- Starboard Value LP recently announced it is engaging in discussions with Rogers Corporation’s management and Board regarding potential value creation opportunities, following the release of Rogers’ second quarter 2025 earnings report and updated guidance for the third quarter.

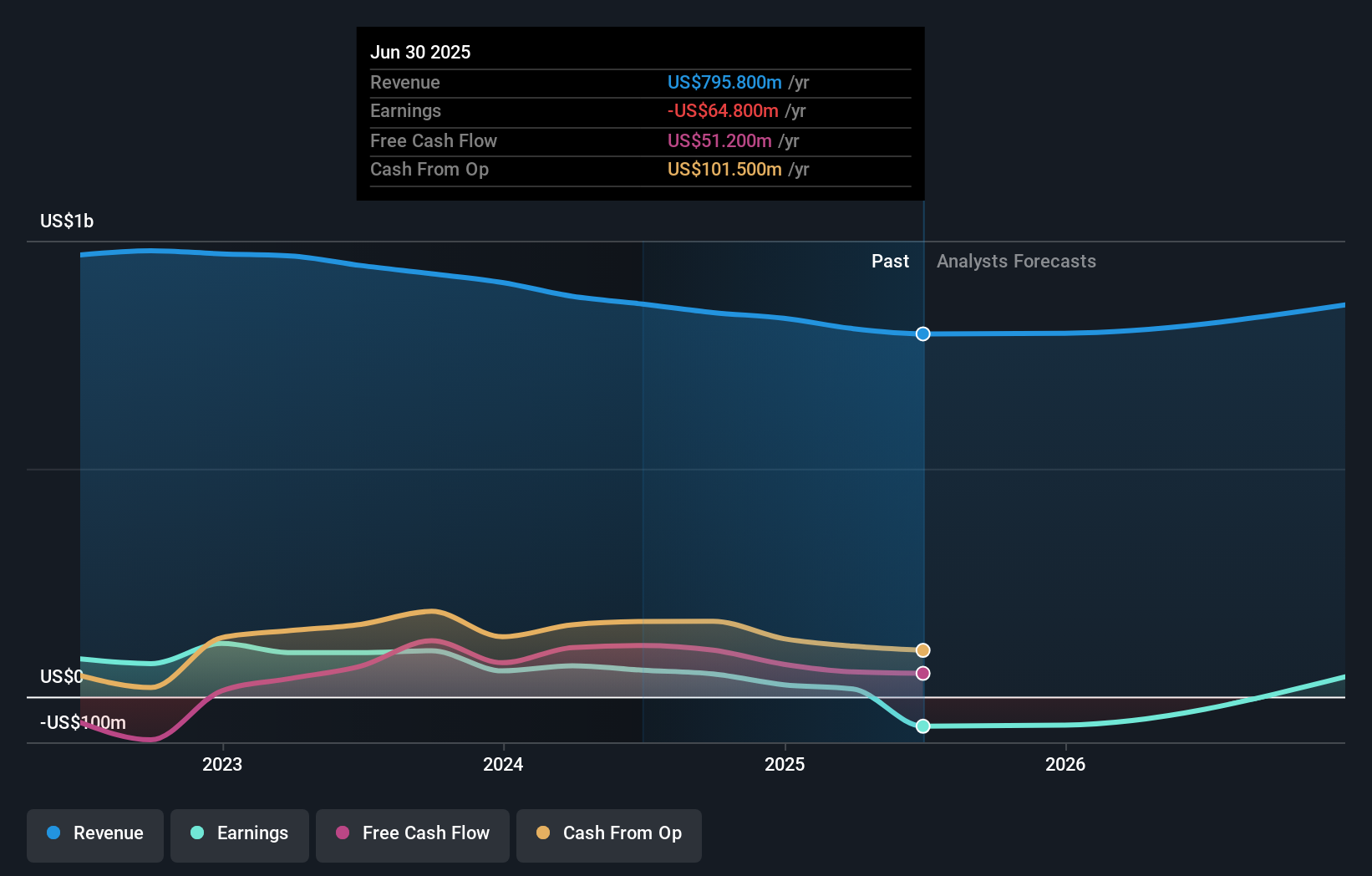

- This activist involvement comes as Rogers reported a net loss of US$73.6 million for the second quarter, alongside subdued sales and earnings guidance for the upcoming quarter, highlighting heightened investor attention as the company considers both operational challenges and possible changes ahead.

- We’ll explore how Starboard Value’s engagement, at a time of financial underperformance, could shift Rogers’ investment narrative going forward.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Rogers Investment Narrative Recap

To be a shareholder in Rogers today, you need conviction in the company’s long-term role in electric vehicles and advanced materials, despite ongoing challenges in core markets. The short-term catalyst remains investor pressure for operational turnaround, but Starboard Value’s engagement following disappointing earnings and guidance only adds focus, it does not yet materially shift the biggest risk, which is persistent demand shortfalls and competitive threats in key EV segments.

One of the most relevant developments is Rogers' latest earnings report, which showed a net loss of US$73.6 million for the second quarter and continued weak sales compared to last year. These results underscore the uncertainty surrounding recovery in core markets, feeding directly into both activist attention and concerns about the sustainability of current restructuring efforts.

By contrast, investors should be aware that ongoing restructuring actions and recurring losses could affect Rogers’ ability to realize the long-term benefits from its core growth segments…

Read the full narrative on Rogers (it's free!)

Rogers is projected to reach $921.6 million in revenue and $87.6 million in earnings by 2028. This outlook requires a 5.0% annual revenue growth rate and a $152.4 million increase in earnings from the current figure of -$64.8 million.

Uncover how Rogers' forecasts yield a $80.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community for Rogers currently span from US$23.43 to US$80. Persistent demand pressures in the EV segment are a central theme, shaping how you might interpret these wide differences in outlook.

Explore 2 other fair value estimates on Rogers - why the stock might be worth as much as 11% more than the current price!

Build Your Own Rogers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Rogers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rogers' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com