- Avnet, Inc. recently reported its fourth quarter and full-year 2025 financial results, revealing fourth quarter sales of US$5.62 billion and a significant decrease in net income year-over-year, while also providing first quarter fiscal 2026 guidance and an update on its completed share buyback program.

- An interesting insight is that despite stable sales, Avnet experienced a substantial drop in profitability and has continued to reduce its share count through repurchases, signaling a focus on shareholder returns amid operational challenges.

- With the company reporting lower earnings alongside continued share repurchases, we'll explore how these developments could influence Avnet's investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Avnet Investment Narrative Recap

To own Avnet shares, investors need confidence in the company’s ability to manage through softening demand in its core markets and maintain efficiency across its supply chain. The latest results did little to change the main catalyst, the ongoing optimization of inventory and cost discipline, but the sharp drop in quarterly net income highlights the risk that market weakness and margin pressure could linger in the near term, potentially affecting both earnings and cash flows.

Among recent announcements, the completion of a significant share repurchase program stands out. Avnet has now repurchased over 15.8 million shares since 2022, which reduces the share count and may enhance earnings per share, though the benefit is currently tempered by lower profits reported in the latest results.

Yet, in contrast to these measures for shareholder returns, investors should be aware that margin pressure tied to demand softness and higher costs could...

Read the full narrative on Avnet (it's free!)

Avnet's narrative projects $24.8 billion revenue and $542.9 million earnings by 2028. This requires 3.8% yearly revenue growth and a $226.1 million earnings increase from $316.8 million today.

Uncover how Avnet's forecasts yield a $51.25 fair value, in line with its current price.

Exploring Other Perspectives

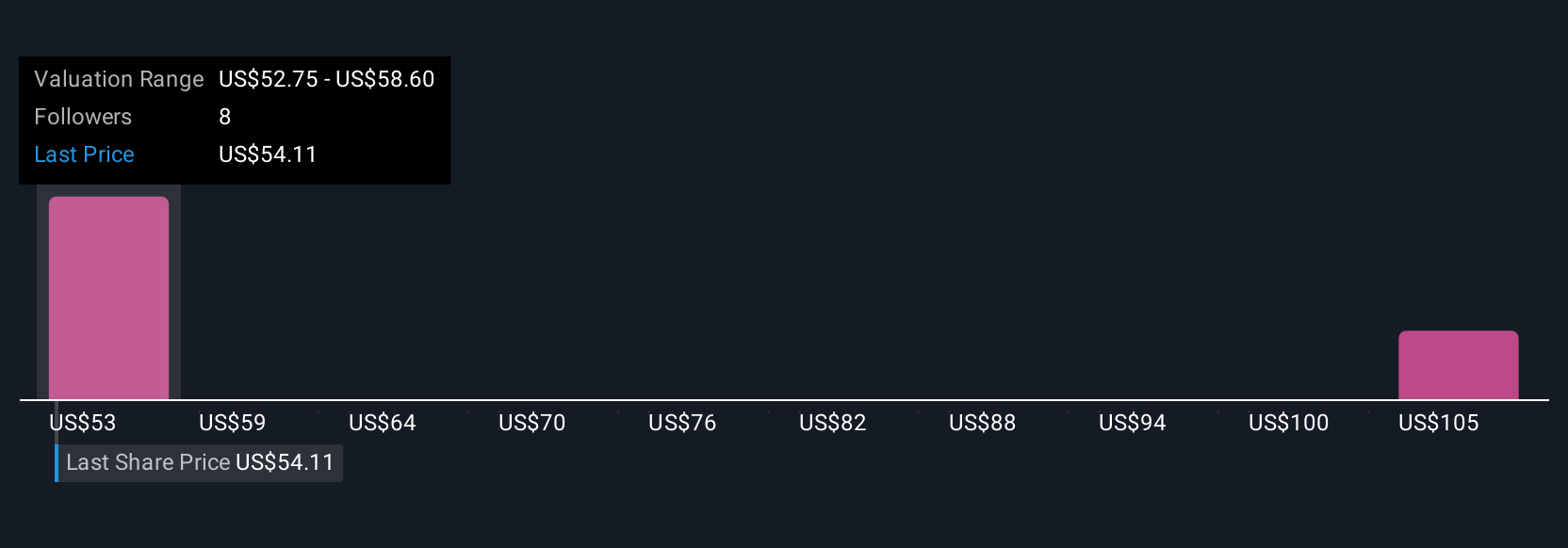

Simply Wall St Community members provided three individual fair value estimates for Avnet, ranging from US$51.25 to US$108.77 per share. With such a spread of opinions, consider how wider economic and geopolitical risks can shape both expectations and outcomes for the company’s performance.

Explore 3 other fair value estimates on Avnet - why the stock might be worth over 2x more than the current price!

Build Your Own Avnet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avnet research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Avnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avnet's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com