- Life Time Group Holdings recently announced higher second quarter 2025 results, with revenue rising to US$761.47 million and net income reaching US$72.1 million compared to the same period last year, alongside a raised full-year 2025 guidance.

- The company is also expanding its digital presence, introducing an AI-powered wellness companion within its app and accelerating plans to open 12 to 14 new fitness clubs in 2026.

- We'll take a look at how Life Time's raised guidance and focus on digital wellness enhance its long-term investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Life Time Group Holdings Investment Narrative Recap

To be a shareholder in Life Time Group Holdings, an investor needs confidence in the fitness and wellness industry’s ability to sustain premium membership growth, alongside demand for high-margin services and expanding club locations. The company’s latest results, showing increased revenue and net income plus a raised outlook, may support optimism around near-term growth, but the heaviest short-term catalyst remains continued execution on club expansion, while the most important risk is whether escalating capital requirements and credit markets could disrupt that buildout; this risk is unchanged after recent earnings.

One recent standout announcement is the launch of L*AI*C, an AI-powered health companion integrated into the Life Time app. This digital initiative reinforces Life Time’s push to raise member engagement and cross-sell higher-margin services, important factors for supporting both physical club usage and digital growth outlined in the latest guidance.

However, investors should also be aware that if funding costs rise or capital access tightens…

Read the full narrative on Life Time Group Holdings (it's free!)

Life Time Group Holdings' outlook forecasts $3.8 billion in revenue and $459.7 million in earnings by 2028. This projection is based on an anticipated annual revenue growth rate of 10.4% and a $232.9 million increase in earnings from the current $226.8 million.

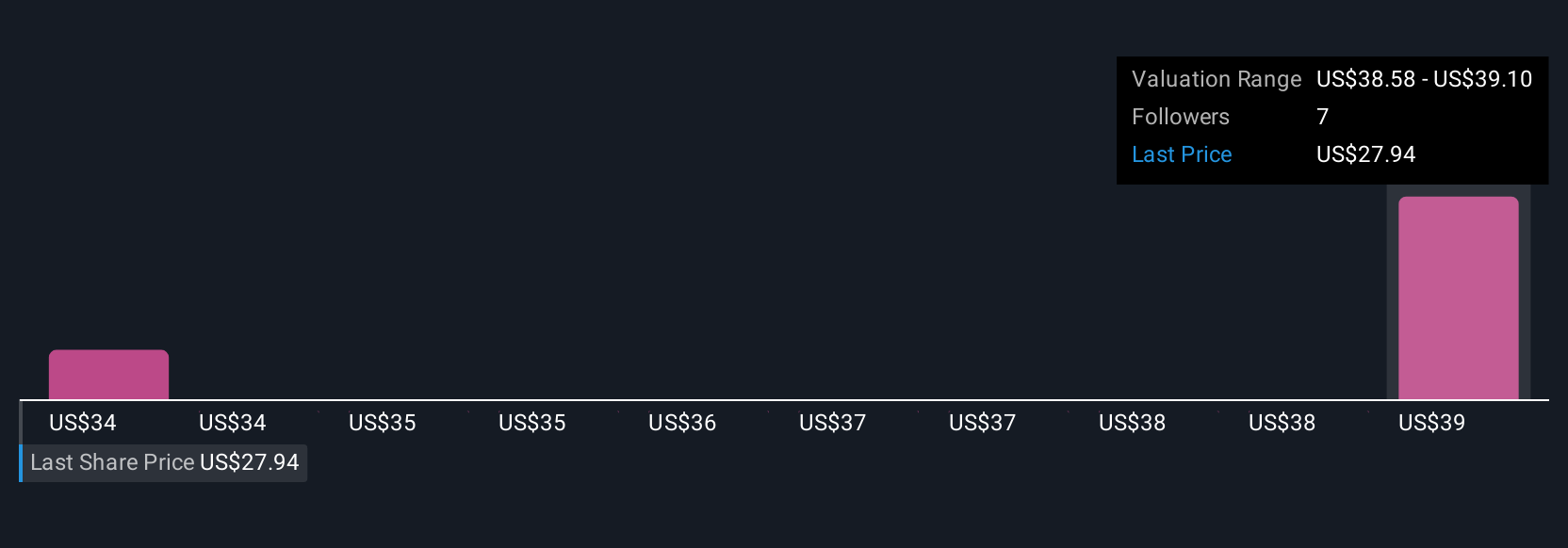

Uncover how Life Time Group Holdings' forecasts yield a $39.00 fair value, a 42% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Life Time’s fair value between US$34.06 and US$39, based on two distinct analyses. While club expansion is driving revenue forecasts, tightening real estate or credit markets remain a key watchpoint for the company’s outlook.

Explore 2 other fair value estimates on Life Time Group Holdings - why the stock might be worth as much as 42% more than the current price!

Build Your Own Life Time Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Life Time Group Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Life Time Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Life Time Group Holdings' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com