- Criteo recently reported its second quarter 2025 earnings, announcing increased sales to US$482.67 million, the completion of a major share buyback tranche, a new partnership with WPP Media to scale commerce intelligence to Connected CTV, and several key executive appointments.

- The company’s progression into AI-driven advertising and its heightened focus on leadership and retail media highlight an ongoing transformation toward a more diversified and technology-driven commerce media platform.

- We'll explore how the expanded executive team and CTV partnership may influence Criteo's investment prospects within the fast-evolving digital advertising sector.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Criteo Investment Narrative Recap

Owning Criteo means believing in its ability to leverage AI-powered advertising and commerce data to grow retail and media partnerships, despite competitive threats from larger tech players. The most important short-term catalyst remains how effectively new partnerships and leadership can ramp up growth in retail and Connected TV (CTV); however, recent earnings growth was matched by a dip in quarterly net income, so the immediate impact appears limited. Margin pressures from increased investment and tough industry competition remain key risks for the business.

Among recent announcements, the partnership with WPP Media to scale commerce intelligence to Connected CTV is especially relevant. This move directly addresses the ongoing shift of advertiser budgets into higher-growth channels like CTV, and could support the company’s efforts to capture incremental spend from brands and agencies seeking smarter, more measurable media solutions.

Yet, as Criteo pushes into new digital channels, investors should also be aware of continuing client concentration and media spend headwinds that could...

Read the full narrative on Criteo (it's free!)

Criteo's narrative projects $1.0 billion revenue and $147.8 million earnings by 2028. This requires a 19.2% yearly revenue decline and an $11.3 million earnings increase from $136.5 million.

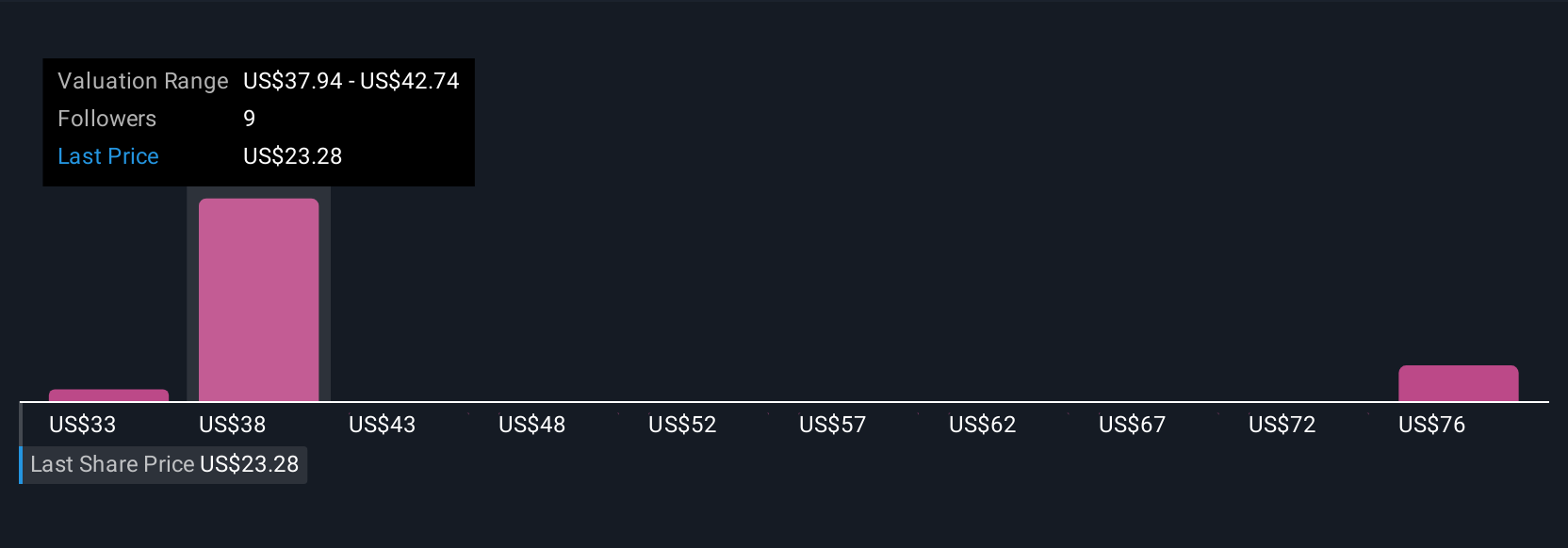

Uncover how Criteo's forecasts yield a $38.17 fair value, a 59% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provide three fair value estimates for Criteo, ranging widely from US$33.14 to US$94.81 per share. While outlooks on future growth vary, many remain watchful of whether Criteo’s newer partnerships can drive sustained top-line acceleration in a very competitive digital ad market.

Explore 3 other fair value estimates on Criteo - why the stock might be worth just $33.14!

Build Your Own Criteo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Criteo research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Criteo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Criteo's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com