- Select Medical Holdings Corporation recently reported second-quarter earnings, showing year-over-year revenue growth to US$1,339.58 million and reaffirmed its full-year revenue and earnings guidance while continuing significant shareholder distributions through dividends and share repurchases.

- Despite higher sales, the company experienced a decline in net income for both the quarter and first half of 2025, highlighting margin pressures amid ongoing capital returns.

- We'll consider how the company's reaffirmed 2025 outlook and large recent share buyback could reshape its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Select Medical Holdings Investment Narrative Recap

To be a shareholder in Select Medical Holdings, you generally need to believe that expanding demand for post-acute care and steady facility-based revenues can outweigh margin pressures from regulatory and reimbursement headwinds. The recent reaffirmation of 2025 guidance, alongside solid top-line growth, does little to shift the key short-term catalyst, recovering margins in major segments, nor does it materially reduce the biggest risk of ongoing reimbursement constraints impacting earnings stability.

The announcement of a substantial share buyback, with over 5.7 million shares repurchased for US$85.04 million in the last quarter, stands out this period. Paired with ongoing shareholder returns through dividends, these measures support near-term value and could help counter market concerns about industry reimbursement changes and free cash flow strain from capital investments.

Yet, despite these capital returns, it's worth noting that margin pressures from regulatory shifts remain one piece of the story investors should be aware of...

Read the full narrative on Select Medical Holdings (it's free!)

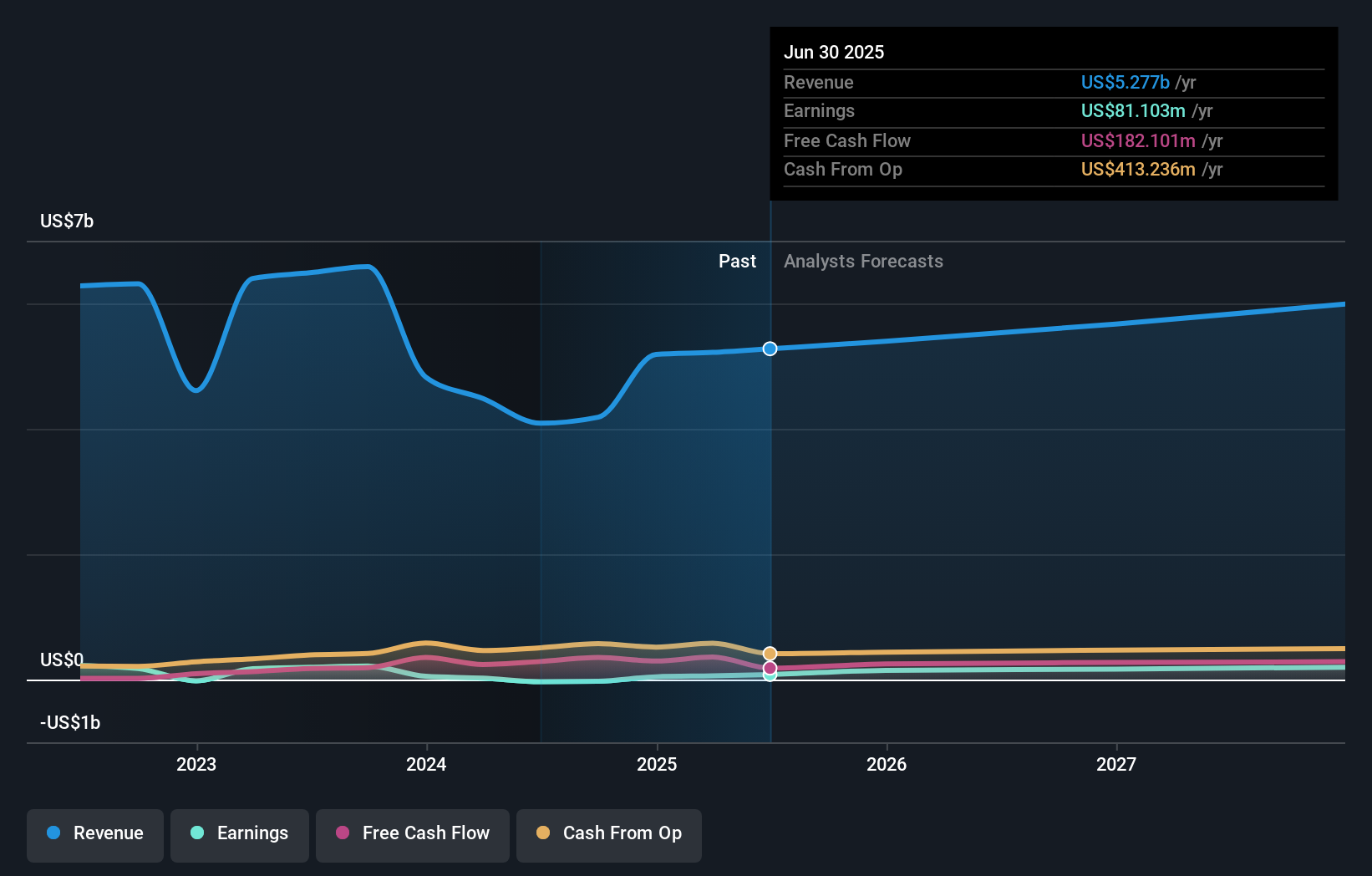

Select Medical Holdings' outlook forecasts $6.1 billion in revenue and $236.5 million in earnings by 2028. This reflects a 5.1% annual revenue growth rate and a $155.4 million increase in earnings from the current $81.1 million level.

Uncover how Select Medical Holdings' forecasts yield a $18.33 fair value, a 53% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community offered fair value estimates for Select Medical Holdings ranging from US$18.33 to US$42.51, with two distinct viewpoints represented. While opinions differ, current earnings remain challenged by regulatory-driven margin compression, inviting you to consider several alternative perspectives before making a decision.

Explore 2 other fair value estimates on Select Medical Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Select Medical Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Select Medical Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Select Medical Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Select Medical Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com