- Ingevity Corporation reported second quarter 2025 results with sales of US$365.1 million, a decrease from US$390.6 million a year earlier, and a net loss of US$146.5 million that included a significant non-cash goodwill impairment charge in its Advanced Polymer Technologies segment.

- Despite the weaker headline figures, adjusted earnings increased by 39%, and management raised the low end of its adjusted EBITDA guidance while emphasizing improved margins and stable free cash flow.

- We’ll explore how management’s decision to raise EBITDA guidance despite sales declines and impairment charges shapes Ingevity’s investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Ingevity Investment Narrative Recap

To be an Ingevity shareholder, you need conviction in the company’s ability to drive higher profitability and more stable cash flow through portfolio repositioning and operational improvements, despite ongoing headwinds in Advanced Polymer Technologies and global trade uncertainty. The recent Q2 results, marked by a goodwill impairment and lower sales, do not materially change the short-term catalyst: accelerating portfolio transformation to support margin recovery. However, the biggest immediate risk remains persistent tariff disruptions and unpredictable demand in key end markets.

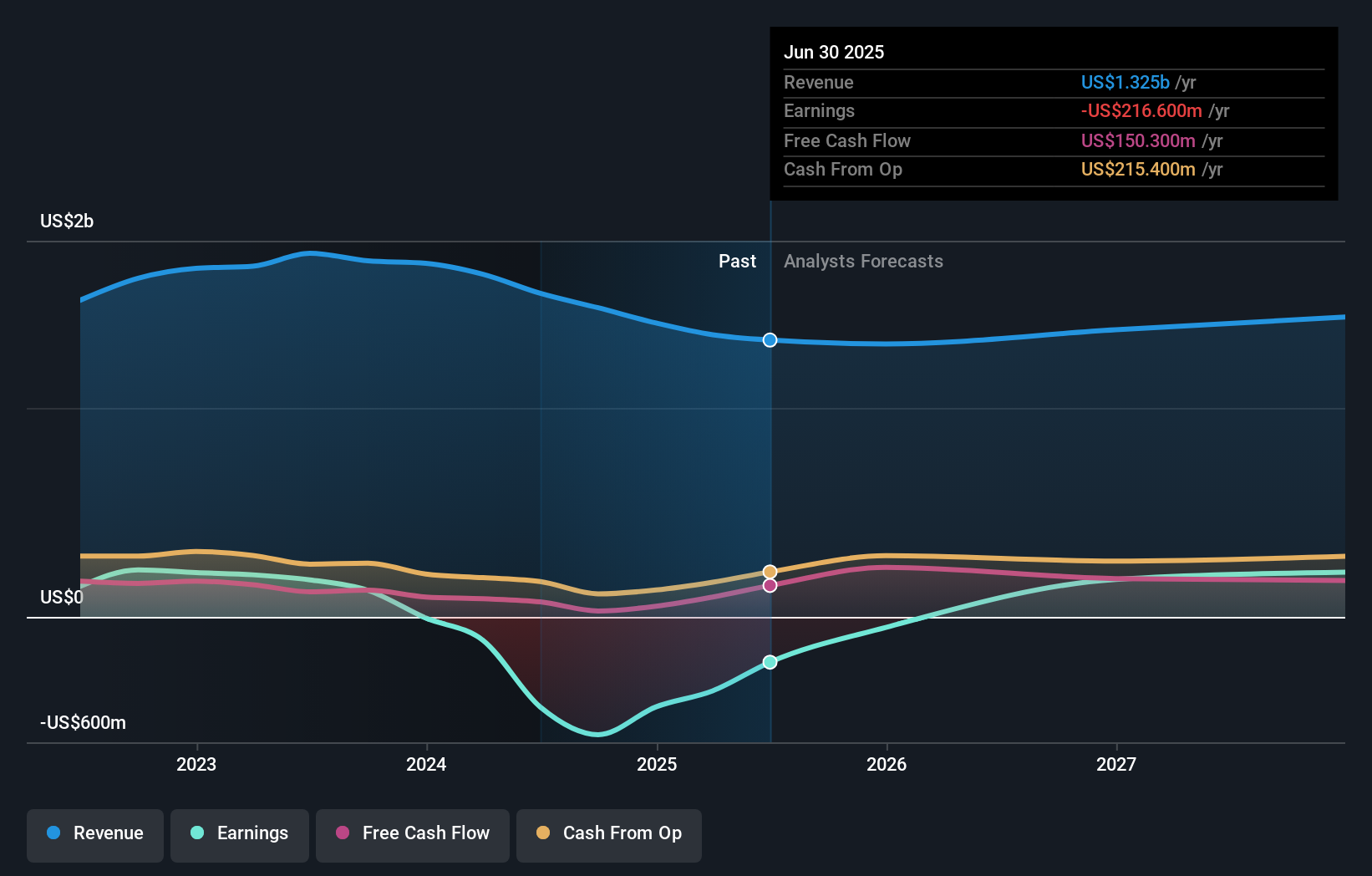

Among recent announcements, the board’s maintenance of full-year 2025 sales guidance at US$1.25 billion to US$1.40 billion stands out, signaling management’s confidence in the core business amid sales pressures. This steady outlook is relevant to short-term margin and portfolio catalysts, as it implies that the company expects to offset ongoing global trade challenges with internal improvements and robust cost controls.

By contrast, investors should be aware that even as Ingevity boosts adjusted guidance and keeps its sales forecast steady, unresolved trade tensions and demand weakness in industrial markets continue to...

Read the full narrative on Ingevity (it's free!)

Ingevity's narrative projects $1.5 billion revenue and $378.5 million earnings by 2028. This requires 3.1% yearly revenue growth and a $595.1 million earnings increase from the current -$216.6 million.

Uncover how Ingevity's forecasts yield a $60.50 fair value, a 20% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s single fair value estimate for Ingevity is US$60.50, showing limited diversity in opinion. With persistent trade and demand risks affecting earnings, it is important to consider several alternative viewpoints as you assess the company’s prospects.

Explore another fair value estimate on Ingevity - why the stock might be worth just $60.50!

Build Your Own Ingevity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingevity research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ingevity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingevity's overall financial health at a glance.

No Opportunity In Ingevity?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com