- Northwest Natural Holding reported its second-quarter and first-half 2025 earnings, highlighting increased sales to US$236.19 million for the quarter and strong year-to-date net income growth following utility customer expansion in Texas and Oregon rate case developments.

- The company's updated 2025 earnings guidance, integration of the SiEnergy and Pines acquisitions, and recent bylaw amendments underscore its focus on growth, regulatory clarity, and diversified operations in gas, water, and renewables.

- We'll explore how robust Texas utility customer growth and favorable Oregon regulatory outcomes affect Northwest Natural Holding's long-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

Northwest Natural Holding Investment Narrative Recap

To be a shareholder in Northwest Natural Holding today, you have to believe that ongoing growth through Texas expansion and constructive regulatory outcomes will outweigh mounting industry headwinds from decarbonization and changing energy policies. The recent earnings report shows continued customer growth and improved year-to-date net income, giving support to the short-term growth catalyst from Texas operations; however, it does not materially reduce the long-term risks related to secular shifts away from natural gas or regulatory challenges that could affect returns. Among the recent company announcements, the update to 2025 earnings guidance (US$2.60 to US$2.80 per share) is most relevant, it reflects acquisition-related transaction costs but reaffirms the company's confidence in its full-year outlook, directly tying into the current catalyst of integrating and scaling the Texas acquisitions for revenue and earnings growth. In contrast, investors should be aware that while near-term growth appears solid, the evolving regulatory environment in the Pacific Northwest remains a key variable, as…

Read the full narrative on Northwest Natural Holding (it's free!)

Northwest Natural Holding's outlook anticipates $1.5 billion in revenue and $147.4 million in earnings by 2028. This is based on a 7.3% annual revenue growth rate and a $44.1 million increase in earnings from the current $103.3 million.

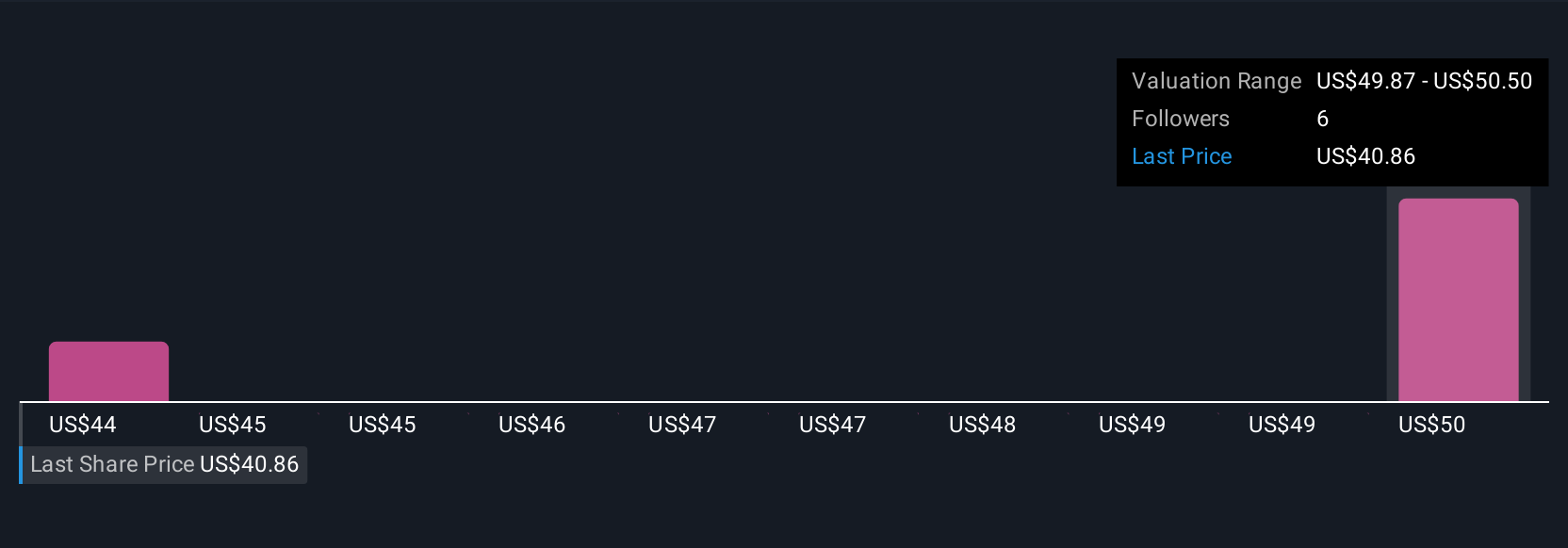

Uncover how Northwest Natural Holding's forecasts yield a $50.50 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Northwest Natural Holding, ranging from US$41.89 to US$50.50 per share. Several see potential for future revenue growth, yet many continue to watch how regulatory and policy trends will affect the company's performance over time.

Explore 2 other fair value estimates on Northwest Natural Holding - why the stock might be worth just $41.89!

Build Your Own Northwest Natural Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northwest Natural Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northwest Natural Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northwest Natural Holding's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com