- Onto Innovation Inc. announced its second quarter 2025 financial results, reporting sales of US$253.6 million, up from US$242.33 million a year ago, while net income decreased to US$33.91 million from US$52.95 million in the prior year period.

- An interesting insight is that despite higher sales, net income and earnings per share both declined year-over-year, and the company has issued third quarter guidance projecting revenue between US$210 million and US$225 million and diluted EPS of US$0.52 to US$0.72.

- We'll examine how Onto Innovation's higher sales but declining net income and detailed forward guidance could reshape its investment outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Onto Innovation Investment Narrative Recap

To be a shareholder in Onto Innovation, you have to believe in the long-term expansion of advanced packaging and AI-driven demand for semiconductor inspection tools. The latest quarter's results, higher revenue but shrinking net income, suggest that growth in the company's end markets may be facing pressures, and the cautious third quarter guidance implies that the biggest short-term catalyst remains AI packaging adoption, while the largest risk for now is the vulnerability to market cycles and project delays. These results do not appear to fundamentally shift the most critical near-term catalysts or risks for Onto Innovation.

Among recent announcements, the introduction of new lithography technologies stands out as particularly relevant, as it reinforces Onto Innovation's efforts to cement its lead within the advanced packaging segment. With this focus, the company aims to capture more value as demand shifts toward higher-complexity solutions, directly supporting its revenue growth drivers while also exposing it to heightened cyclical risks should adoption falter.

In contrast, investors should be alert to the impact any delay in AI packaging projects could have on expected growth and near-term results...

Read the full narrative on Onto Innovation (it's free!)

Onto Innovation's narrative projects $1.3 billion revenue and $286.8 million earnings by 2028. This requires 8.8% yearly revenue growth and a $67.9 million earnings increase from $218.9 million today.

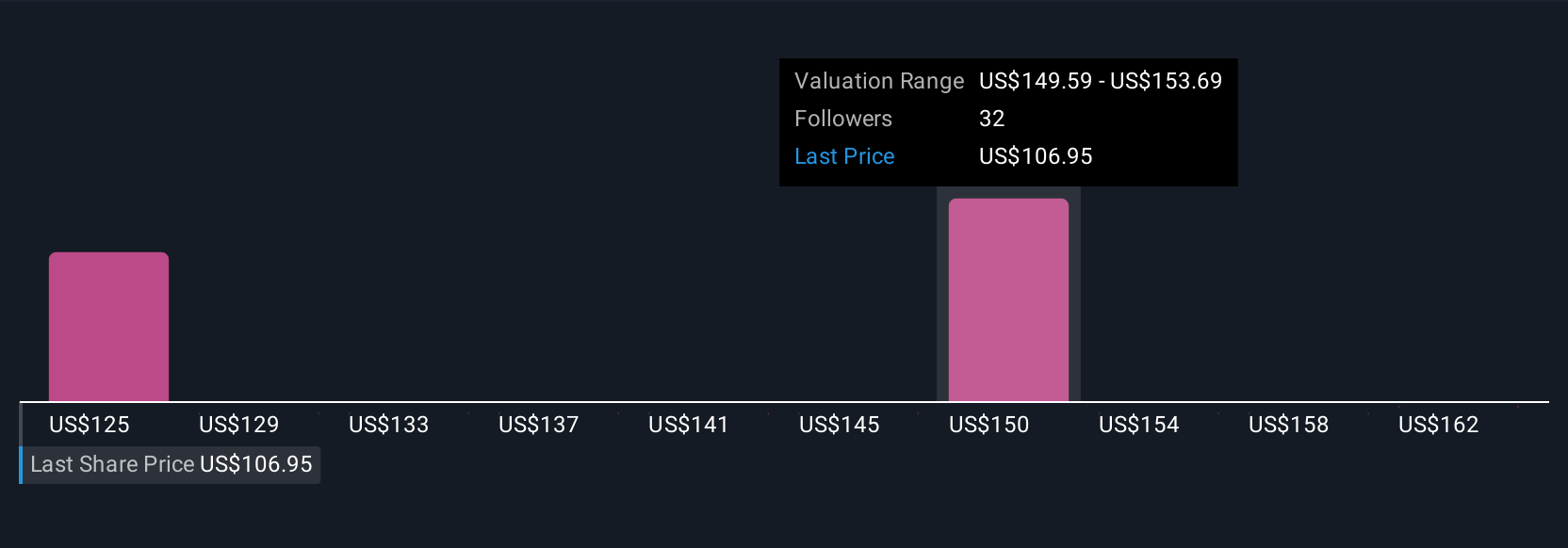

Uncover how Onto Innovation's forecasts yield a $134.62 fair value, a 45% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s three fair value estimates for Onto Innovation range from US$134.63 to US$165.99 per share. While these outlooks vary, recent quarterly profit pressures highlight how future results could be strongly influenced by shifts in the advanced packaging and AI sectors, so consider reviewing different perspectives before making your next move.

Explore 3 other fair value estimates on Onto Innovation - why the stock might be worth as much as 79% more than the current price!

Build Your Own Onto Innovation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Onto Innovation research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Onto Innovation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Onto Innovation's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com