- In late July 2025, UFCW 8-Golden State, alongside UFCW Locals 5 and 648, announced a tentative labor agreement with Albertsons Companies covering 25,000 employees at Safeway and Vons, delivering wage increases, healthcare improvements, pension enhancements, and stronger job protections after months of negotiations and the threat of a large-scale walkout.

- This breakthrough not only addresses employee welfare but also signals a reduction in operational risks and potential disruptions for Albertsons' retail operations moving forward.

- We will explore how resolving labor negotiations and securing worker stability could influence Albertsons Companies' investment outlook in the months ahead.

These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Albertsons Companies Investment Narrative Recap

To be a shareholder of Albertsons Companies, you need confidence in the supermarket chain's ability to maintain stable earnings and navigate a competitive retail environment, especially with pressure from rising costs and digital transformation. The recent tentative labor agreement with UFCW reduces immediate risks of operational disruptions and margin shocks from strikes, but rising labor expenses remain a headwind and don't materially change the near-term importance of shifting to digital and defending margins from competitors.

Among recent corporate updates, the July 2025 union agreement stands out as the most relevant; its resolution of wage and benefit negotiations for 25,000 workers could help stabilize store operations, at least temporarily, and supports consistency in service, an important consideration as shareholders focus on the impacts of operating cost pressures versus potential growth catalysts like technology investments.

In contrast, investors should remain aware that lingering margin pressures from higher wages could resurface if digital growth does not accelerate and offset these costs...

Read the full narrative on Albertsons Companies (it's free!)

Albertsons Companies' forecast projects $86.3 billion in revenue and $1.0 billion in earnings by 2028. This is based on analysts assuming a 2.1% annual revenue growth, and reflects an earnings increase of about $46 million from current earnings of $954.3 million.

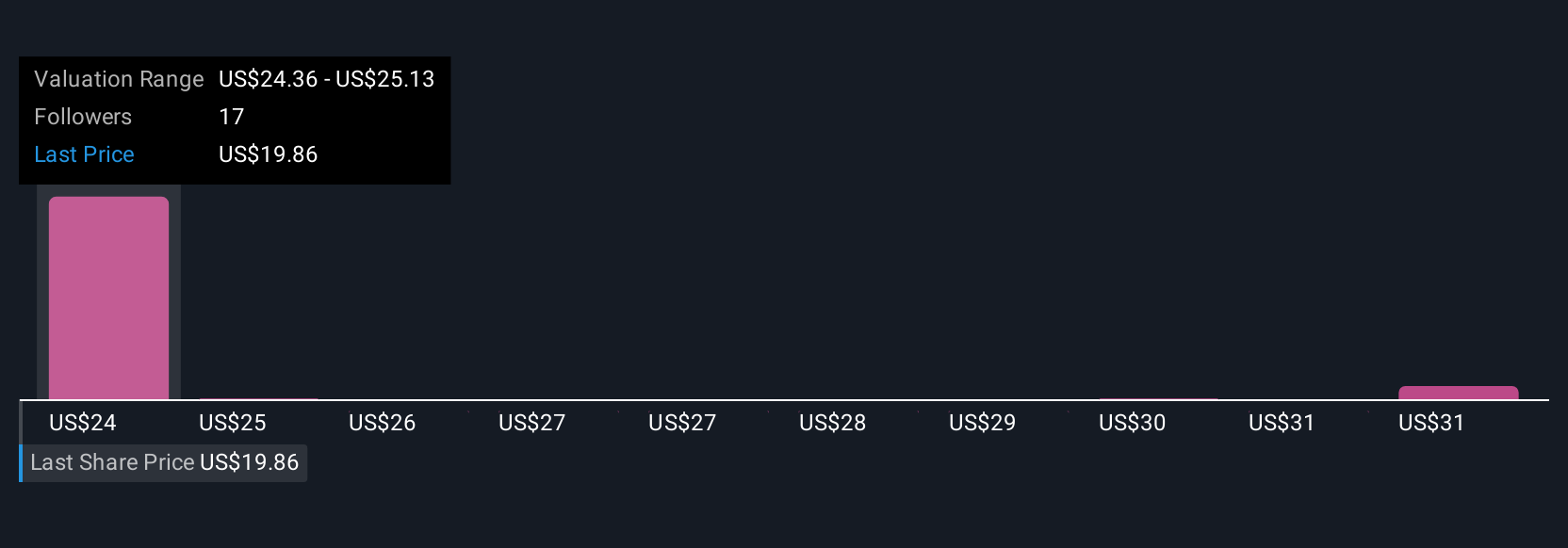

Uncover how Albertsons Companies' forecasts yield a $24.36 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Five members from the Simply Wall St Community calculated fair value estimates for Albertsons, ranging from US$24.36 to US$32.10 per share. While shareholder views span a broad spectrum, the recent labor agreement underscores how shifts in costs can affect outlook and highlights why it is worth hearing from more than one side when evaluating future profitability.

Explore 5 other fair value estimates on Albertsons Companies - why the stock might be worth just $24.36!

Build Your Own Albertsons Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Albertsons Companies research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Albertsons Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Albertsons Companies' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com