- Black Hills Corporation recently reported improved second-quarter and half-year earnings, alongside reaffirmed 2025 guidance and the announcement of regulatory approval for new natural gas rates in Kansas.

- The regulatory approval is expected to recover US$118 million of system investments and support future infrastructure upgrades for reliable service delivery.

- Next, we'll examine how regulatory certainty from new rate approvals may influence Black Hills' long-term earnings outlook and risk factors.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Black Hills Investment Narrative Recap

To be a Black Hills shareholder today, you need to believe in the company's ability to steadily recover investments through approved rate cases while navigating rising infrastructure costs. The recent Kansas rate approval and stronger half-year earnings help reinforce short-term revenue stability, supporting the main catalyst of timely regulatory recovery; however, these developments do not fully resolve ongoing risks tied to capital intensity and demand volatility from large, tech-driven customers.

Among recent announcements, the Kansas rate case approval stands out as most relevant: not only does it secure US$118 million in cost recovery for past projects, but it also provides US$15.2 million in new base rate revenues, which could help offset future margin pressures if infrastructure expenses rise faster than expected.

By contrast, investors should also be aware that even with rate approvals, exposure to concentrated, potentially volatile data center demand may still...

Read the full narrative on Black Hills (it's free!)

Black Hills' outlook forecasts $2.5 billion in revenue and $375.2 million in earnings by 2028. Achieving this would require a 3.4% annual revenue growth rate and an earnings increase of $91 million from the current $284.2 million level.

Uncover how Black Hills' forecasts yield a $65.17 fair value, a 9% upside to its current price.

Exploring Other Perspectives

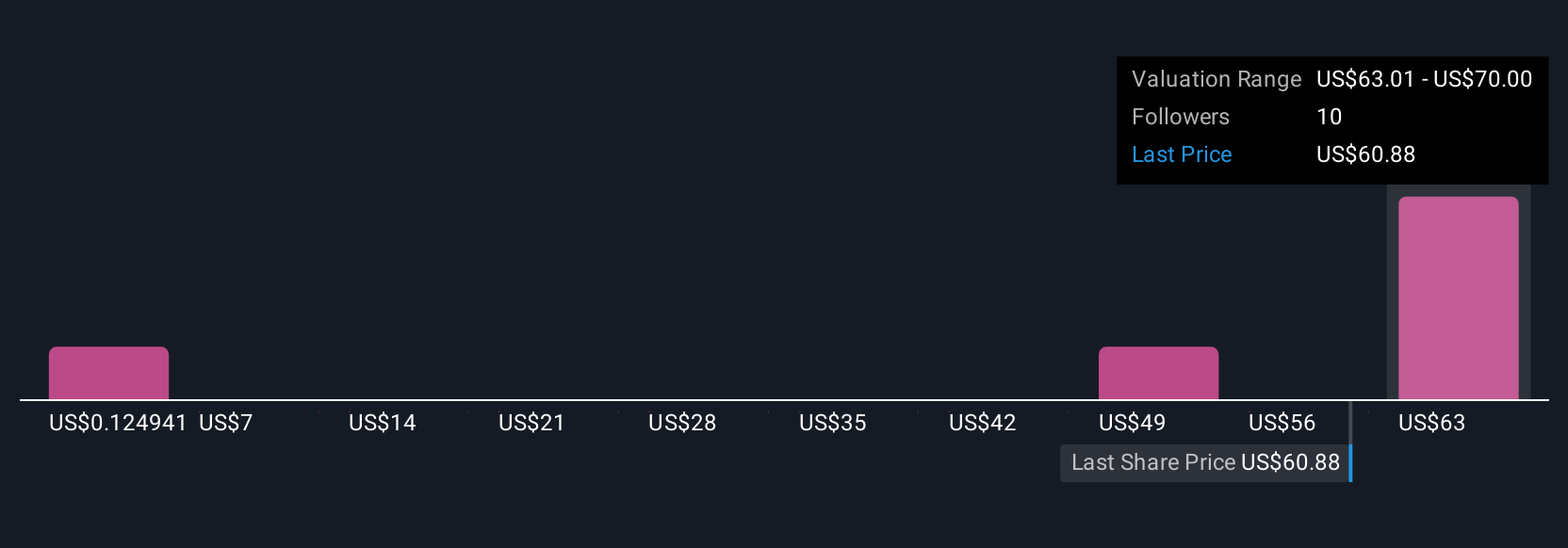

Six individual fair value estimates from the Simply Wall St Community range widely from just above US$0.12 up to US$70 per share. While community perspectives highlight sharp disagreement, analyst consensus still flags demand risk from large customers as a key factor shaping Black Hills' future performance.

Explore 6 other fair value estimates on Black Hills - why the stock might be worth as much as 17% more than the current price!

Build Your Own Black Hills Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Hills research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Black Hills research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Hills' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com