- California Water Service Group recently reported its second quarter 2025 earnings, showing year-over-year quarterly growth in sales to US$264.95 million and net income to US$42.17 million, and declared its 322nd consecutive quarterly dividend of US$0.30 per share, payable in August.

- While quarterly results were stronger compared to last year, the company’s six-month sales and net income saw meaningful declines, reflecting uneven financial performance over the half-year.

- We'll explore how the modest six-month results and ongoing dividend stability might influence California Water Service Group’s investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

California Water Service Group Investment Narrative Recap

Being a shareholder in California Water Service Group means believing in the reliability of regulated water utilities and the expectation that infrastructure investment and rate case approvals will drive long-term growth. The recent quarterly earnings beat does not materially alter the key short-term catalyst, the resolution of the California General Rate Case, and the biggest risk remains regulatory uncertainty around this outcome and its impact on future allowed rates.

Among recent announcements, the company's 322nd consecutive quarterly dividend stands out, emphasizing management's ongoing commitment to returning capital to shareholders despite uneven six-month results. This stability provides reassurance amid variable earnings, but it does not offset the underlying risk of delays or unfavorable developments in regulatory proceedings, which could affect both future profitability and dividend sustainability.

However, investors should be aware that even with this consistent dividend, regulatory approval delays could...

Read the full narrative on California Water Service Group (it's free!)

California Water Service Group's outlook forecasts $1.1 billion in revenue and $188.4 million in earnings by 2028. This projection is based on an annual revenue growth rate of 4.5% and a $52.6 million increase in earnings from the current level of $135.8 million.

Uncover how California Water Service Group's forecasts yield a $55.60 fair value, a 19% upside to its current price.

Exploring Other Perspectives

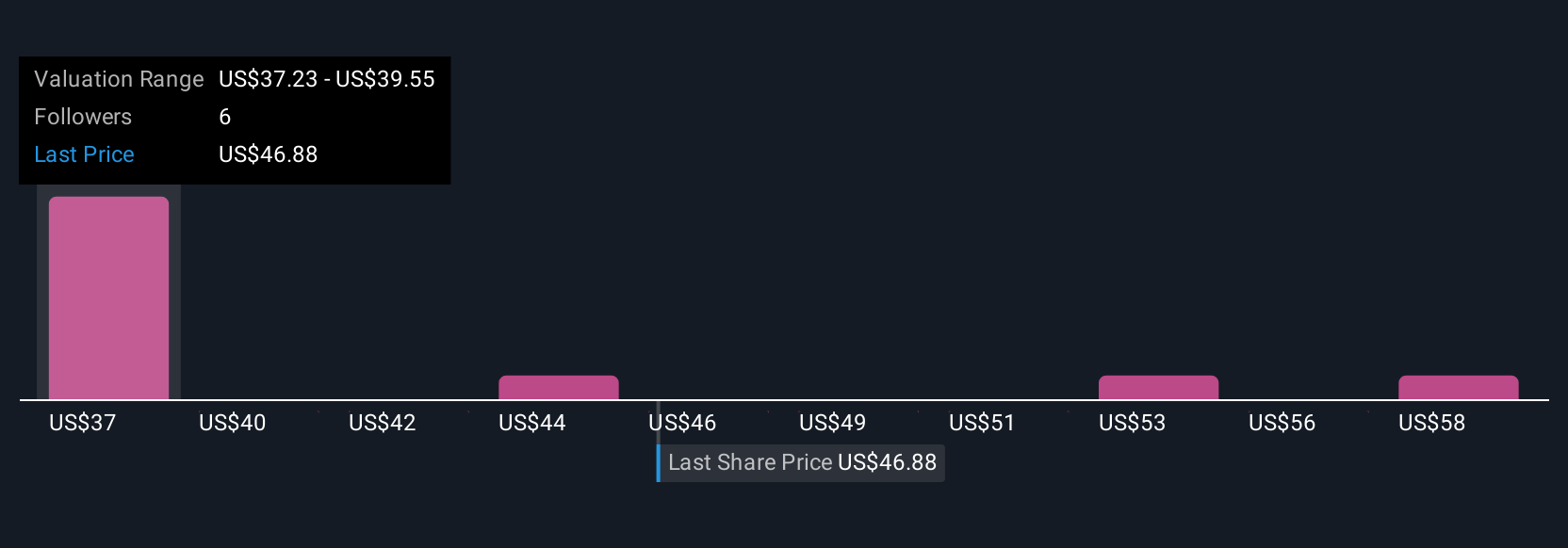

Four members of the Simply Wall St Community have assigned fair values to California Water Service Group with estimates spanning from US$37.23 to US$60.39 per share. While views vary widely, the ongoing uncertainty surrounding regulatory approvals continues to shape expectations and the company’s potential for near-term earnings recovery, make sure to consider several perspectives as you assess your own outlook.

Explore 4 other fair value estimates on California Water Service Group - why the stock might be worth as much as 29% more than the current price!

Build Your Own California Water Service Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your California Water Service Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free California Water Service Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate California Water Service Group's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com