- In late July 2025, Lear Corporation reinstated its full-year 2025 guidance and confirmed a new phase in its capital return strategy, including the extension of its US$2.0 billion unsecured revolving credit facility to July 2030 and completion of an additional US$25 million in share repurchases.

- The company's renewed outlook comes as it continues to invest in restructuring and automation, expecting cost savings and margin improvement despite production headwinds and a slight reduction in operating earnings guidance for the year.

- With this return to consistent guidance and continued investment in efficiency measures, we'll examine how Lear's latest financing and buyback actions influence its future investment narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Lear Investment Narrative Recap

To be a shareholder in Lear right now, you generally have to believe the company can convert its platform wins in electrified seating and wire programs into higher revenue and margin, even as it manages through ongoing auto production uncertainty. The recent extension of Lear’s US$2.0 billion revolving credit facility and steady buybacks add financial flexibility but do not materially change the near-term catalyst, which remains tied to automaker output levels, or the largest risk: sustained lower volumes on key platforms.

The announcement of a 2 percent raise in Lear's 2025 revenue guidance, boosted by foreign exchange, cost recoveries, and business consolidation, aligns with this catalyst, although new core operating earnings guidance is slightly lower, reinforcing the ongoing margin pressure from uneven automotive volumes.

By contrast, investors should be aware of ongoing headwinds that could limit revenue growth if production remains below expectations or major programs wind down...

Read the full narrative on Lear (it's free!)

Lear's outlook assumes revenues will reach $24.6 billion and earnings $1.0 billion by 2028, with analysts forecasting annual revenue growth of 2.5%. This represents more than a doubling of earnings, rising by about $530 million from the current $469.8 million.

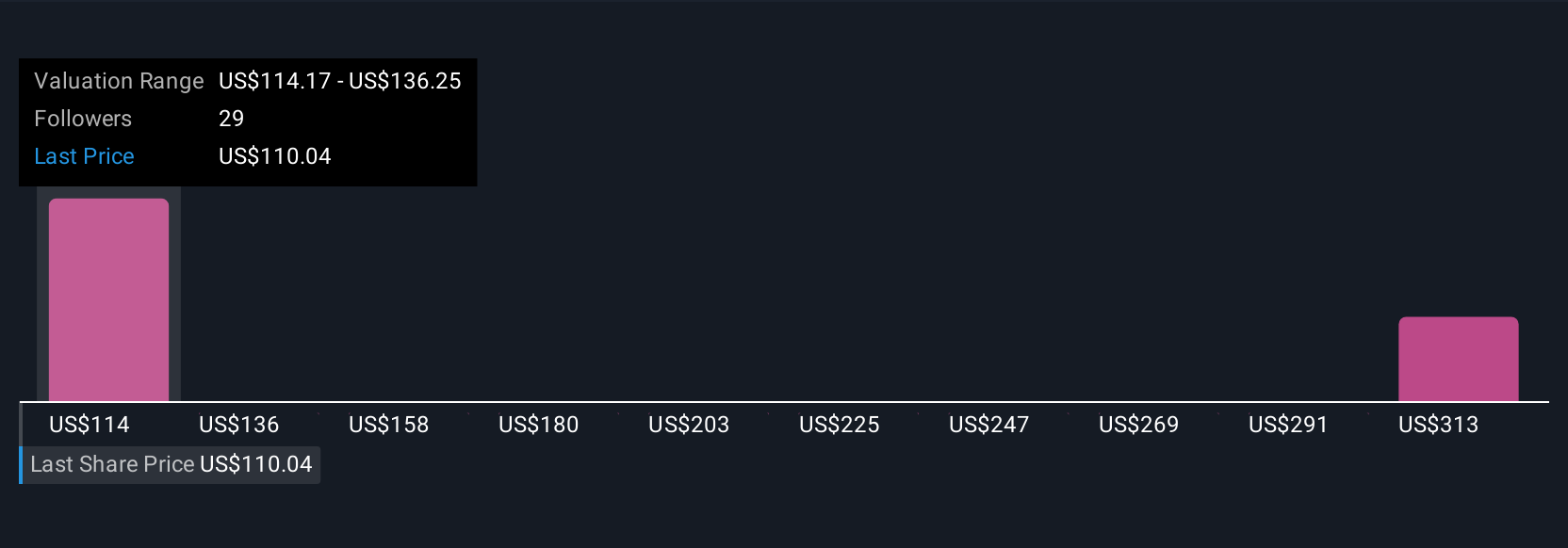

Uncover how Lear's forecasts yield a $114.17 fair value, a 19% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community offers two retail investor fair value estimates for Lear that range sharply from US$114 to US$328 per share. While some see substantial upside, others remain focused on risks tied to auto production volatility and potential supply chain complications, explore more views to see where you stand.

Explore 2 other fair value estimates on Lear - why the stock might be worth over 3x more than the current price!

Build Your Own Lear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lear research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lear's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com