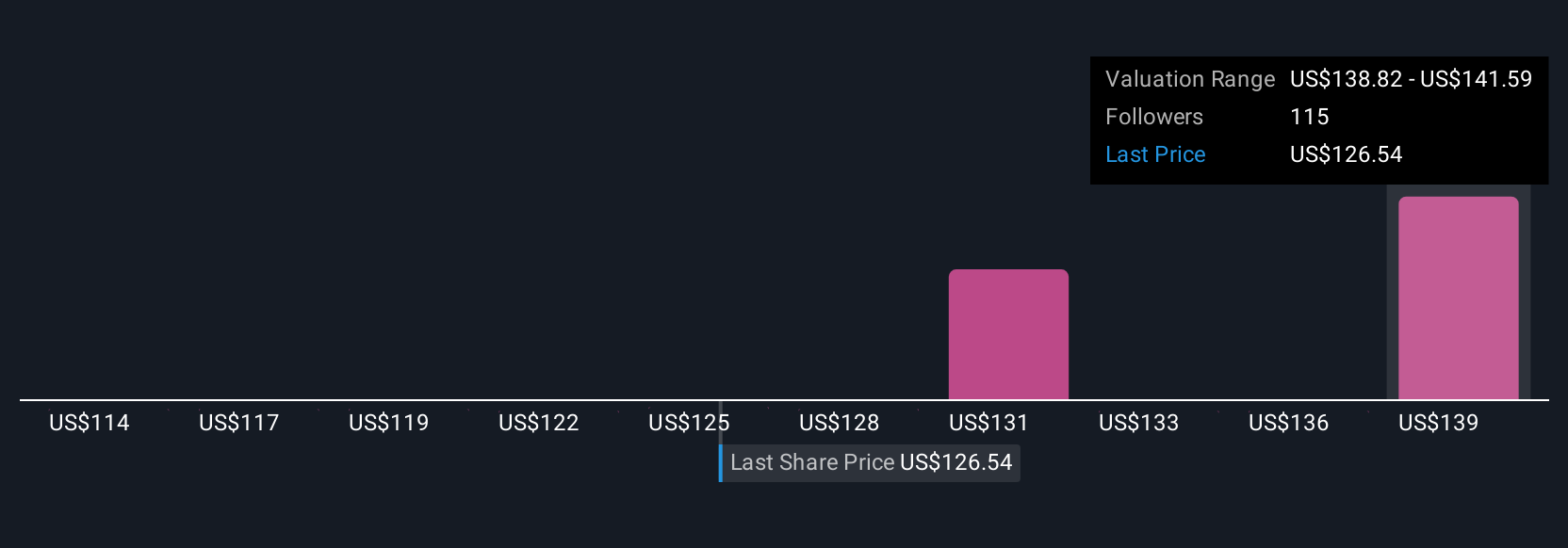

Ten private investor valuations in the Simply Wall St Community set Abbott’s fair value between US$113.88 and US$142.48 per share. Given ongoing competitive challenges in diagnostics, it’s clear market participants approach future earnings with varying expectations, explore multiple viewpoints when forming your own.

Explore 10 other fair value estimates on Abbott Laboratories - why the stock might be worth as much as 6% more than the current price!

Build Your Own Abbott Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abbott Laboratories research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Abbott Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abbott Laboratories' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com