- Tenet Healthcare recently reported second quarter 2025 results that exceeded analyst expectations, with both revenue and earnings per share surpassing estimates and profit margin showing improvement.

- This performance was primarily driven by higher revenue and operational efficiency, sparking increased analyst attention and positive earnings estimate revisions for the company.

- We'll examine how Tenet Healthcare's stronger-than-expected profit margins shape its investment narrative and future outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Tenet Healthcare Investment Narrative Recap

Owning Tenet Healthcare stock means believing in the company’s ability to drive sustainable profit growth through operational efficiency, margin expansion, and outpatient care growth, while managing policy and volume uncertainties. The recent outperformance in quarterly revenue and earnings provides support for stronger short-term profit margins, which may bolster investor sentiment, but it doesn’t fundamentally shift the potential risk from ongoing policy changes, specifically the possibility of ACA subsidy reductions that could impact future admissions and revenue mix.

Of the recent announcements, Tenet’s increased share buyback authorization, now up to US$3,000 million, stands out. This move signals confidence in capital allocation discipline and returns for shareholders, aligning with positive margin trends as a near-term catalyst; however, buybacks alone may not offset policy or volume risks.

Yet, in contrast to improving quarterly performance, investors should also consider how changes in healthcare legislation or ACA subsidies could impact revenue going forward...

Read the full narrative on Tenet Healthcare (it's free!)

Tenet Healthcare is projected to reach $23.3 billion in revenue and $1.4 billion in earnings by 2028. This outlook assumes a 4.0% annual revenue growth rate but a decrease in earnings of $0.1 billion from the current $1.5 billion.

Uncover how Tenet Healthcare's forecasts yield a $197.29 fair value, a 21% upside to its current price.

Exploring Other Perspectives

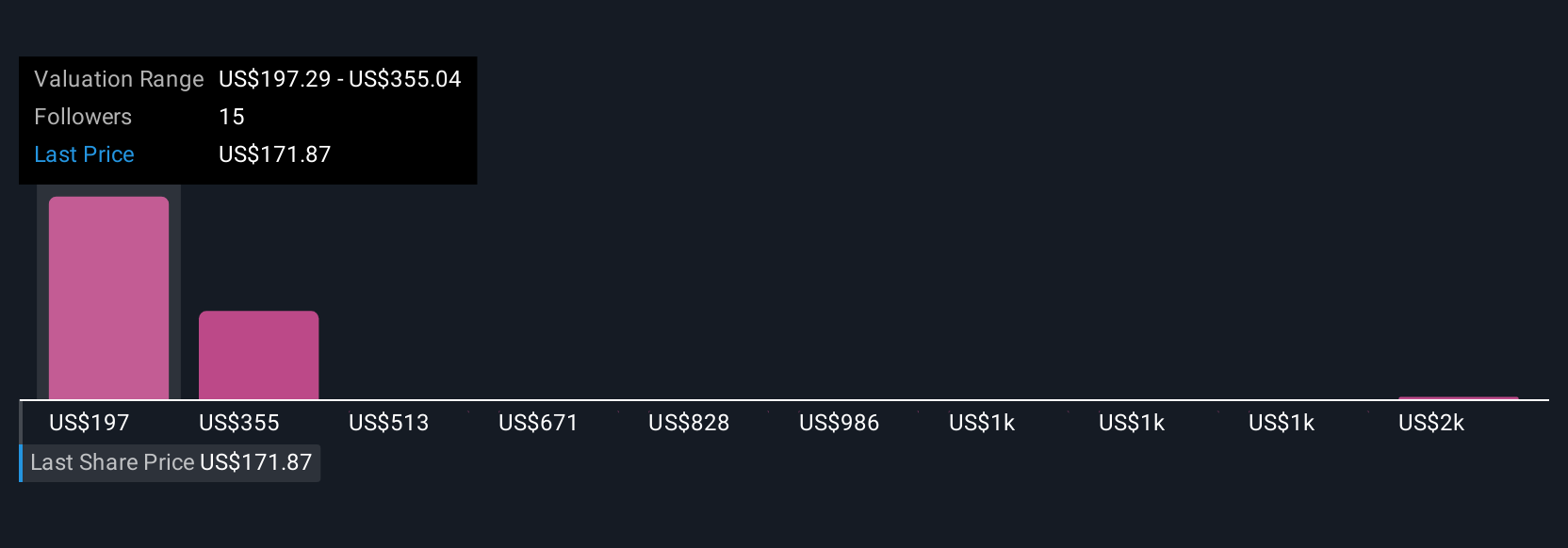

Fair value estimates from three Simply Wall St Community contributors span from US$197 to US$1,774 per share, capturing broad differences in growth forecasts and risk tolerance. While some see strong catalysts in outpatient and operational initiatives, others highlight regulatory and healthcare policy risks that could change the company’s outlook; explore these varied perspectives for a fuller view.

Explore 3 other fair value estimates on Tenet Healthcare - why the stock might be worth just $197.29!

Build Your Own Tenet Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tenet Healthcare research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Tenet Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tenet Healthcare's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com