- On August 5, 2025, International Seaways declared both a regular quarterly dividend of US$0.12 per share and a supplemental dividend of US$0.65 per share, to be paid on September 24, 2025, to shareholders of record as of September 10, 2025.

- Alongside these dividends, the company reported significantly lower revenue and net income for the second quarter and first half of 2025 compared to the previous year, reflecting a weaker operating period despite continued shareholder payouts.

- We’ll examine how International Seaways’ supplemental dividend and weaker quarterly results may influence its long-term investment narrative.

These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

International Seaways Investment Narrative Recap

To be a shareholder in International Seaways, you need confidence in the company's ability to generate stable cash flows from its tanker fleet, adapt to global oil market trends, and effectively manage capital allocation through both growth investments and regular dividends. The recent supplemental dividend, despite weaker Q2 and first-half 2025 results, does not materially change the biggest short-term catalyst, fleet modernization and supply-demand dynamics, nor the largest risk: volatile tanker rates driven by global market uncertainty.

Among recent announcements, the August 2025 earnings report stands out, revealing a substantial drop in revenue and net income compared to the same periods last year. This decline puts a spotlight on the importance of maintaining operating margins despite challenging market cycles, reinforcing why investors are so focused on earnings stability as a primary catalyst.

However, even with continued shareholder distributions, investors should not overlook the possibility that tanker market volatility could...

Read the full narrative on International Seaways (it's free!)

International Seaways is projected to have $748.6 million in revenue and $143.4 million in earnings by 2028. This reflects a 4.5% annual decline in revenue and a decrease in earnings of $178.3 million from current earnings of $321.7 million.

Uncover how International Seaways' forecasts yield a $53.80 fair value, a 23% upside to its current price.

Exploring Other Perspectives

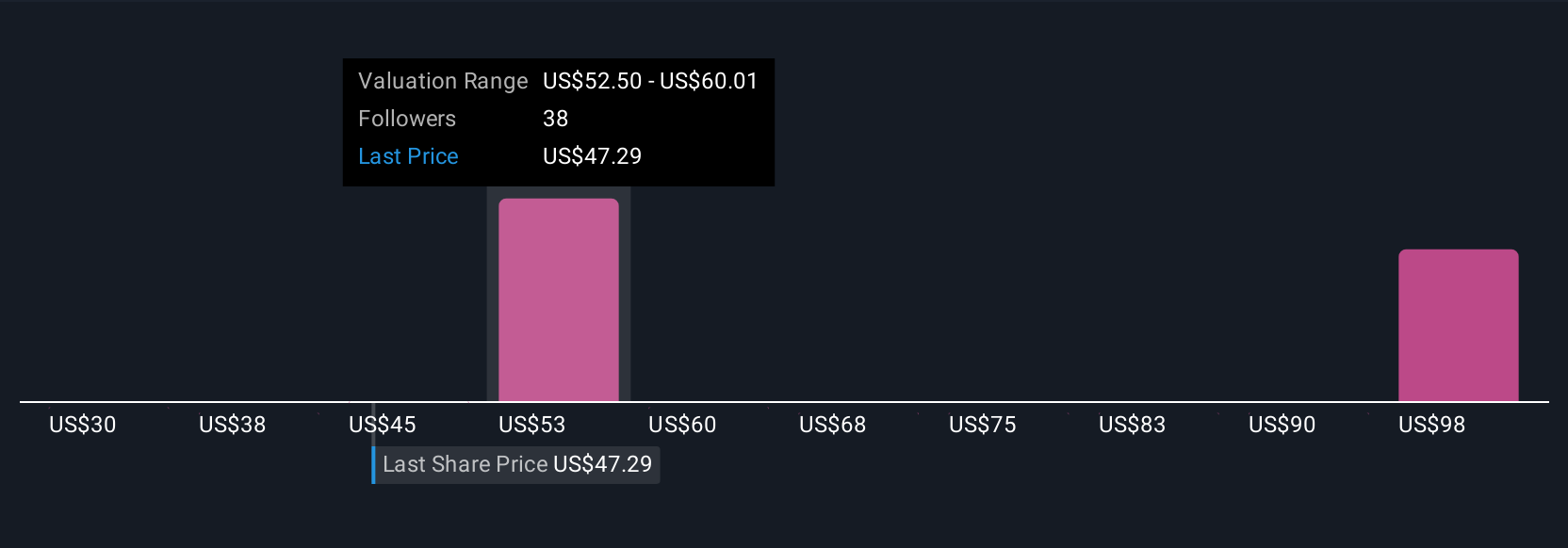

Fair value estimates from the Simply Wall St Community span from US$30 to over US$100, based on five individual analyses. While some see deep value, others are more conservative; this diversity is crucial, especially given ongoing tanker rate uncertainty that could affect future returns.

Explore 5 other fair value estimates on International Seaways - why the stock might be worth over 2x more than the current price!

Build Your Own International Seaways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Seaways research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free International Seaways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Seaways' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com