- Argan, Inc. experienced a pullback this week after its share price soared to very large gains over the past three years, reflecting a period of substantial earnings growth and strong dividend payments for investors.

- This recent adjustment brings shareholder returns more in line with the company's underlying performance, suggesting market sentiment is now better aligned with Argan’s business fundamentals.

- We’ll explore how the recent recalibration of returns, following extraordinary growth, impacts Argan’s investment outlook and future prospects.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Argan Investment Narrative Recap

To own shares in Argan, investors need confidence in the company’s ability to successfully deliver large-scale energy infrastructure projects while maintaining disciplined capital management and steady growth in earnings. The recent share price pullback appears to be a normalization after exceptional multi-year returns, and does not materially affect the near-term outlook, as the critical short-term catalyst remains timely execution and cost management on major natural gas facility builds; the biggest risk continues to be project delays or cost overruns that could impact margins and revenue visibility.

Among recent company announcements, Argan’s decision to increase its quarterly dividend to US$0.375 per share is particularly relevant, as it highlights the board’s continued confidence in cash flow strength and shareholder returns, even as the stock adjusts. This supports the broader narrative of capital discipline and offers reassurance to investors focused on income, especially with the ongoing expansion pipeline potentially driving future results.

In contrast, there is another aspect of Argan’s business that investors should be aware of: the increased execution risk on large, fixed-price projects, especially if supply chain or regulatory challenges emerge…

Read the full narrative on Argan (it's free!)

Argan's outlook anticipates $1.4 billion in revenue and $140.0 million in earnings by 2028. This projection is based on a 15.6% annual revenue growth rate and a $39.9 million increase in earnings from the current $100.1 million.

Uncover how Argan's forecasts yield a $225.33 fair value, a 4% downside to its current price.

Exploring Other Perspectives

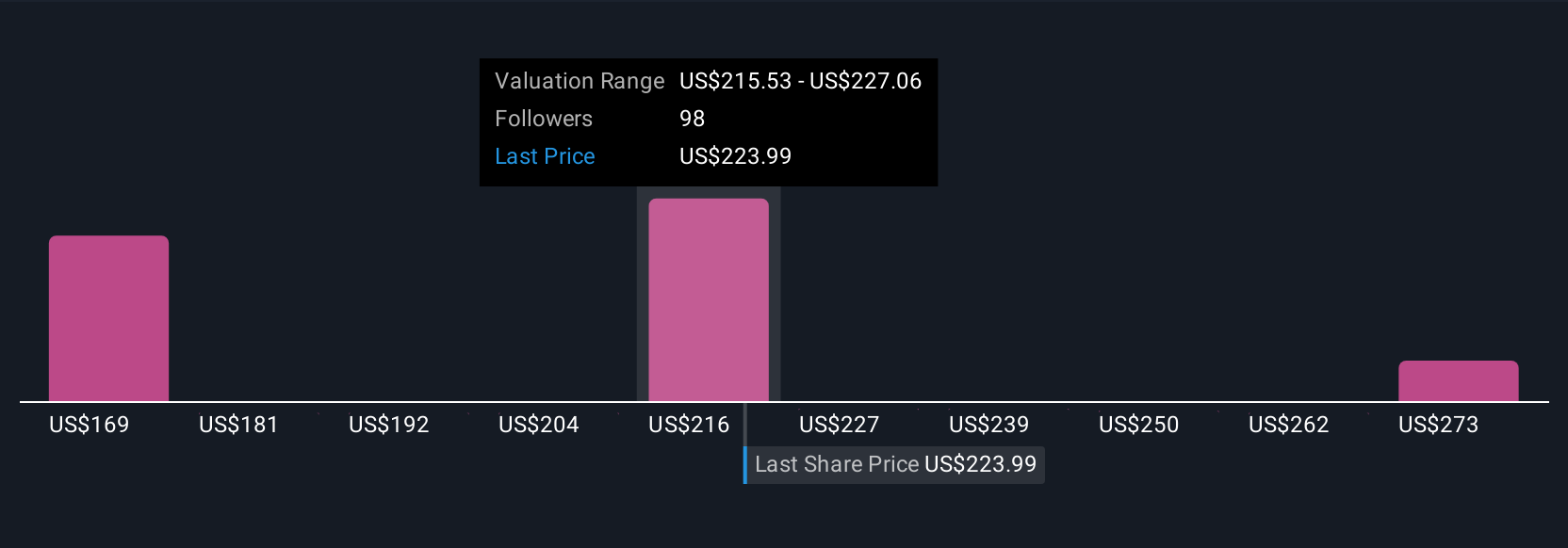

Nine members of the Simply Wall St Community estimate Argan’s fair value from US$169.58 up to US$284.68 per share. While these opinions vary, many remain focused on the company’s remarkable earnings growth, but project execution remains essential for sustaining returns over time.

Explore 9 other fair value estimates on Argan - why the stock might be worth 28% less than the current price!

Build Your Own Argan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Argan research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Argan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Argan's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com