Northern Trust (NTRS) reported a 24% price increase over the last quarter, possibly buoyed by several significant developments. The company's appointment by Aristotle Capital Management for middle office outsourcing services, impacting $40 billion in assets, highlighted its strength in asset servicing. Furthermore, the announcement of an expanded share buyback program, with authorization for up to $2.5 billion, might have positively influenced investor sentiment. Concurrently, the broader market experienced gains, with major indexes like the Dow and S&P 500 posting over 1% increases. These Northern Trust events likely supported the broader market trends during the quarter.

We've spotted 1 possible red flag for Northern Trust you should be aware of.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

The recent developments at Northern Trust appear to have reinforced positive investor sentiment. The appointment for asset servicing and an expanded share buyback program could potentially enhance investor confidence, suggesting improved cash flow management and commitment to shareholder value. However, these initiatives might not fully offset ongoing industry challenges like fee pressures from passive investing and the need for substantial tech investments. The company's revenue and earnings forecasts could face constraints from these pressures, as margin gains from efficiencies risk being non-recurring without further innovation or expansion into high-growth areas like alternatives and digital services.

Contextually, Northern Trust's shares have delivered a total return of 76.42% over five years, reflecting resilience and growth over longer periods. In comparison, Northern Trust has outperformed the US market return of 22.4% and the Capital Markets industry's 43.5% over the past year, indicating strong recent performance relative to peers. This broader outperformance might be attributed to effective management strategies and favorable market conditions in recent quarters.

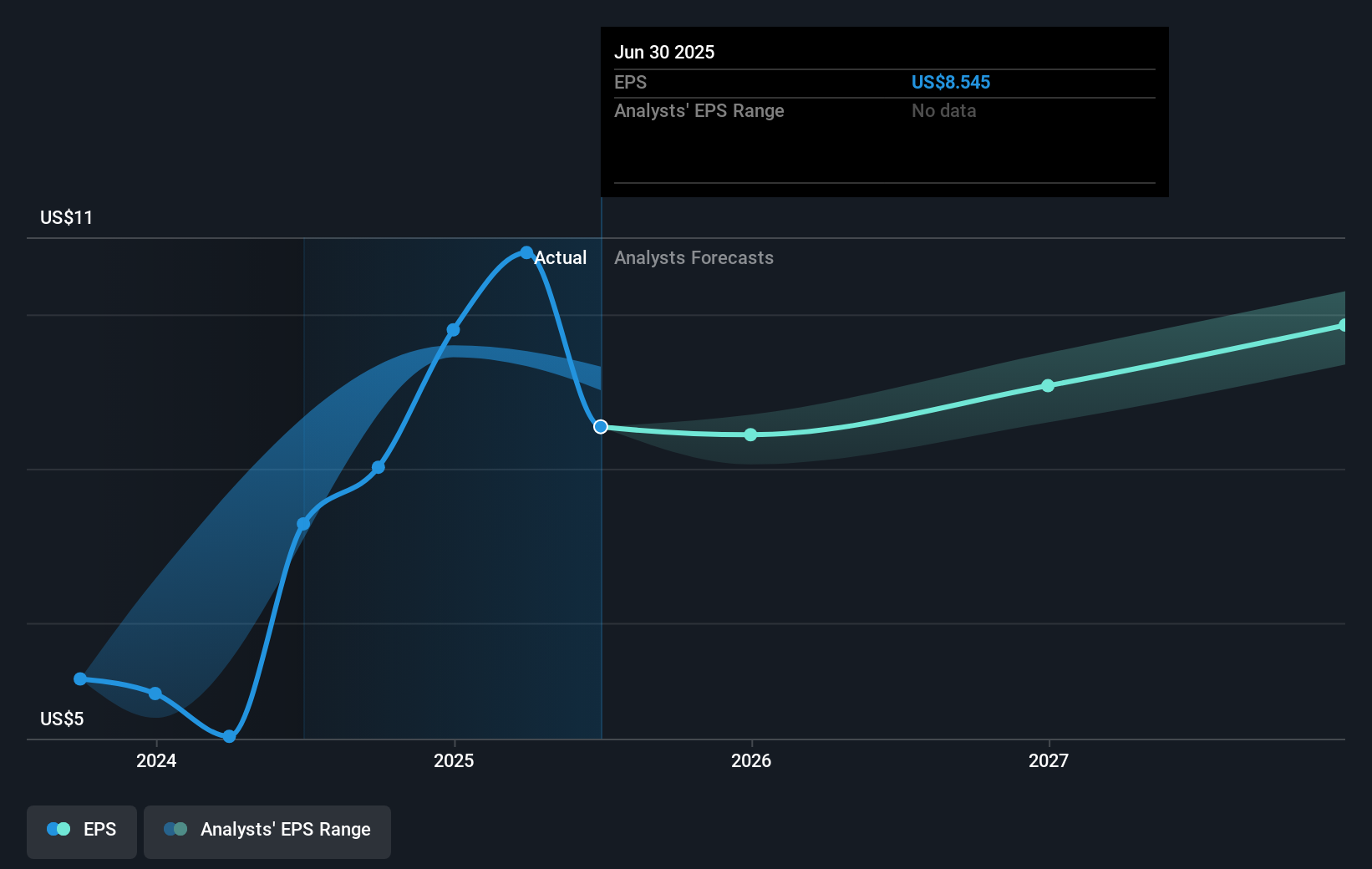

Despite a current share price of US$124.73, above analysts' consensus price target of US$117.79, indicating potential overvaluation by about 5.90%, investor optimism evidently persists. Short-term price increases contrast with analysts' more tempered 2028 earnings projections of US$1.4 billion, suggesting challenges in sustaining this trajectory amid expected revenue declines of 1.6% annually and tightening profit margins. Investors should weigh these dynamics carefully against the backdrop of broader market trends affected by Northern Trust's ongoing initiatives and industry positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com