- On July 28, 2025, Kevin W. Williams informed the board of Kaiser Aluminum Corporation of his resignation as director, effective August 1, 2025, with the company confirming the departure was not due to any disagreements.

- The board plans to address the vacancy by seeking a new member with skills that match ongoing company strategy and support succession planning.

- We will explore how the board's focus on aligning new leadership with strategic goals shapes the evolving investment narrative for Kaiser Aluminum.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Kaiser Aluminum's Investment Narrative?

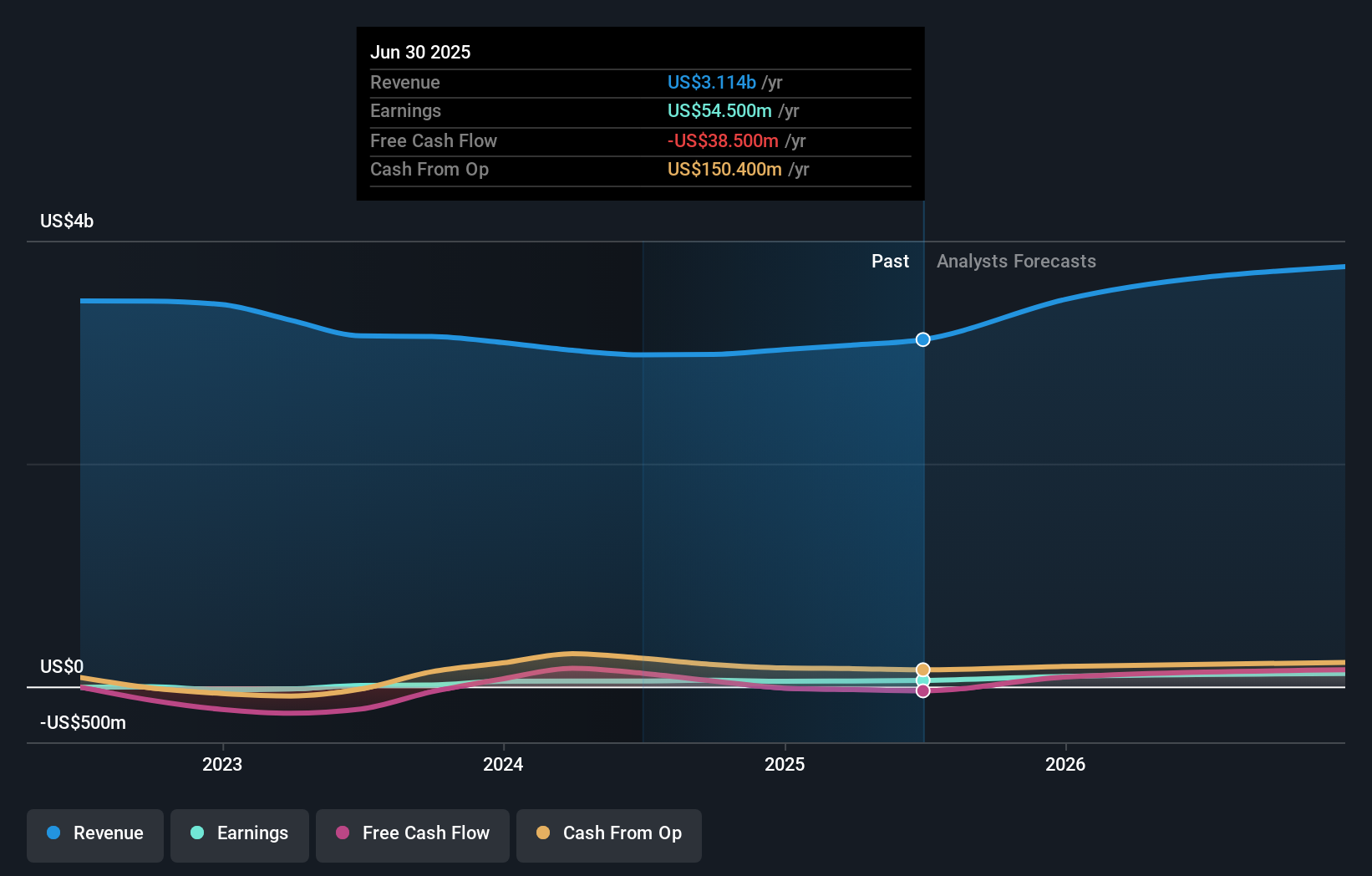

To have conviction in Kaiser Aluminum as an investment, it helps to believe in the company's ability to continue executing on disciplined growth and shareholder returns amid moderate industry volatility. The board’s approach to succession, especially after Kevin W. Williams’s recent resignation, seems relatively measured, and the company has stated there are no points of contention behind his departure. Given the timing and market reaction, with the share price barely moving, the change is unlikely to alter the most critical short-term catalysts: earnings momentum, dividend sustainability, and the pursuit of operational efficiencies. Bigger risks, like tight dividend coverage and exposure to interest costs, remain in focus, particularly as profit growth has slowed well below its longer-term trend. In short, the board change fits the ongoing pattern of board refreshment and doesn’t appear to materially shift the main risks or rewards in view.

But dividend sustainability stands out as a risk some investors may want to watch closely. Kaiser Aluminum's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Kaiser Aluminum - why the stock might be worth over 3x more than the current price!

Build Your Own Kaiser Aluminum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaiser Aluminum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kaiser Aluminum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaiser Aluminum's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com