As the Nasdaq reaches record highs driven by a surge in chip stocks and Apple, the broader market shows mixed signals with the S&P 500 losing some momentum amid economic concerns. In this environment, dividend stocks can provide stability and income potential, making them an attractive option for investors looking to enhance their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.79% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.81% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.91% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.53% | ★★★★★★ |

| Ennis (EBF) | 5.56% | ★★★★★★ |

| Employers Holdings (EIG) | 3.11% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.83% | ★★★★★☆ |

| Dillard's (DDS) | 5.56% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.09% | ★★★★★★ |

| Archer-Daniels-Midland (ADM) | 3.53% | ★★★★★☆ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

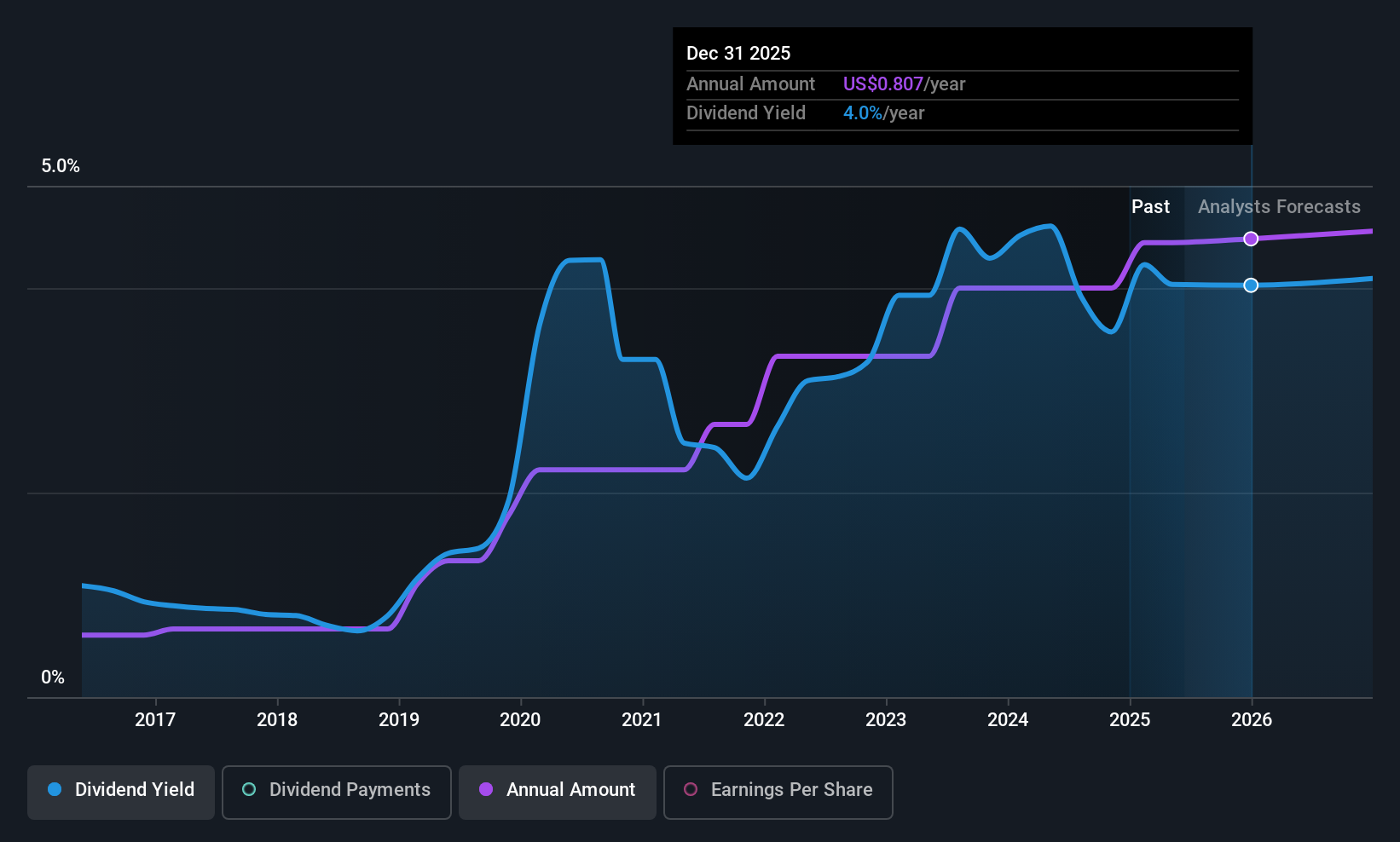

PCB Bancorp (PCB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small and middle market businesses and individuals, with a market cap of $289.35 million.

Operations: PCB Bancorp's revenue segments include providing a variety of banking products and services tailored to the needs of small and middle market businesses as well as individual clients.

