- On July 31, 2025, CRA International, Inc. reported a strong second quarter with sales of US$186.88 million and net income of US$12.12 million, alongside raising its annual revenue guidance and announcing a quarterly dividend of US$0.49 per share.

- The company also updated its share repurchase program, buying back 230,673 shares in the latest period and completing over 74% of its ongoing buyback authorization.

- With the company lifting its revenue outlook on the back of robust earnings performance, we’ll consider how this development may shape CRA International's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CRA International Investment Narrative Recap

To be a shareholder in CRA International, you generally need confidence in sustained demand for complex regulatory and litigation advisory, especially as M&A activity and regulatory scrutiny remain elevated. The latest earnings report, with upgraded revenue guidance, reinforces the near-term catalyst of robust client demand, but does not materially address the persistent risk of business cyclicality tied to broader dealmaking trends and regulatory activity, which could still pressure revenues if market conditions change.

The company’s raised annual revenue guidance stands out, signaling management’s view of continued momentum following a period of strong practice growth. However, while higher revenue projections are encouraging for the near-term, investors should weigh this alongside the ongoing dependency on buoyant M&A and legal environments, the very catalyst now powering results but also the most significant exposure if those drivers slow.

By contrast, investors should be aware of how concentrated exposure to M&A and regulatory cycles could affect future earnings if...

Read the full narrative on CRA International (it's free!)

CRA International's narrative projects $822.0 million revenue and $60.0 million earnings by 2028. This requires 4.9% yearly revenue growth and a $3.6 million earnings increase from $56.4 million today.

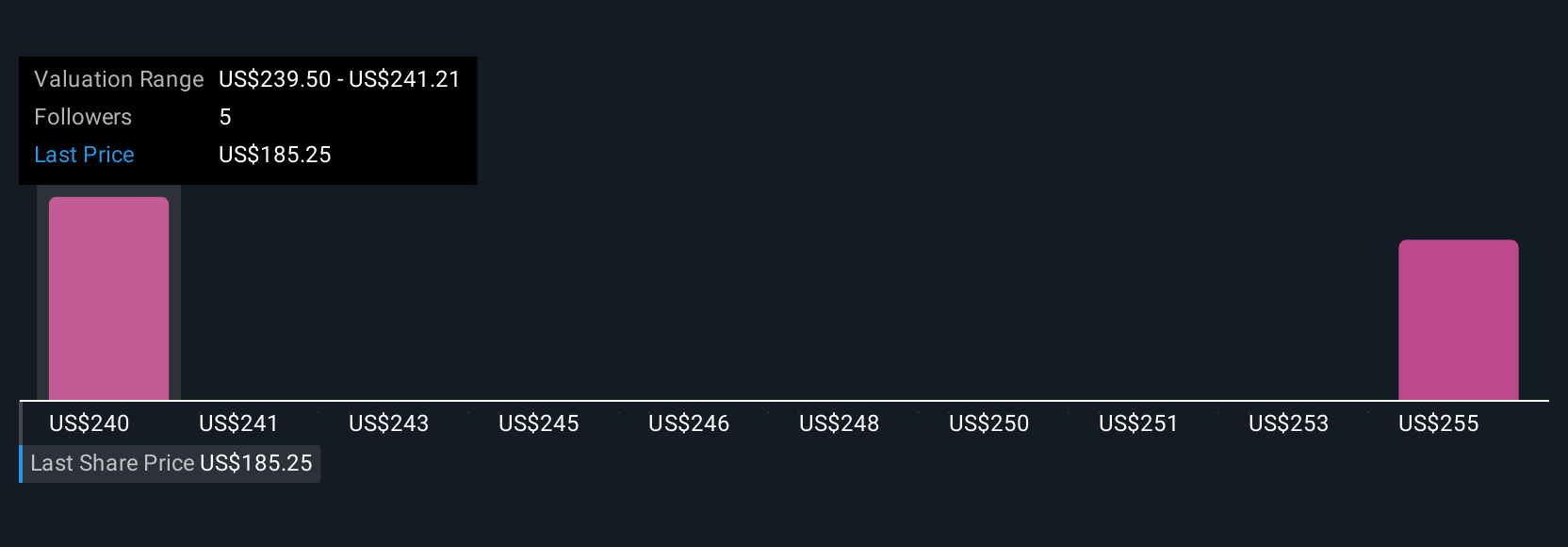

Uncover how CRA International's forecasts yield a $239.50 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a tight range between US$239.50 and US$258.24 per share. While revenue guidance has been raised, views on CRA International’s reliance on robust deal activity continue to shape expectations for performance in the months ahead.

Explore 2 other fair value estimates on CRA International - why the stock might be worth as much as 37% more than the current price!

Build Your Own CRA International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CRA International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CRA International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CRA International's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com