- Otter Tail Corporation recently reported its second quarter 2025 earnings, revealing better-than-expected adjusted earnings per share, increased annual earnings guidance, and the declaration of a US$0.525 quarterly dividend payable in September.

- An interesting aspect is that the company's Plastics segment outperformed expectations and management secured approval to recover capital investments for two solar projects alongside filing for a new electric rate increase.

- To understand what this means for investors, we’ll look at how Otter Tail’s raised annual earnings guidance reshapes its broader investment narrative.

These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Otter Tail Investment Narrative Recap

To own Otter Tail Corporation, investors need conviction in the company’s ability to drive recurring earnings from regulated utilities and diversified growth in both manufacturing and plastics, while navigating the complexities of major capital investment. The recent uptick in annual earnings guidance, primarily attributed to outperformance in the Plastics segment and recovery approval for solar investments, positively supports the most important near-term catalyst, robust regulated earnings. However, the raised guidance does not materially reduce the largest current risk: that Otter Tail’s ambitious growth targets rely on regulatory approvals and timely realization of new large-load contracts, both of which carry execution risk.

Among the recent news, the approval to recover capital investments for two solar projects stands out. This is especially relevant given that major rate-base expansions and cost recovery mechanisms are central to Otter Tail’s planned earnings growth. If future regulatory or policy changes threaten the economics of renewable projects, this would directly impact the company’s long-term growth drivers even as short-term catalysts remain intact.

By contrast, investors should also consider the possibility that regulatory or legislative shifts affecting clean energy incentives could quickly reshape the outlook for ...

Read the full narrative on Otter Tail (it's free!)

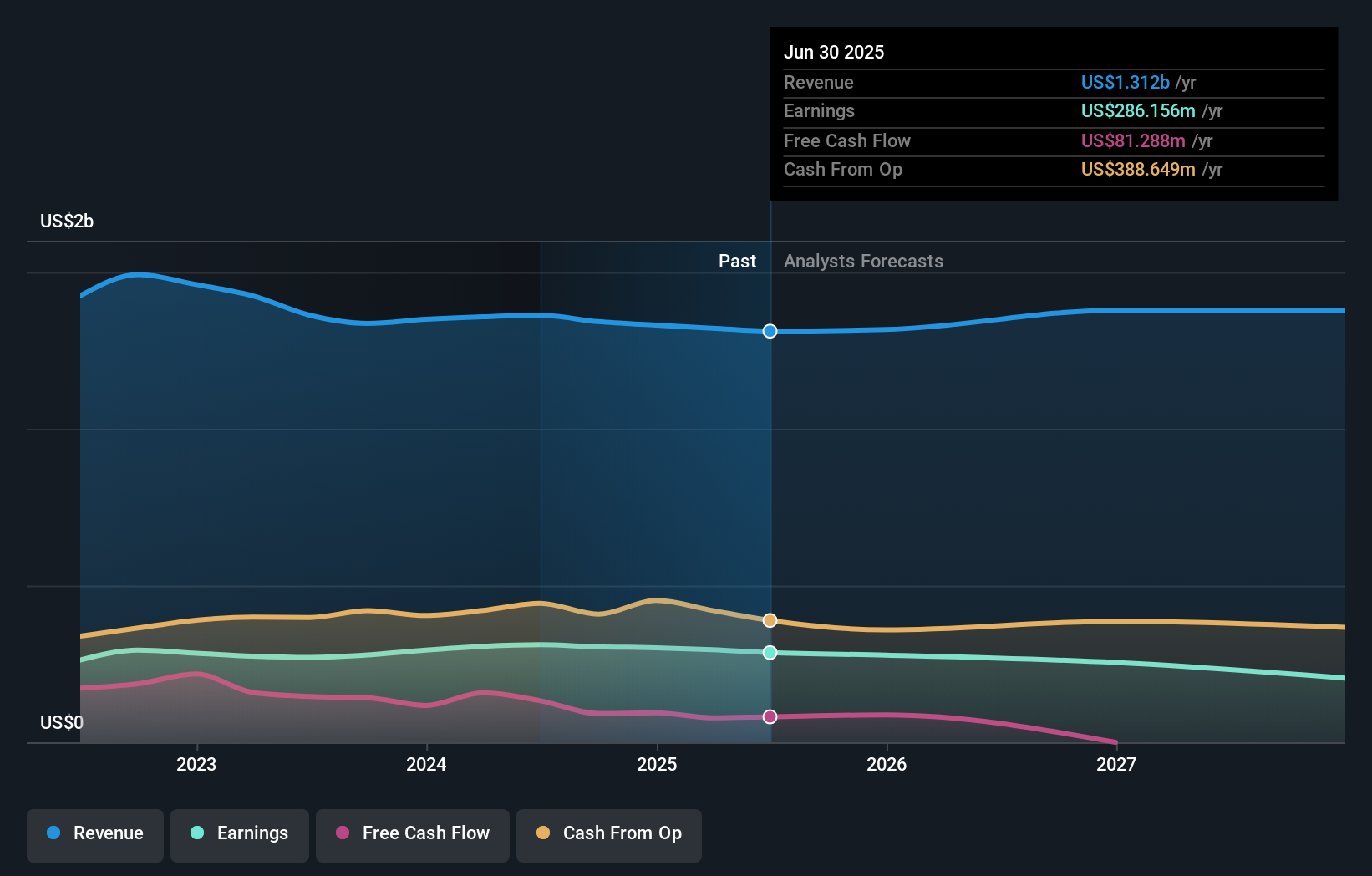

Otter Tail's outlook anticipates $1.4 billion in revenue and $185.6 million in earnings by 2028. This is based on a projected 2.0% annual revenue growth rate and reflects a decrease in earnings of $100.6 million from the current $286.2 million.

Uncover how Otter Tail's forecasts yield a $83.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted four fair value estimates for Otter Tail, ranging from US$0.01 to US$83. This wide spread reflects varied growth and risk views, especially as upcoming regulation could redefine future returns.

Explore 4 other fair value estimates on Otter Tail - why the stock might be worth less than half the current price!

Build Your Own Otter Tail Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Otter Tail research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Otter Tail research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Otter Tail's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com