- American States Water Company recently reported its second quarter and six-month 2025 results, with sales rising to US$163.07 million and net income reaching US$33.69 million for the quarter, alongside an increase in its third quarter dividend to US$0.5040 per share.

- This combination of higher earnings and a dividend boost highlights the company’s continued focus on delivering value and returning capital to shareholders.

- Given these stronger earnings and dividend increase, we'll explore how American States Water's financial momentum could influence its long-term investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

American States Water Investment Narrative Recap

To be an American States Water shareholder, you generally need to believe in the steady long-term demand for regulated water and electric utility services, plus management’s discipline around infrastructure spending and returning capital to shareholders. The recent second-quarter results, higher sales, growing net income, and another dividend increase, help support the story of consistent operational execution, but they do not materially shift the biggest catalyst, which remains the ability to capture value from authorized infrastructure investments, or the biggest risk, continued pressure on net margins from rising expenses.

The latest dividend hike to US$0.5040 per share fits within the company’s pattern of regular payout increases and is particularly relevant as it underscores their commitment to delivering shareholder returns, even while facing higher costs and margin pressures. This action also ties directly into the investment thesis for yield-focused investors but highlights the need to monitor whether cash flows can keep funding this growth as expenses fluctuate.

By contrast, investors should be aware that persistent cost pressures and uncertain regulatory outcomes could eventually challenge the long-term dividend growth that many expect...

Read the full narrative on American States Water (it's free!)

American States Water's outlook anticipates $698.7 million in revenue and $151.0 million in earnings by 2028. This scenario assumes annual revenue growth of 4.7% and a $28.5 million increase in earnings from the current $122.5 million.

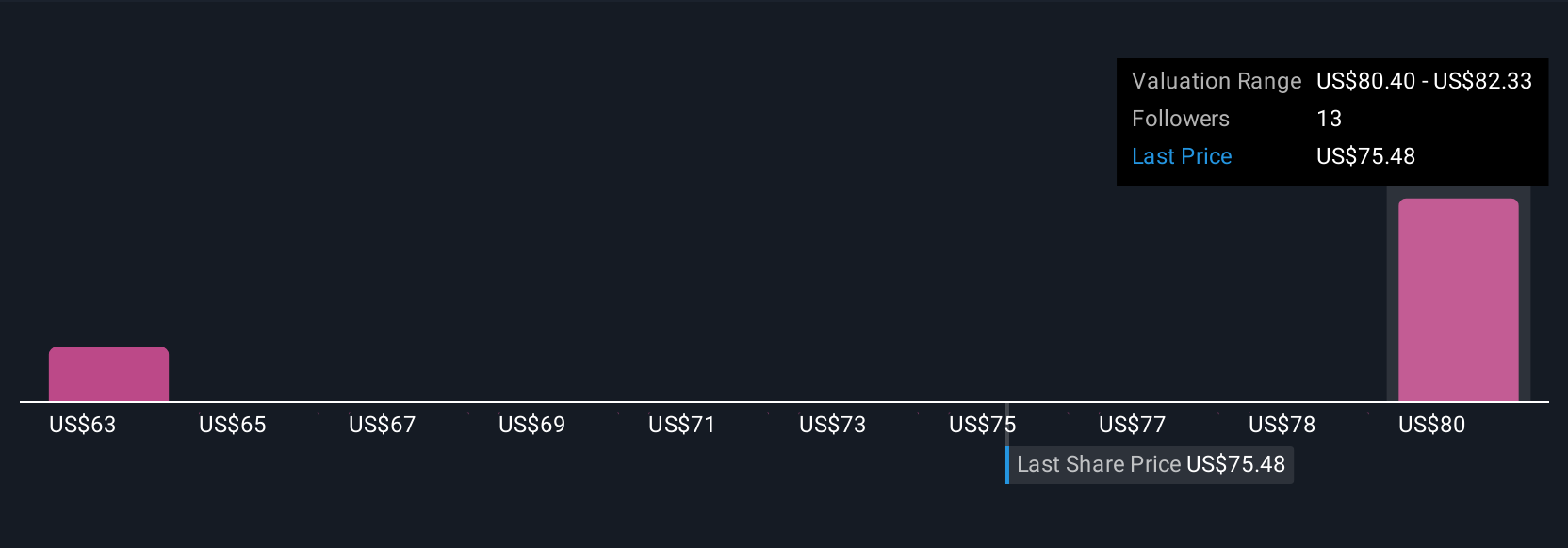

Uncover how American States Water's forecasts yield a $82.33 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for American States Water range from US$59.05 to US$82.33 across three unique viewpoints. These diverging opinions mirror ongoing concerns about profit margin pressure and highlight why it is valuable to review a variety of perspectives before making decisions.

Explore 3 other fair value estimates on American States Water - why the stock might be worth 22% less than the current price!

Build Your Own American States Water Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American States Water research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American States Water research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American States Water's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com