- Eagle Materials Inc. recently reported first-quarter earnings surpassing analyst expectations, alongside shareholder approval to declassify its Board of Directors at the annual general meeting and a quarterly dividend declaration of US$0.25 per share payable in October 2025.

- The combination of stronger-than-expected financial performance and a shift toward improved corporate governance could signal heightened operational confidence and enhanced accountability for investors.

- We’ll examine how the shareholder-backed Board declassification may influence the company’s longer-term investment outlook and governance profile.

These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Eagle Materials Investment Narrative Recap

To be a shareholder in Eagle Materials, you need to believe in the resilience of US construction markets, especially infrastructure and residential sectors, and the company's ability to sustain earnings through economic cycles. Recent earnings surpassed expectations, but with ongoing housing affordability issues and regional exposure, the current news around board declassification and dividend announcement does not materially shift the key short-term catalyst, federal and state infrastructure funding, or alleviate the main risk of persistently weak wallboard demand.

Among the recent announcements, the approval to declassify the Board of Directors stands out as most relevant for investors, as it reflects a move toward stronger corporate governance practices. Improved board accountability could increase investor confidence, but it does not directly address the underlying earnings sensitivity to demand and regional volatility that remain central to the company's near-term outlook.

However, investors should be aware that, despite the governance changes, one risk persists…

Read the full narrative on Eagle Materials (it's free!)

Eagle Materials is projected to reach $2.6 billion in revenue and $524.5 million in earnings by 2028. This outlook assumes a 3.8% annual revenue growth and a $71.6 million earnings increase from current earnings of $452.9 million.

Uncover how Eagle Materials' forecasts yield a $246.89 fair value, a 10% upside to its current price.

Exploring Other Perspectives

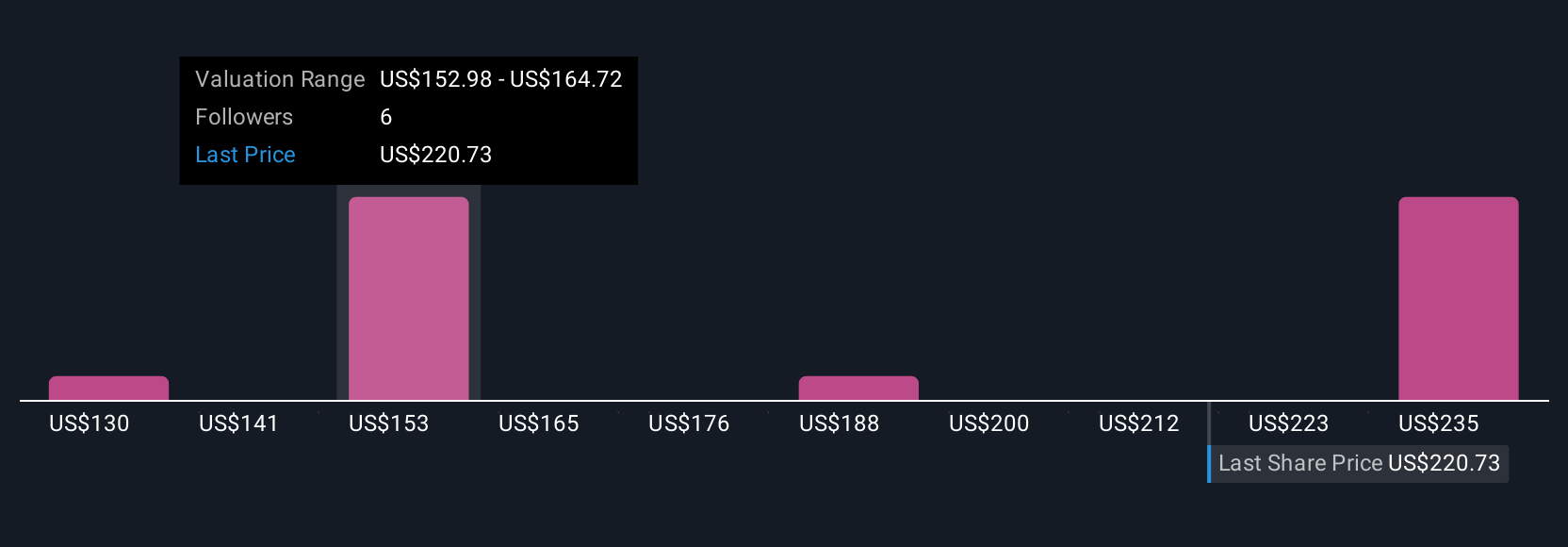

Simply Wall St Community members submitted 4 fair value targets for Eagle Materials, ranging from US$129.50 to US$246.89. While opinions differ, the uncertainty around sustained wallboard demand growth continues to shape the outlook for earnings and returns.

Explore 4 other fair value estimates on Eagle Materials - why the stock might be worth 42% less than the current price!

Build Your Own Eagle Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eagle Materials research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Eagle Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eagle Materials' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com