- Apple Cinemas and IMAX Corporation recently announced an agreement to install five new IMAX with Laser systems across the United States, doubling IMAX's presence within Apple Cinemas locations and bringing the advanced technology back to Philadelphia for the first time since 2020.

- This partnership highlights the persistent demand for premium cinema experiences and marks a year of strong system signings for IMAX in North America, reinforcing its leadership in immersive theater technology.

- We'll explore how the doubling of IMAX's U.S. footprint with Apple Cinemas could impact the company's future growth prospects.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

IMAX Investment Narrative Recap

Being an IMAX shareholder means believing in a continued appetite for premium, immersive cinema experiences and the company’s ability to expand its global network of advanced theaters, even as at-home entertainment remains a long-term risk. The recent Apple Cinemas partnership, while doubling IMAX’s U.S. footprint within that chain, is not likely to dramatically shift near-term box office dependence or content volatility, the two main short-term catalysts and risks, respectively. The addition supports IMAX’s steady installation growth but does not diminish its structural reliance on blockbuster film releases.

Among recent announcements, the expanded agreement with Regal Cinemas to open four new IMAX with Laser locations in major U.S. metropolitan areas stands out. Like the Apple Cinemas deal, it highlights the momentum behind network expansion, reinforcing the pace of new system signings as a primary company catalyst, even as high content volatility remains a risk to consistent earnings growth moving forward.

By contrast, investors should be aware that ongoing dependence on major Hollywood releases still means...

Read the full narrative on IMAX (it's free!)

IMAX's outlook projects $465.5 million in revenue and $73.0 million in earnings by 2028. This assumes an 8.7% annual revenue growth rate and a $40.2 million earnings increase from the current $32.8 million.

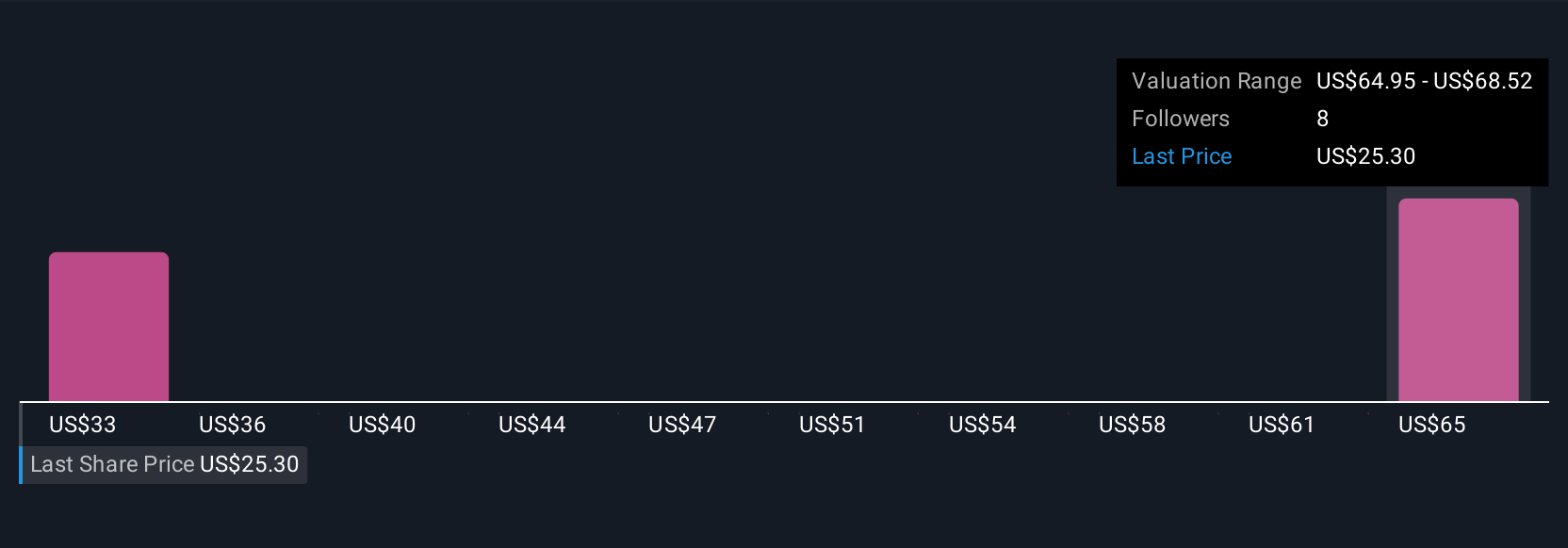

Uncover how IMAX's forecasts yield a $32.82 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 diverse fair value estimates for IMAX, ranging from US$32.82 to US$56.17 per share. These wide-ranging views sit against a backdrop of accelerating system installations and highlight just how differently market participants may assess future prospects.

Explore 2 other fair value estimates on IMAX - why the stock might be worth just $32.82!

Build Your Own IMAX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IMAX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IMAX's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com