- NextEra Energy recently expanded its operations through both organic projects and acquisitions, adding to a backlog of nearly 30 GW in renewable energy projects.

- This significant project pipeline highlights the company's ongoing commitment to renewables, which could further solidify its industry position and resilience.

- We'll now explore how the expanding renewable project backlog could influence NextEra Energy's broader investment outlook and risk landscape.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

NextEra Energy Investment Narrative Recap

To own NextEra Energy, you need to believe in the long-term demand for renewables and the company's ability to deliver returns from its large, capital-intensive project base. The nearly 30 GW renewable project backlog announced is significant, but unless there are rapid changes in policy or financing costs, the most important short-term catalyst, continued project execution, remains reliant on the broader regulatory and economic climate. Key risk drivers, such as interest rates and tax incentive policy, remain at the forefront and are only modestly moved by this news.

Among recent announcements, the regular dividend increase to US$0.5665 per share earlier this year stands out, reinforcing NextEra's stated commitment to shareholder returns. This dividend track record, maintained alongside a growing project backlog, aligns with the company's reputation for reliable capital returns, but also highlights the underlying need for steady project cash flows as a catalyst to supporting these payouts going forward.

However, as optimism around renewables expands, investors should remember the contrast posed by ongoing uncertainty in project financing costs and permitting risks, especially if interest rates remain...

Read the full narrative on NextEra Energy (it's free!)

NextEra Energy's narrative projects $35.1 billion revenue and $9.6 billion earnings by 2028. This requires 10.7% yearly revenue growth and a $3.7 billion earnings increase from $5.9 billion today.

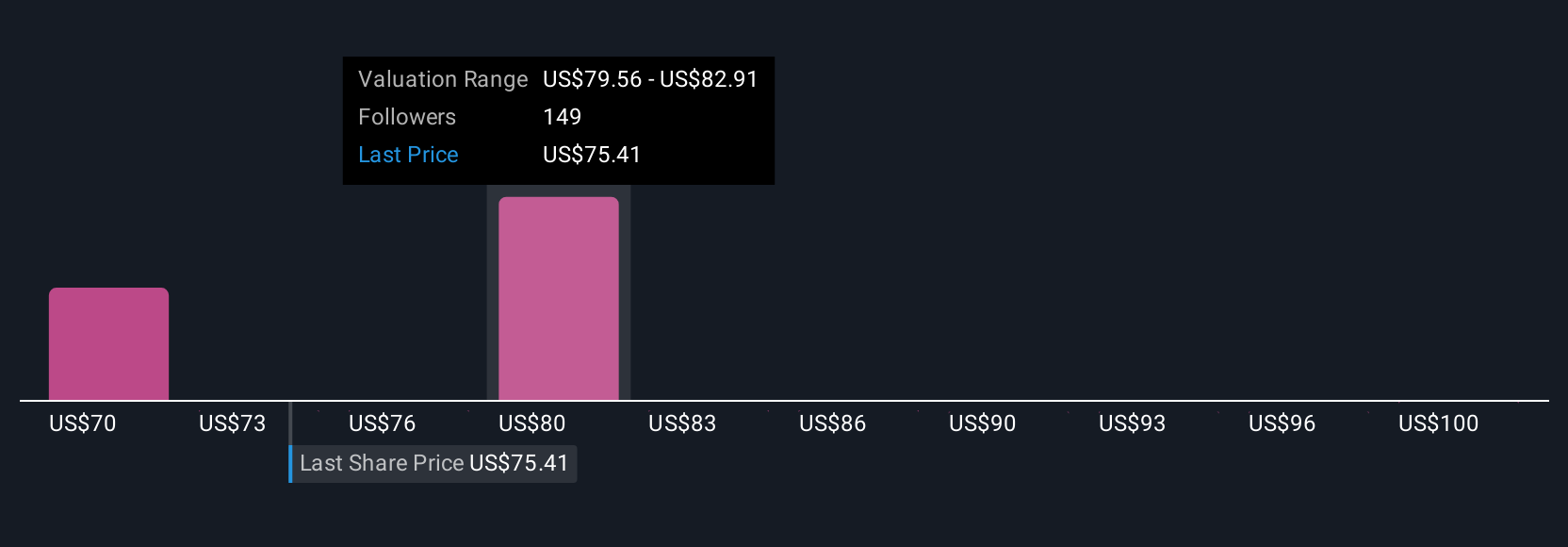

Uncover how NextEra Energy's forecasts yield a $81.98 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Some analysts hold a much more optimistic outlook, expecting revenues could reach US$39.3 billion by 2028, far above consensus. If you’re considering whether recent news shifts the narrative, remember that high-conviction views on demand growth, margin expansion, and market share gains may be at odds with the real-world challenges highlighted by the backlog announcement. Investor opinions can differ widely, so it’s worth exploring both consensus and bullish perspectives when reviewing NextEra’s prospects.

Explore 9 other fair value estimates on NextEra Energy - why the stock might be worth as much as 42% more than the current price!

Build Your Own NextEra Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextEra Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NextEra Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextEra Energy's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com