- Kulicke and Soffa Industries recently announced its third quarter 2025 earnings, reporting sales of US$148.41 million and swinging from net income to a net loss year-over-year.

- The company’s guidance for the upcoming quarter projects a return to positive earnings per share despite this period’s weak result.

- We’ll examine how the company’s shift from profitability to a net loss shapes Kulicke and Soffa’s wider investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Kulicke and Soffa Industries' Investment Narrative?

To be a shareholder in Kulicke and Soffa Industries right now, you need confidence in a return to profitability and the company’s ability to generate durable earnings growth after a weak third quarter. The latest results, revealing a swing to net loss on lighter sales, shifted sentiment slightly but are matched by management’s forward-looking guidance that projects a rebound in the coming quarter. This may help ease short-term concerns, but it also puts greater clarity on the importance of demand recovery and execution of new initiatives, like the partnership with Lavorro Inc. While ongoing buybacks and a consistent dividend offer some support, the main risk remains underlying demand volatility in semiconductor equipment markets and the impact of past one-off losses. The latest results increase focus on near-term results as both a catalyst and a risk.

But despite signs of a quick rebound, inconsistent cash flow remains a concern investors should track.

Exploring Other Perspectives

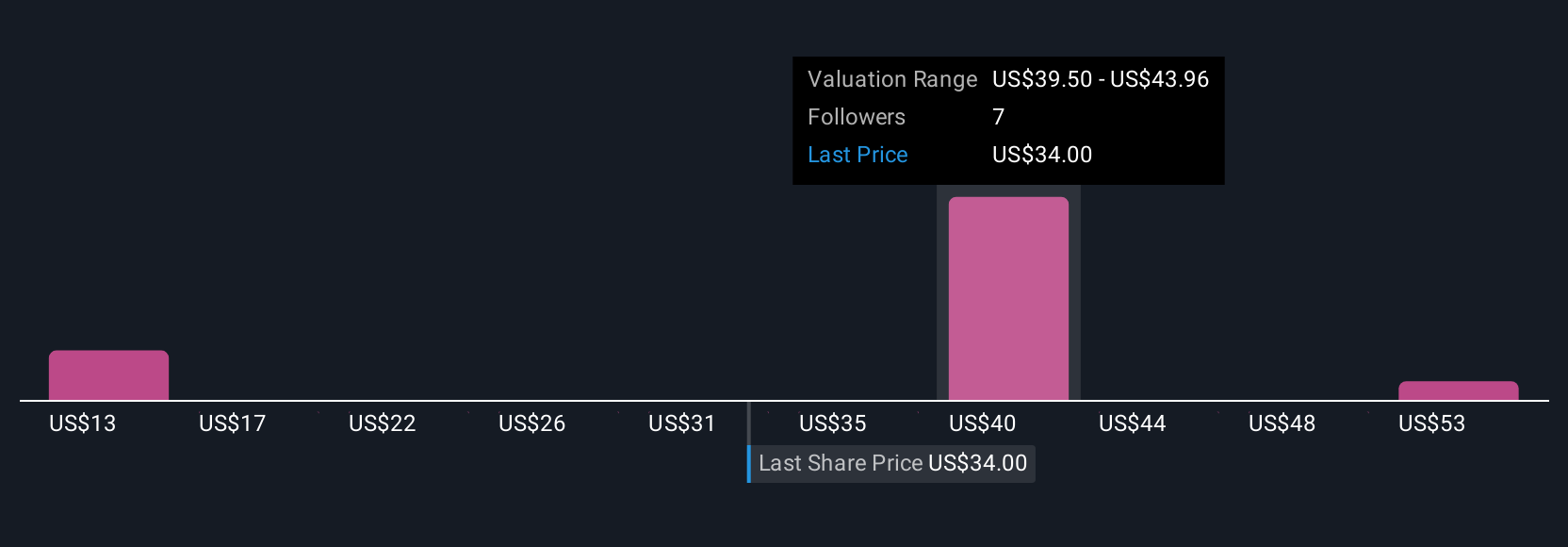

Explore 3 other fair value estimates on Kulicke and Soffa Industries - why the stock might be worth less than half the current price!

Build Your Own Kulicke and Soffa Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kulicke and Soffa Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kulicke and Soffa Industries' overall financial health at a glance.

No Opportunity In Kulicke and Soffa Industries?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com