- Sealed Air Corporation recently reported its second-quarter 2025 earnings, showing slightly decreased quarterly sales and net income alongside improved results for the first half of the year, while also announcing the appointment of Kristen Actis-Grande as its new Chief Financial Officer, effective August 25.

- The blend of stable financial performance and an incoming CFO with extensive finance leadership experience marks a period of transition for Sealed Air, potentially influencing future operational and strategic decisions.

- We'll assess how the combination of resilient half-year earnings and new financial leadership could shape Sealed Air's investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Sealed Air Investment Narrative Recap

To be a Sealed Air shareholder today, you need to believe in the company’s ability to grow its packaging business through sustainable product innovation and margin protection despite ongoing pressure in core food and protective segments. The latest quarterly results, showing resilient first-half earnings but declining second-quarter sales and profits, affirm continued operational discipline, but the pace of North American protein recovery and evolving consumer packaging demand remain the most important catalysts and risks. Neither the financial update nor the CFO transition appears to materially shift these near-term factors.

The announcement of Kristen Actis-Grande as incoming Chief Financial Officer directly relates to Sealed Air’s ongoing campaign to boost operational agility and margin expansion. Her arrival, following a period of interim leadership, positions the company to possibly accelerate finance-driven strategies that support cost productivity efforts and global commercial initiatives, especially as Sealed Air continues to focus on supply chain optimization and disciplined capital allocation in a challenging demand environment.

Yet, contrasting these operational improvements, investors should be aware of the persistent risk that ongoing declines in North American beef volumes could continue to ...

Read the full narrative on Sealed Air (it's free!)

Sealed Air's outlook anticipates $5.7 billion in revenue and $538.6 million in earnings by 2028. This is based on analysts' assumptions of 2.4% annual revenue growth and an $239.2 million increase in earnings from the current $299.4 million.

Uncover how Sealed Air's forecasts yield a $39.14 fair value, a 33% upside to its current price.

Exploring Other Perspectives

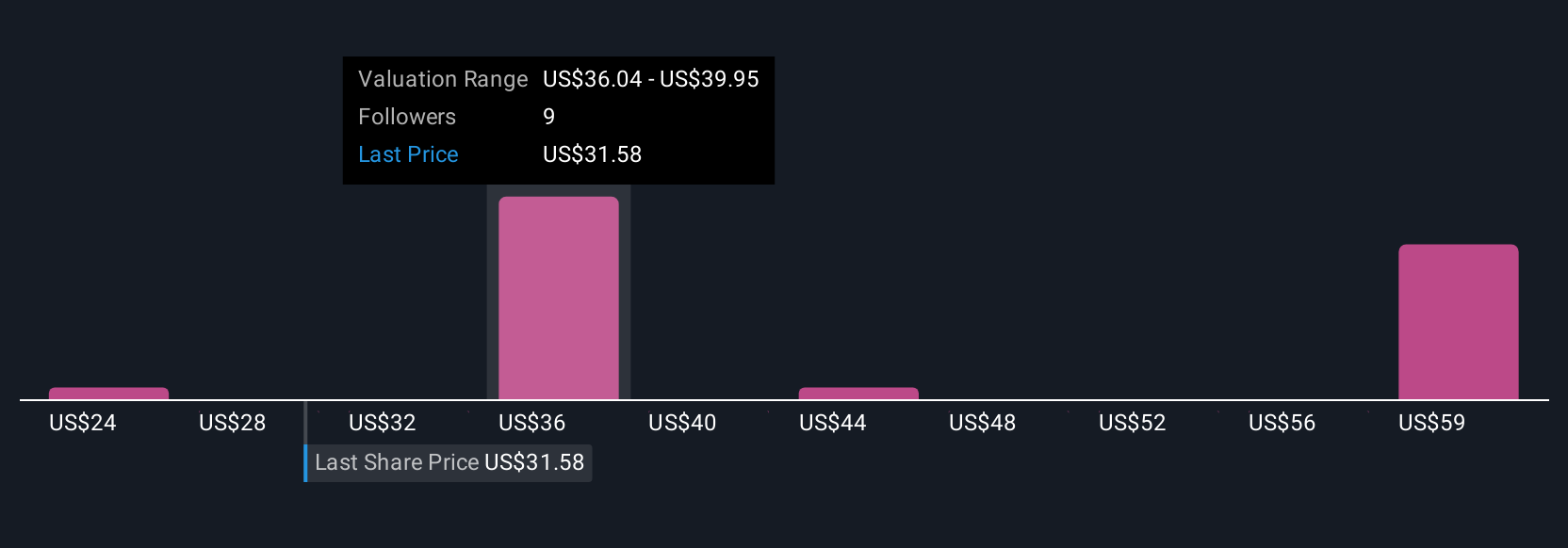

Four members of the Simply Wall St Community set fair value estimates for Sealed Air between US$24.33 and US$59.71, a wide range. With risks lingering around food segment volumes, your view on market recovery timing could shape your own expectations, so review alternative projections and see how others interpret the available information.

Explore 4 other fair value estimates on Sealed Air - why the stock might be worth over 2x more than the current price!

Build Your Own Sealed Air Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sealed Air research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sealed Air research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sealed Air's overall financial health at a glance.

No Opportunity In Sealed Air?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com