Dividend Yield: 3.9%

PCB Bancorp offers a stable dividend yield of 3.85%, with payments growing over the past decade and well-covered by earnings due to a low payout ratio of 35.3%. Recent earnings growth, with net income rising to US$9.07 million, supports dividend sustainability despite prior SEC filing delays affecting Nasdaq compliance. The company trades below fair value estimates, enhancing its attractiveness for value-seeking investors, though its yield is lower than the top quartile in the US market.

- Take a closer look at PCB Bancorp's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that PCB Bancorp is priced lower than what may be justified by its financials.

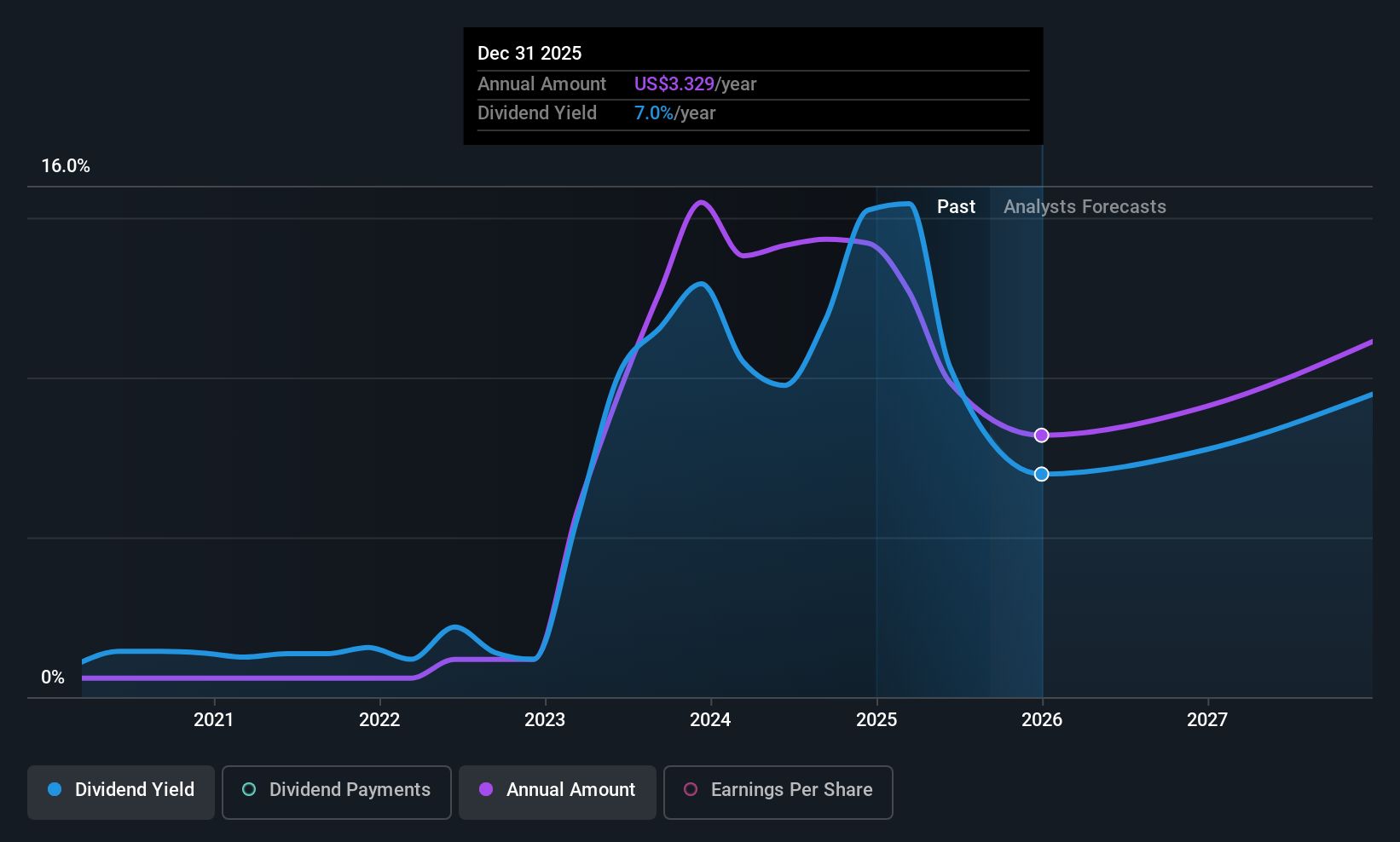

International Seaways (INSW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: International Seaways, Inc. owns and operates a fleet of oceangoing vessels for transporting crude oil and petroleum products in the international flag trade, with a market cap of $2.16 billion.

Operations: International Seaways, Inc. generates revenue through its operation of a fleet of oceangoing vessels dedicated to the transportation of crude oil and petroleum products across international waters.

Dividend Yield: 7.6%

International Seaways declared a regular quarterly dividend of US$0.12 and a supplemental dividend of US$0.65 per share, reflecting its high yield in the top 25% of U.S. payers. Despite this, earnings and revenue have declined, with net income at US$61.65 million for Q2 2025 compared to US$144.72 million last year. The dividends are covered by earnings and cash flows but remain volatile and unreliable due to an unstable track record over the past five years.

