- SiriusPoint recently announced its second quarter 2025 results, reporting revenues of US$748.2 million, net income of US$63.2 million, and a quarterly cash dividend of US$0.50 per Series B preferred share payable in August.

- While revenues rose slightly year-over-year, the company experienced a significant decline in net income and earnings per share compared to the prior period, indicating evolving profitability dynamics.

- We’ll examine how SiriusPoint’s lower net income, despite increased revenue, alters the company’s investment narrative going forward.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

SiriusPoint Investment Narrative Recap

To be a SiriusPoint shareholder, you need to believe in the ongoing value of its specialist underwriting capabilities and its ability to capture opportunities across catastrophe and specialty insurance markets, even as earnings fluctuate. The latest results, showing higher revenue but sharply lower net income, have not fundamentally changed the short-term focus for investors, which remains on restoring profit margins; the persistence of earnings volatility is still the most relevant risk near term.

Among the recent announcements, the approval of another quarterly cash dividend on its Series B preferred shares stands out. This consistent capital return signals management’s commitment to rewarding shareholders, although dividend payments do not directly address the underlying pressure on net income, which continues to be shaped by external risks and margin trends.

However, beneath these headlines, investors should pay close attention to the company’s exposure to interest rate movements and the worrying trend of persistently low investment income…

Read the full narrative on SiriusPoint (it's free!)

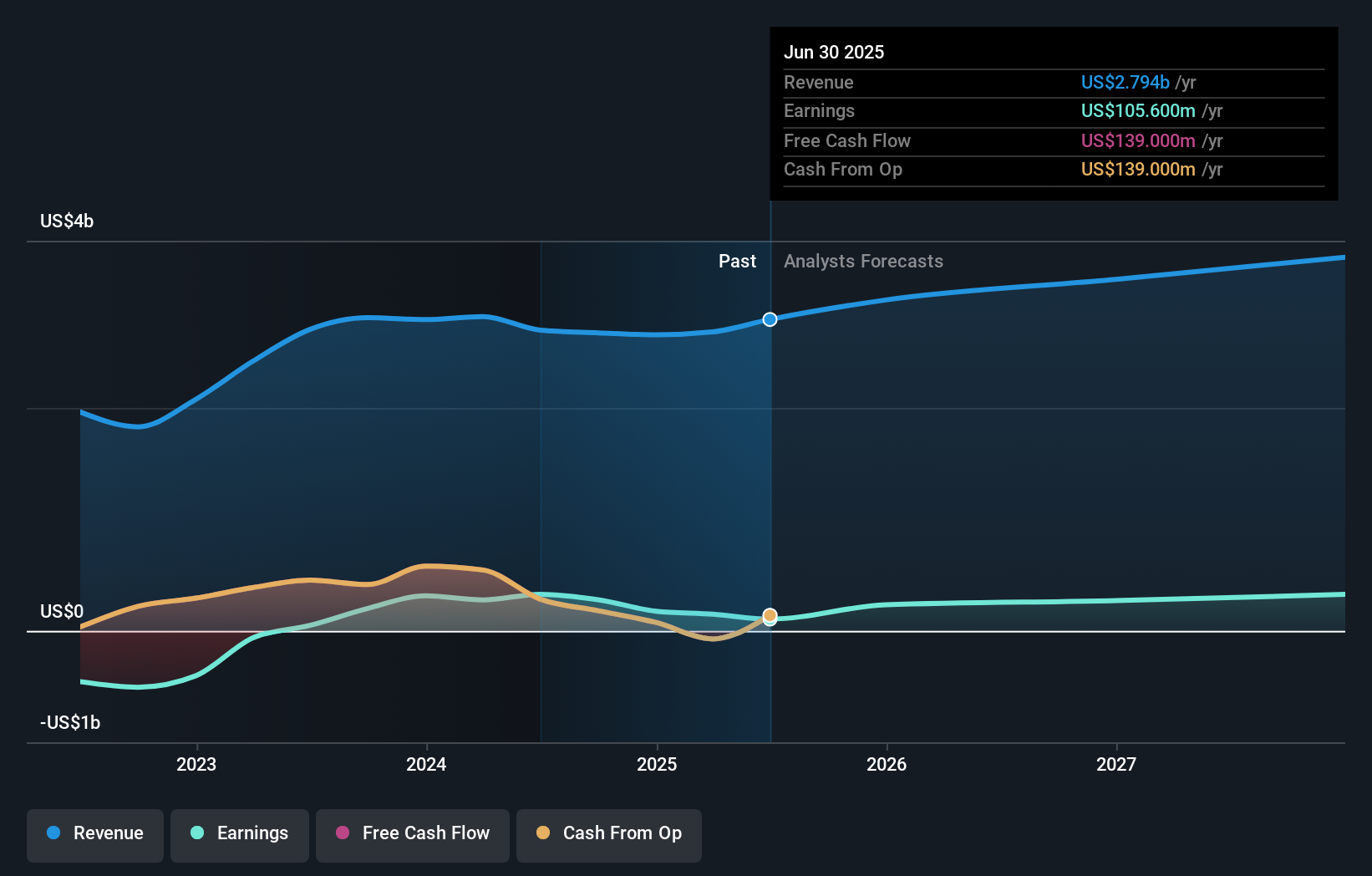

SiriusPoint's outlook anticipates $3.5 billion in revenue and $352.0 million in earnings by 2028. This reflects an annual revenue growth rate of 8.8% and a $203.0 million increase in earnings from the current $149.0 million.

Uncover how SiriusPoint's forecasts yield a $25.33 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Ten retail investors in the Simply Wall St Community all estimated SiriusPoint’s fair value at US$23.19 per share. While these views suggest limited dispersion, the company’s recent decline in earnings underscores why community opinions and professional outlooks on future profitability can differ widely, explore these perspectives to compare your own outlook.

Explore another fair value estimate on SiriusPoint - why the stock might be worth just $23.19!

Build Your Own SiriusPoint Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SiriusPoint research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free SiriusPoint research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SiriusPoint's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com