- Kadant Inc. recently reported that its second quarter sales and net income declined compared to the prior year, and the company also reduced its full-year 2025 earnings guidance.

- The results reflect both lower sales and cautious outlook, with management providing new revenue and GAAP EPS estimates for the upcoming quarter as well.

- We'll examine how Kadant's revised earnings guidance may affect the long-term outlook and analyst narrative for the company.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Kadant Investment Narrative Recap

Kadant’s long-term story centers on stable recurring revenue from its aftermarket parts and services, supported by an aging installed equipment base and modernization demand. The recent Q2 sales and earnings decline, along with a reduction in full-year guidance, tempers immediate optimism but does not fundamentally alter the core catalyst of aftermarket demand; however, it does reinforce concerns about capital project cyclicality as a near-term business risk.

The company’s updated third-quarter guidance, calling for revenue between US$256 million and US$263 million and GAAP EPS of US$2.12 to US$2.22, directly follows lowered full-year expectations. This near-term forecast gives investors fresh insight into how management sees short-term order flow, crucial in gauging the risk of further order deferrals or margin pressure during a period of economic caution.

Still, against this backdrop of cautious optimism, investors should closely monitor how sustained delays in capital-equipment spending might impact...

Read the full narrative on Kadant (it's free!)

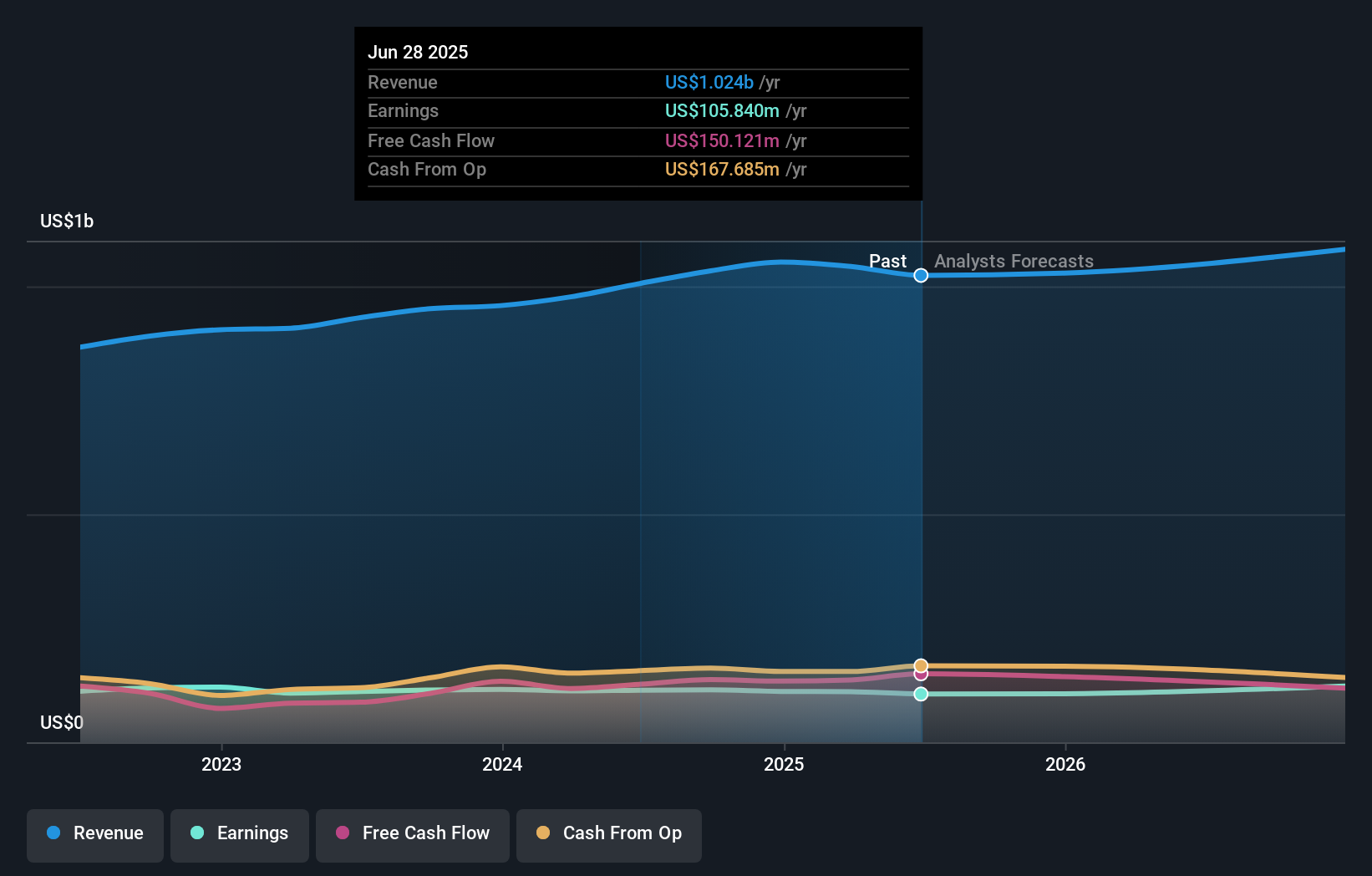

Kadant's outlook anticipates $1.1 billion in revenue and $141.4 million in earnings by 2028. This projection relies on a 3.5% annual revenue growth rate and a $35.6 million increase in earnings from the current $105.8 million.

Uncover how Kadant's forecasts yield a $343.33 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put Kadant’s fair value between US$180 and US$200, based on two independent estimates. With investors debating international market risks and possible order delays, it is clear that a range of perspectives exists on what the company is truly worth.

Explore 2 other fair value estimates on Kadant - why the stock might be worth as much as $200.00!

Build Your Own Kadant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kadant research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Kadant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kadant's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com