- Brookfield Renewable recently declared a quarterly dividend of US$0.373 per class A share and announced earnings for the second quarter of 2025, reporting sales of US$952 million and a net loss of US$1.41 billion.

- The company highlighted record Funds From Operations, expanded its partnership with Google for up to 3,000 megawatts of hydroelectric capacity, and increased its investment in Colombia's Isagen business while continuing asset recycling efforts.

- We’ll examine how Brookfield Renewable’s record Funds From Operations and major Google agreement shape its evolving investment outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Brookfield Renewable Investment Narrative Recap

For investors considering Brookfield Renewable, the investment case often centers on confidence in the ongoing shift to clean energy and the potential for long-term, stable returns in renewables. The latest quarterly results, including record Funds From Operations and the expanded Google agreement, help support growth catalysts, but short-term risks tied to regulatory uncertainty and funding in public markets remain; the immediate impact of these announcements on those risks appears limited.

The newly secured partnership with Google for up to 3,000 megawatts of hydroelectric capacity is especially relevant, positioning Brookfield Renewable to harness the surging electricity demands of technology clients. This directly connects to the biggest short-term catalyst: capitalizing on rising data center power needs through large, contracted projects.

But while the headlines focus on growth, investors should also be aware that changes in U.S. tax credit policies could...

Read the full narrative on Brookfield Renewable (it's free!)

Brookfield Renewable's narrative projects $7.1 billion in revenue and $689.4 million in earnings by 2028. This requires 22.3% yearly revenue growth and a $2.0 billion increase in earnings from the current level of -$1.3 billion.

Uncover how Brookfield Renewable's forecasts yield a $35.00 fair value, in line with its current price.

Exploring Other Perspectives

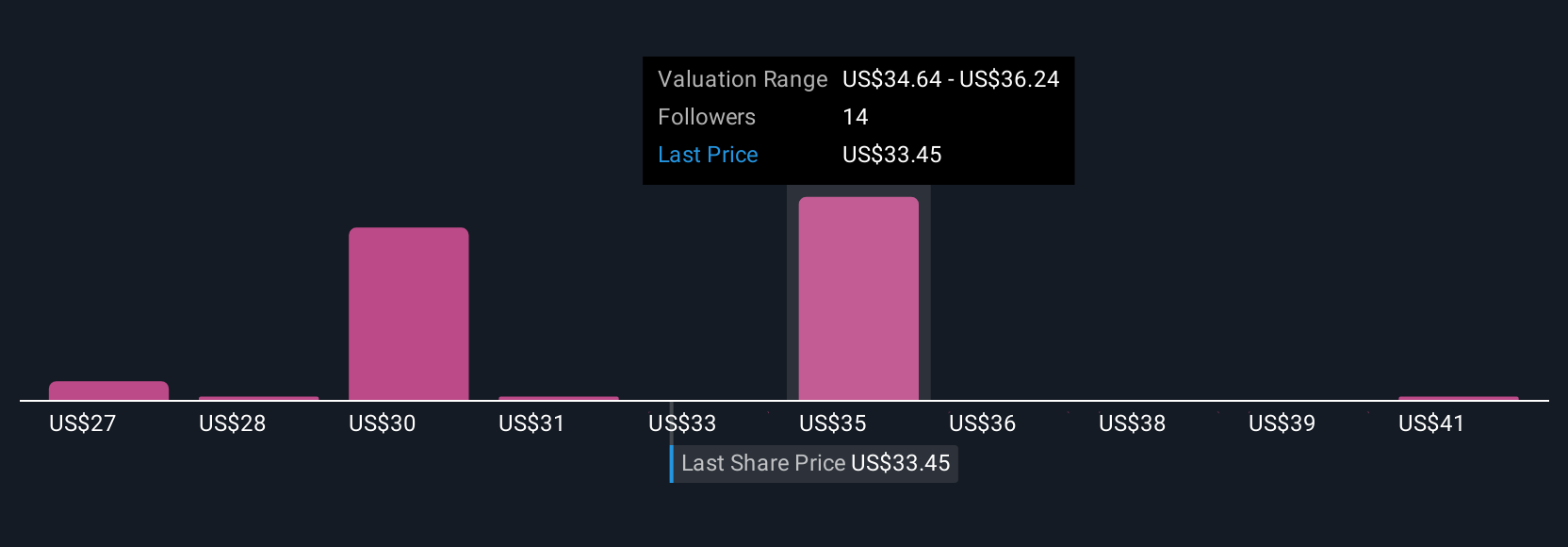

Eight fair value estimates from the Simply Wall St Community range from US$26.64 to US$42.64 per share, with opinions spanning nearly US$16. Recent earnings volatility highlights how forecasts and investor sentiment can shift quickly, so be sure to consider a variety of viewpoints.

Explore 8 other fair value estimates on Brookfield Renewable - why the stock might be worth 22% less than the current price!

Build Your Own Brookfield Renewable Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Renewable research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Brookfield Renewable research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Renewable's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com