- Get an in-depth perspective on International Seaways' performance by reading our dividend report here.

- According our valuation report, there's an indication that International Seaways' share price might be on the cheaper side.

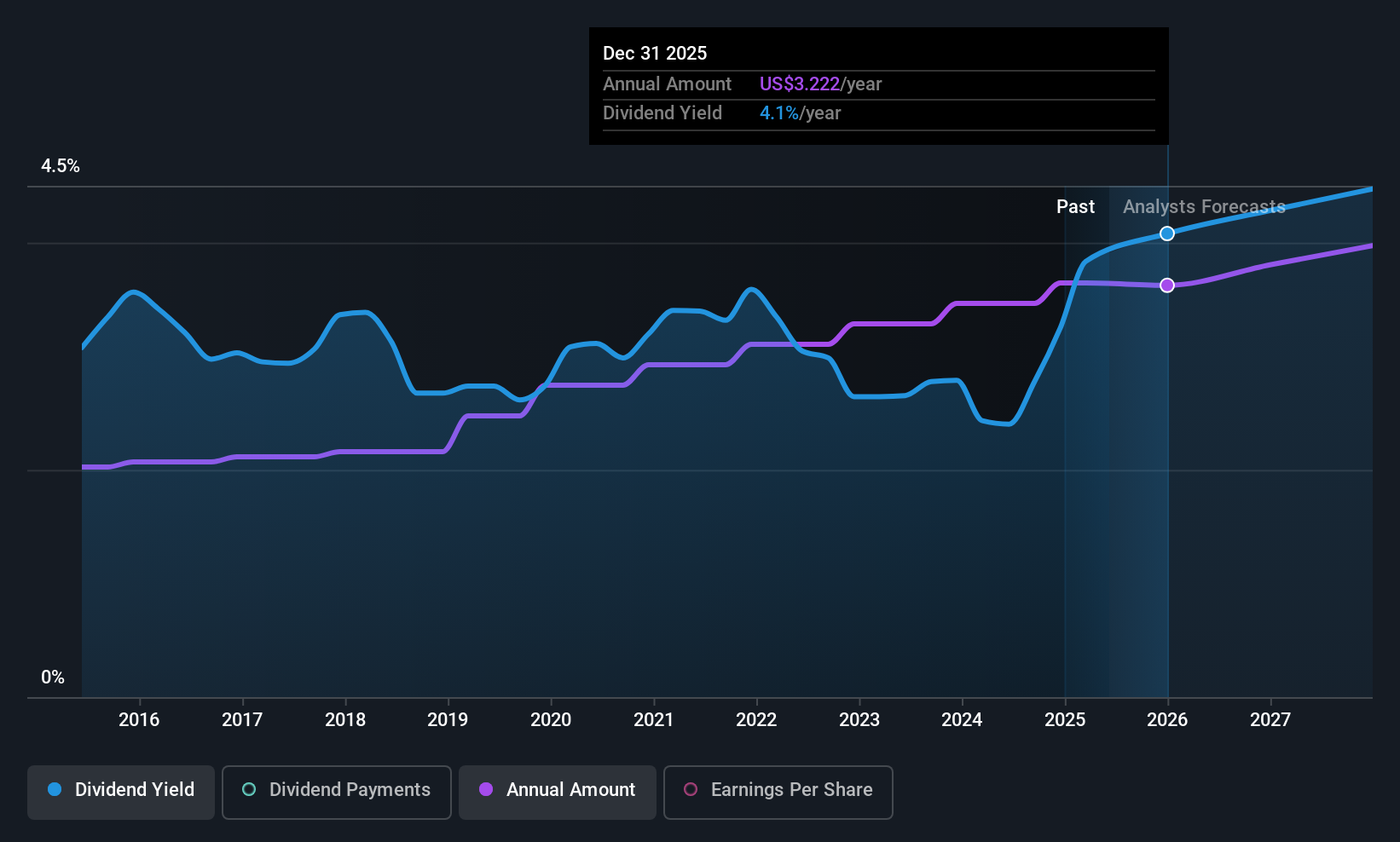

Merck (MRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Merck & Co., Inc. is a global healthcare company with a market cap of approximately $198.42 billion, focused on pharmaceuticals, vaccines, and animal health products.

Operations: Merck & Co., Inc.'s revenue is primarily derived from its pharmaceuticals, vaccines, and animal health segments.

Dividend Yield: 4%

Merck's dividend is well-covered by earnings and cash flows, with a stable history over the past decade. The payout ratio stands at 48.6%, ensuring sustainability. Despite recent earnings declines, Merck maintains a reliable dividend yield of 4.03%. However, it trades below its estimated fair value and has been reclassified into value indices from growth indices recently. Recent strategic alliances and product developments may bolster future revenue streams, potentially supporting continued dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Merck.

- In light of our recent valuation report, it seems possible that Merck is trading behind its estimated value.

Where To Now?

- Investigate our full lineup of 142 Top US Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com