- On August 6, 2025, NetApp announced that Amazon FSx for NetApp ONTAP is now supported as an external storage option for Amazon Elastic VMware Service (Amazon EVS) on AWS, enabling organizations to migrate VMware workloads more efficiently to the cloud with advanced disaster recovery and ransomware protection features.

- This integration allows users to manage and protect their cloud workloads using familiar VMware tools, while benefiting from fast migration, reduced costs, and enhanced cyber resiliency through NetApp’s Intelligent Data Infrastructure.

- We'll examine how NetApp's deeper VMware-AWS integration, particularly with new real-time ransomware protections, could reshape its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

NetApp Investment Narrative Recap

NetApp’s investment story centers on its ability to drive growth by expanding its hybrid cloud and data management solutions, as demand for these services continues to rise. The newly announced Amazon EVS and ONTAP integration could strengthen its positioning in cloud storage and security, supporting its public cloud growth catalyst; however, potential deal slippage and sales execution remain important short-term risks, and these do not appear materially changed by this news.

Among recent announcements, the introduction of new data security capabilities through NetApp’s BlueXP ransomware protection directly complements this AWS partnership, reinforcing NetApp’s value proposition as cloud adoption accelerates. This further ties into the company’s efforts to capture share in cloud workload migration and enhance its cyber resiliency credentials.

Yet, while the cloud opportunity grows, investors should equally consider that foreign exchange volatility and ongoing demand softness in Europe could ...

Read the full narrative on NetApp (it's free!)

NetApp's narrative projects $7.5 billion revenue and $1.4 billion earnings by 2028. This requires 4.3% yearly revenue growth and a $0.2 billion earnings increase from the current $1.2 billion.

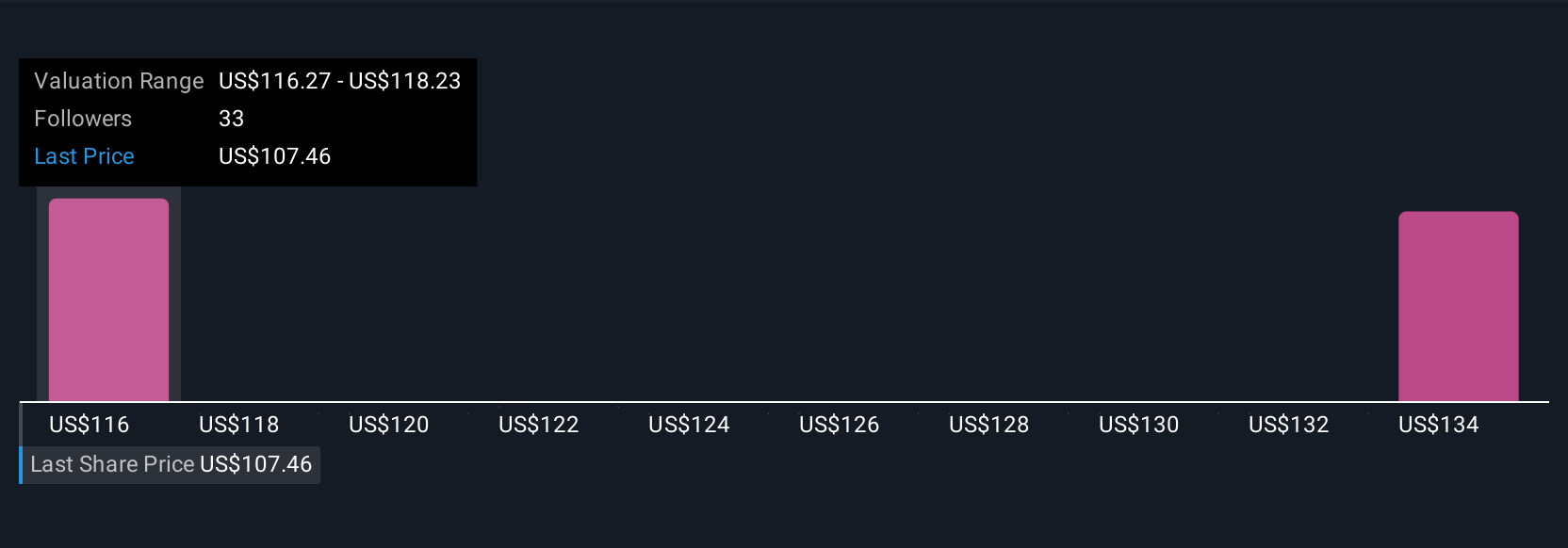

Uncover how NetApp's forecasts yield a $115.07 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community valuations for NetApp span US$115.07 to US$171.30 across four forecasts. Amid this range, the push for accelerated public cloud revenue growth may shape how these varied outlooks play out in the months ahead.

Explore 4 other fair value estimates on NetApp - why the stock might be worth just $115.07!

Build Your Own NetApp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetApp research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free NetApp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetApp's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com