Kimberly-Clark (KMB) experienced a 10% rise in its share price over the past week, a move that contrasts the general market's strong, yet moderate gains. The company's appointment of John Carmichael as President for North America may have bolstered investor confidence, aligning with positive market sentiment as major indexes surged to record levels. Despite the company's reported declines in quarterly sales and net income, these leadership changes might have reinforced investor optimism. Additionally, the broader market rally, driven by rebounding tech stocks and easing economic concerns, likely supported this positive trajectory for Kimberly-Clark's stock.

Every company has risks, and we've spotted 2 risks for Kimberly-Clark you should know about.

The recent appointment of John Carmichael as President for North America is a significant development for Kimberly-Clark that might positively influence its strategic direction and investor perception. Over the past three years, the company's total return, including share price and dividends, was 13.31%. Despite recent leadership changes and a short-term share price bump, Kimberly-Clark's one-year performance still outpaced the US Household Products industry, which saw a decline of 10.7%.

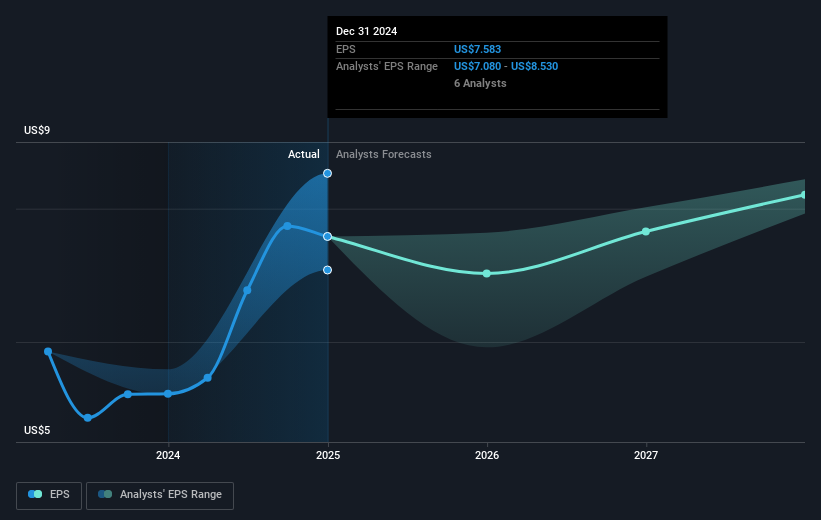

This leadership change could impact revenue and earnings forecasts by potentially boosting investor confidence and driving more effective strategic initiatives. Nevertheless, analysts have set a price target of US$142.01, just 4.17% above the current share price, indicating a relatively modest expected upside. The company's share performance in relation to its sector and market context suggests that while short-term moves can be driven by fresh leadership and market sentiment, long-term success will depend on consistent execution against market challenges and strategic priorities.

Evaluate Kimberly-Clark's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com